To date, drilling at Forrest Kerr has targeted near-surface, high-grade gold and copper mineralization. That has yielded some nice intersections, and backed by the market with two separate stock runs for ABN in 2017 and 2018.

Guyana Goldstrike (TSXV:GYA)

Guyana Goldstrike’s flagship property is the Marudi Project. Mineralization at Marudi is related to gold-hosted banded iron deposits that occur in other greenstone belts around the world. These deposits can be remarkably long-lived with sizeable gold production.

Last year, Guyana Goldstrike received funding from Zijin Mining, one of the largest gold companies in China, which came through with a substantial $3.2 million - in exchange for a 24% stake in the company.

Guyana Goldstrike aims to add ounces at gold-bearing iron formation

Guyana Goldstrike discovers mineralized outcrops along 1,100m trend

The end game is to find a million ounces or more - enough to incite a take over bid in our opinion.

Gold prices continued to march upward on Wednesday, trading at $US1,501.20 on Wednesday as of this writing.

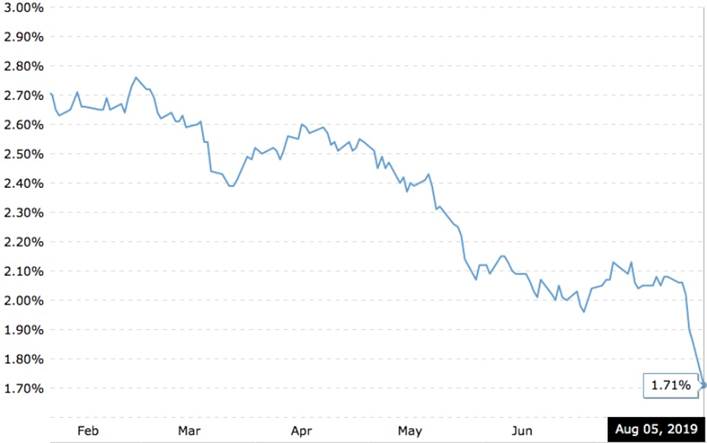

Gold has been on a tear the past month, the beneficiary of an increasingly dovish monetary environment, as central banks around the world cut interest rates and roll out bond-buying programs to stimulate sagging economic growth.

Despite not bearing a yield, gold tends to do well under low interest rates because it holds its value against fiat currencies which rise and fall with interest-rate fluctuations. Gold is also a hedge against inflation, brought about by asset-buying programs done by central banks to inject more money into their economies.

Gold bulls started running in June, immediately after the US Federal Reserve strongly hinted it would lower interest rates in July, and took off again following the Fed’s July 31 decision to cut rates by 25 basis points. More precisely, gold first fell on disappointment that the Fed hadn’t cut deep enough - the markets and the White House wanted at least a 50-basis-point cut - but then rallied following US President Trump’s threat of hitting China with 10% tariffs on the remaining $300 billion worth of Chinese imports to the US - made the day after the rate cut.

The precious metal used mostly for jewelry and investment purposes has booked impressive gains year to date. For those who think it’s time to take profits and book a beach holiday with their gold investments, we beg to differ.

Six months ago we predicted this trade war would escalate (it has), that China wouldn’t throw in the towel (it hasn’t) despite having far more of its goods under tariff than the United States and that Trump’s obsession with a low US dollar would bring about a currency war (it’s happening).

In this article we’re stepping away from our crystal ball to focus on the gold market - not only the macro environment - gold price drivers like interest rates, tariffs and currencies - but also the present investing picture for junior gold miners, which quite frankly, isn’t all that pretty. In 2019, less money is being spent on exploration, fewer holes are being drilled, and a lot of the ones that are, are showing less than impressive assay results.

To us though, all that means is less competition for investors’ dollars and a much easier culling of the herd to identify the best from the rest. We’re already half-way through the northern-hemisphere drilling season meaning news flow is starting soon. If you want to make money on a discovery hole at a greenfield project, or cash in on a big resource increase at a more advanced brownfield, you’re not alone, we’re with you, and believe now is the time to lay out our favorite gold juniors.

History has shown that junior gold companies offer the best leverage against a rising gold price. That is definitely where we are at, and, we think, will be for the foreseeable future. It’s the perfect storm for gold and junior gold stocks.

Trump responds to Fed dog whistle

We know that President Donald Trump wants a massively lower dollar and will do anything to get it. Why? Trump thinks a low dollar is the way to bring jobs back to the US after so many were exported abroad to take advantage of lower labor costs. He wants to rebuild the US manufacturing sector, primarily through cheaper exports. He’s particularly targeted China for competitively devaluing its currency to dump cheap exports into the US, such as steel and aluminum. All Chinese imports into the US are now subject to tariffs of between 10 and 25%.

Throughout the past several years, the dollar has remained high in relation to other currencies, and that has created a large US trade deficit – $825 billion for 2018. Trump wants to get rid of the trade deficit, especially the deficit with China.

So was it a coincidence that Trump ordered 10% tariffs on $300 billion worth of Chinese imports, the day after the US Federal Reserve didn’t give him what he wanted, a 50-point rate cut? We think not!

Just look at what happened to the dollar. Exactly what Trump wished.

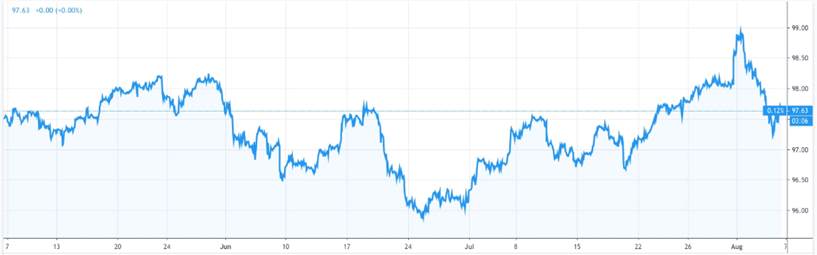

When Trump entered the White House in January 2017, the dollar initially fell, to as low as 88.45 on the DXY (dollar versus a basket of other currencies), in January 2018. Since then it’s been on a relentless upward climb, coming within a whisker of 99 at the end of July. After Trump’s tariff announcement, however, the greenback plunged to 97.12 on Aug. 5.

The dollar and gold move in opposite directions, with both going their separate ways due to increasing trade war tensions. On Monday gold hit record highs in a number of currencies including the British pound, the Japanese yen and the Australian and Canadian dollars.

But what is the connection between the Fed’s interest rate reduction, Trump’s trade war escalation and the falling buck?

It starts with Jerome Powell’s explanation that the rate cut was due to “global developments” (ie. the trade war), not anything to do with the US economy - the Fed’s normal reasoning for interest rate decisions.

That was like a dog whistle to Trump, who came a runnin’ with his reply.

Within 24 hours, the unconventional president announced that the trade truce was over and his administration was planning a full court press on the Chinese with 10% tariffs on $300 billion of their products - a 180-degree turn from his climb-down on more tariffs, following the recent G20 meeting in Japan.

Zero Hedge hints that Powell made a colossal blunder in letting Trump use tariffs to pressure the Fed to cut rates, thereby getting his lower dollar:

The problem for Powell is that by scapegoating the global economy for the rate cut, the Fed is now trapped having certified before the world that any further escalations in Trump's trade war are effectively a justification for more rate cuts. Whether this was Powell's intention is unclear, although it certainly means that Trump is now de facto in charge of the Fed's monetary policy by way of US foreign policy, and it also means that as BofA writes on Friday, "the Fed is unintentionally underwriting the trade war."

Another commentator, veteran Bloomberg markets reporter John Authers, wrote in an op-ed:

My best guess to explain the sudden escalation from Trump is that he was presented with a new and very appealing reason to raise tariffs – that this was the way he could force the Fed to cut rates. Now we will find out the consequences.

It all points to one conclusion: President Trump has found a way to lower the dollar and fix the trade deficit.

Trump will force the Fed to keep cutting rates all the way up to the election in the fall of 2020, using trade wars ie. China and the EU, as the reason to do it.

At Ahead of the Herd we think real interest rates will fall deep into negative territory (the 10-year Treasury real yield is already scraping zero), the US dollar will fall off its podium of exorbitant privilege, as the world’s reserve currency, and stock market participants will suffer horrendous losses.

Trade war escalates

The consequences of more Trump tariffs weren’t long in coming.

On Monday China, for the first time in more than a decade, decided to set the yuan’s value below the key level of seven to the US dollar.

China also ordered its state-owned firms to stop importing US agricultural products. Tariffs on soybeans, the most valuable crop American farmers grow for China, forced the Trump administration to compensate farmers by up to $28 billion over two years.

Trump responded by calling China a currency manipulator, sending stock markets reeling on Monday, and pushing gold to a six-year high. The People’s Bank of China denied it was lowering the yuan to gain an advantage in the trade dispute.

Many commentators, including myself, believe this is the start of a currency war that could drag the US dollar, the euro and the Chinese yuan, among other currencies, into a downward spiral.

Reuters noted that labeling China a currency manipulator fulfills a promise Trump made on his first day in office:

“As a result of this determination, Secretary Mnuchin will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions,” the Treasury Department said.

Speaking of the Treasury, let’s not forget the proposed new rule that allows the United States to impose tariffs on any country it determines is manipulating its currency - thereby extending the trade war well beyond China.

A finding of currency manipulation by the Treasury would trigger countervailing import duties against foreign products, to be implemented by the US Commerce Department.

In other words, any country whose currency is found to have been manipulated would automatically be subject to tariffs. There’s no reason why, if the proposal becomes law, Commerce wouldn’t keep hitting China with duties, beyond the current 25% maximum, should the yuan keep falling. Or the EU. The ECB is already on Treasury’s list of potential currency manipulators.

The US hasn’t seen such blatant protectionism since the 1930s.

To make matters worse, Trump joked he should take the trade fight to the European Union by slapping 25% tariffs on Mercedes Benzes and BMWs.

The president without joking has suggested the European Central Bank unfairly devalued the euro by announcing its intention to cut interest rates.

Among the US Treasury’s list of potential currency manipulators are eight European countries including the UK, France, Germany, Italy and Switzerland.

Vietnam, added to the list in May, could be the next front opened up in the US-instigated trade war. Asia Times tells us that last month, an eye-popping 400% duty was slapped on Vietnamese steel imports to the US, that originate from Taiwan and South Korea. A 25% duty on Vietnam’s exports to the United States would impose severe economic pain on the Southeast Asian nation’s economy - shaving more than 1% off its GDP. Trump has named Vietnam among the worst abusers of trade; the country has a $40 billion surplus with the US.

Canada is also on the Treasury’s currency manipulator watch list.

Safe-haven demand

It’s all good fuel for gold. Beyond the trade dispute, there are other reasons for owning gold that we outlined in a previous article. They include safe-haven demand driven by such dangerous conflicts as the war in Yemen, the frequent tensions between the US and Chinese navies in the South China Sea, and the close call with Iran recently over a drone strike.

On Monday the Trump administration froze all of Venezuela’s assets, putting the South American failed state in the same company as Cuba, North Korea, Syria and Iran. NBC News reports the ban blocks US companies and individuals from doing business with the Maduro regime and its top supporters.

There is also a brewing confrontation between South Korea and Japan over a set of disputed islands in the Sea of Japan. The South Korean Military wants to conduct defense drills at the Takeshima islands which are claimed by Japan but controlled by South Korea. According to Japan Times, the conflict is the latest in a series between the two former WWII adversaries, that stem from court rulings last year ordering Japanese firms to pay compensation to South Koreans, forced to work for them during the war.

Finally, something we predicted several months ago looks more likely - an arms buildup between the US and Russia. A week ago Friday the US formally withdrew from the 1987 Intermediate Nuclear Forces Agreement (INF), which restricted missile launches from the two Cold War enemies. Without a new agreement in place, there is nothing stopping Russia from developing new missiles pointing at Europe, and the US responding in kind, or vice versa.

Tough junior gold market

Summing up, there are a number of factors pointing in the direction of gold right now as a smart investment. Gold is being judged against bond yields and what the Federal Reserve is going to do next.

Gold investors love low interest rates because that could weaken the dollar, thereby pushing up commodity prices and making dollar-priced investments like gold attractive.

The gold price is also being lifted by very low and in some countries, negative interest rates on sovereign debt. If investors have to effectively pay for lending money to borrowers, gold is seen as a better investment.

The idea of monetary easing causing inflation also appeals to gold investors, since the precious metal is known to hold its value over time versus depreciating fiat currencies.

And then there’s the roller-coaster ride of the trade war; generally, bad news generally causes stocks to slide and gives gold a lift.

Since June most of the major gold companies have risen in value, as have gold ETFs, corresponding with a higher gold price. GDXJ, a junior gold miners’ fund that invests 80% in companies that get half or more of their revenues from gold/ silver or gold/silver royalty/ streaming companies, is up 34%, year to date.

More data was revealed Aug. 2 by Mining.com, which used data from sister company InfoMine to analyze companies listed on the TSXV, the ASX, London Stock Exchange (LSE), NYSE and Johannesburg Stock Exchange (JSX).

The results of the survey reveal an industry that has gone quiet, at a time when it should be burning rubber on eight cylinders. Among the takeaway findings:

Means buying opportunity

At Ahead of the Herd, we recognize the challenges of operating in a market that has, since the mining bear from 2012-16, lost a lot of companies and many investors who moved over to other investing lenses like pot and cryptocurrencies.

We’re big believers in gold; its market fundamentals are the best we’ve seen in a long time. And we see junior company price momentum continuing to the end of this summer’s exploration season, and well beyond.

There are a few ways to play the gold market right now, but we hold to the time-honored maxim of sticking to gold juniors with good projects in safe jurisdictions with great management teams. We’ve carefully put together a portfolio of early-stage and advanced exploration companies that will provide the novice or expert gold investor with opportunities for both discovery-hole bursts in market value and more gradual upside from increased resource delineation.

Sun Metals and Guyana Goldstrike have been directing their treasuries to exploration expenditures at their advanced-stage properties. What both have in common, is they have delivered quality drill results over the past year, and each has a great chance at building a resource that could take investors along for a ride. We’re looking forward to their news flow over the next few months as results roll in.

Aben is busy drilling trying to stack up more evidence to prove geological theories at its two flagship properties, Justin in the Yukon and Forrest Kerr in British Columbia.

Our two exploration drill plays, Max Resource Corp and NV Gold Corp, both have high potential for hitting a discovery hole or two this summer, while collecting important geological data that test exploration hypotheses.

Max Resource Corp (TSXV:MXR)

While Max’s attention was focused earlier this year on the conglomerates, the company is working right now on an 8-km shear zone that has had some great results; one of the grab samples returned 220 g/t.

At newly acquired North Choco, the team is doing soil and stream sediment sampling, and following up ground magnetics work to target elephant-size porphyries lurking under the dense jungle and forest canopy. The ground crew will be searching for large orebodies characteristic of porphyries.

Max pursuing new high-grade gold target and hunting for copper-gold porphyry

Working both properties over the summer, Max is aiming for a copper-gold porphyry discovery, by October.

NV Gold Corp (TSXV:NVX)

In its 2019 exploration program, NV Gold plans to chase surface anomalous gold to depth at its flagship Frazier Dome project. The idea is to try and find the source of the high-grade surface mineralization found during 2018 drilling.

The company has chosen its Slumber property as the first to be drilled in August, among a thick portfolio of over a dozen gold projects in Nevada.

Slumber is one of several high-level epithermal gold systems on a trend that runs through two mountain chains and continues north into Oregon. The target is volcanic-rock-hosted epithermal gold and silver mineralization, and the hope is to find a bonanza-type vein gold deposit.

NV Gold identifies large, structural target for August drilling

CEO Peter Ball and other NVX management have 125 years of combined experience in Nevada, and they have an incredible data set to help guide their claim-staking and exploration efforts. I expect big things from these boys.

Sun Metals Corp (TSXV:SUNM)

Sun Metals is exploring for precious and base metals over a 96-square-kilometer polymetallic district in central British Columbia. Stardust is the name of the company’s flagship project, located about 250 km northwest of Prince George. About $25 million was invested in the project prior to Sun Metals acquiring the property.

Sun Metals Provides Update on Stardust Exploration Program

Aben Resources Ltd (TSXV:ABN)

Aben has completed the first phase of its 2019 exploration program and started the second, as the cashed-up gold junior tries to stack up more evidence to prove geological theories at its two flagship properties, Justin in the Yukon and Forrest Kerr in British Columbia.

Western Canada-focused Aben has $5 million in its treasury - ample working capital for a company its size - and budgeted $1 million to its Justin project, which butts onto Golden Predator’s (TSXV:GPY) 3 Aces property.

At Forrest Kerr, located in BC’s famed Golden Triangle, Aben is planning an initial 5,000m of drilling to follow up on last year’s expansion of the North Boundary Zone. The company has the opportunity to execute on a number of targets thanks to the authorization of 45 new drill pad locations versus just nine in 2018, which limited the amount, and angle, of drilling. The drilling budget may double to 10,000m, depending on what is found at the mountainous, structurally-controlled project, lying equidistant between the past-producing Snip and Eskay Creek mines.

Aben Resources Provides Drilling Update for Forrest Kerr Gold Project in BC’s Golden Triangle, Assays Pending for Justin Gold Project in the Yukon