Amazon.com, Inc. (NASDAQ:AMZN) once again felt the electronic wrath of President Donald Trump today, after he took aim at Amazon's shipping practices, calling the U.S. Post Office the company's "delivery boy," and threatening antitrust action. In response, AMZN stock is down 0.7% to trade at $1,801.24, but options bears had already started to come out of the woodwork for some time now.

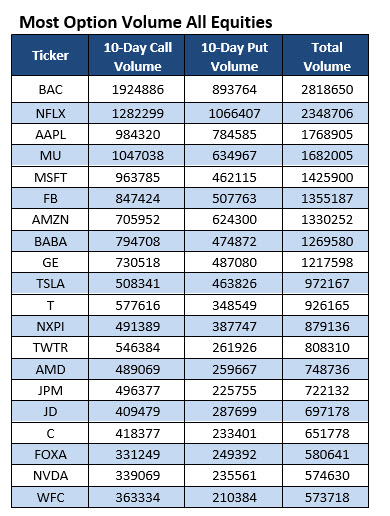

In fact, the stock popped up on Schaeffer's Senior Quantitative Analyst Rocky White's list of 20 stocks that have attracted the highest options volume during the past 10 trading days. (Names highlighted in yellow are new to the list.) While Amazon call volume was more prevalent on an absolute basis, options traders have still been more put-skewed than usual right now.

As alluded to above, at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), AMZN's 10-day put/call volume ratio of 0.92 is in the elevated 74th percentile of its annual range. While this ratio indicates that bought calls still outnumbered puts on an absolute basis, the elevated percentile tells us that traders have initiated bearish bets over bullish at a faster-than-usual clip during the past two weeks.

Those wanting to bet on AMZN with options are in luck, considering the stock has consistently rewarded premium buyers over the past year. This is based on its elevated Schaeffer's Volatility Scorecard (SVS) reading of 89 (out of a possible 100), which indicates the equity has tended to make outsized moves compared to what the options market was expecting.

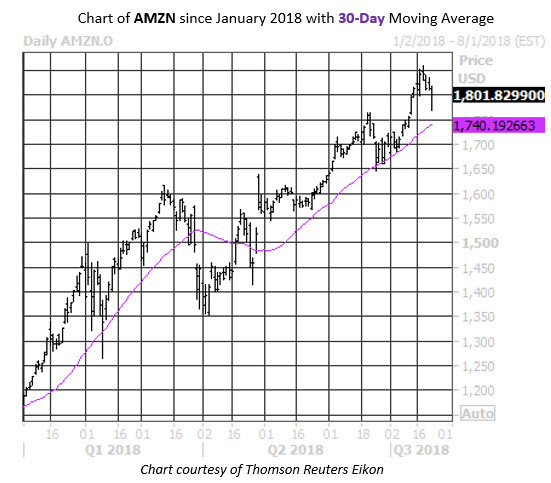

Last Wednesday, Amazon stock nabbed a fresh record high of $1,858.88. Since then, the pullback has been contained by their 30-day moving average, a trendline of support in place since an earnings-induced bull gap in late April.

Speaking of earnings, AMZN's next leg higher could come later this week, after the e-commerce giant reports second-quarter results after the close on Thursday. Amazon.com boasts a positive earnings reactions in five of the past eight quarters, and on average, the equity has moved 4% the day after earnings over this two-year time frame, regardless of direction. This time around, the options market is pricing in a bigger-than-usual 7.7% single-session post-earnings swing.