Trump Rally Stalling Before Tax Cut And Budget Votes

I will update around 6:55 a.m.

Pre-Open Analysis

The Emini has had a weak 3-day rally after two big bear days on the daily chart. The bulls want a strong breakout to a new all-time high. Yet, because the buy climaxes on the daily, weekly and monthly charts are so extreme, the odds of much higher prices without a pullback first are small. Consequently, the bulls will probably take profits at a new high and the bears will continue to sell above prior highs.

The bears want a lower high or a double top with the all-time high. However, despite how overbought the higher time frames are, the odds will always favor at least slightly higher prices until the bears create consecutive big bear days on the daily chart.

Overnight Emini Globex Trading

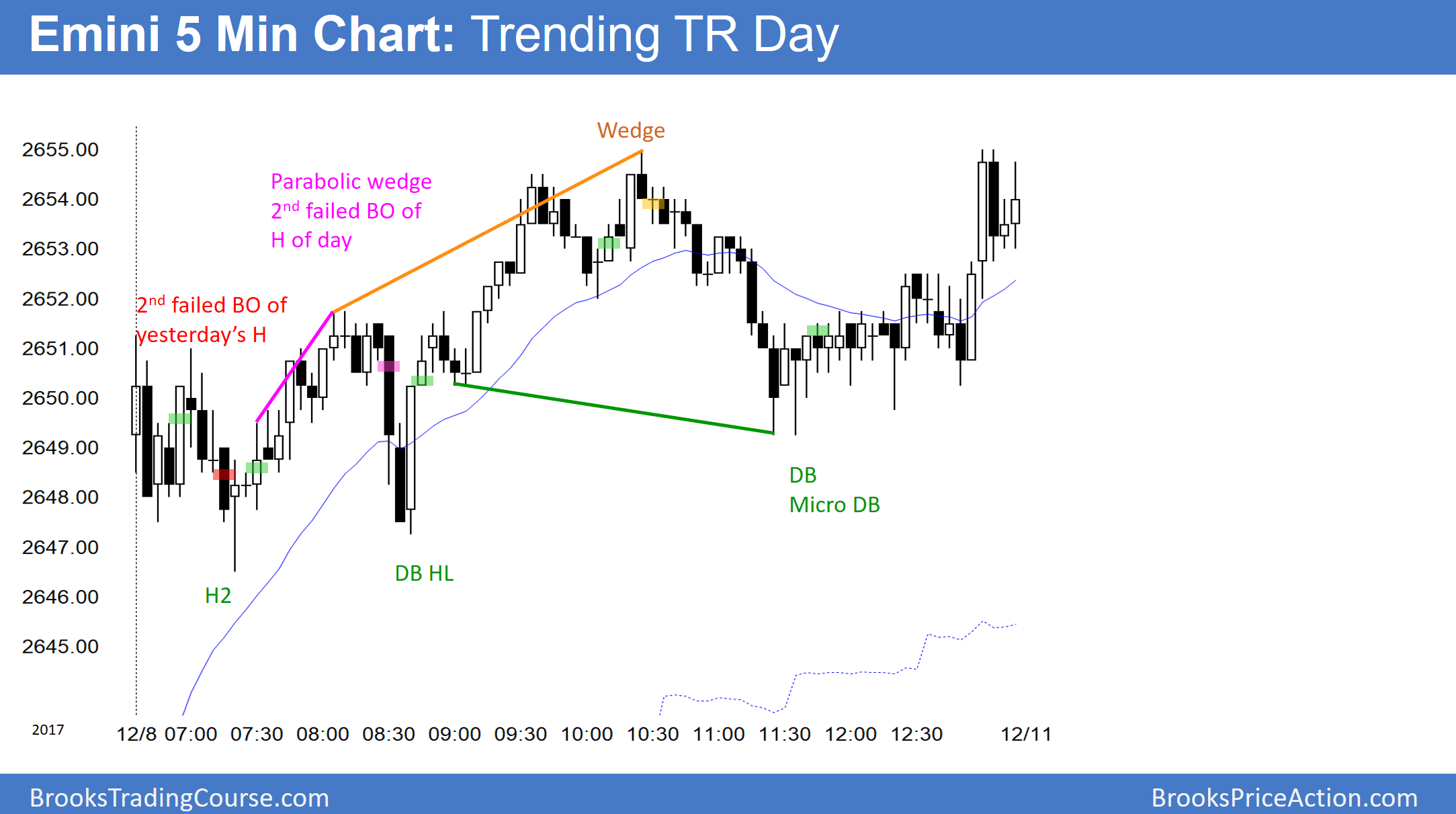

The Emini is up one point in the Globex market and near the top of the 2-week trading range. Tomorrow is the Alabama Senate vote and Wednesday has an FOMC announcement. In addition, last week’s 2-day rally looks more like a leg in a 2-week trading range than a resumption of the bull trend. Consequently, the odds are against a strong break to a new all-time high today.

Since there were 2 strong bull days, the odds are against a big bear day today as well. Therefore, the odds favor another ordinary day today. Since the Emini is not quite at the all-time high and there will probably not be a big gap up or down, traders will wait for a strong breakout up or down before swing trading. In addition, if today again has a lot of early trading range trading, today will probably be another trading range day.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.