I will update around 6:55 a.m.

Pre-Open Market Analysis

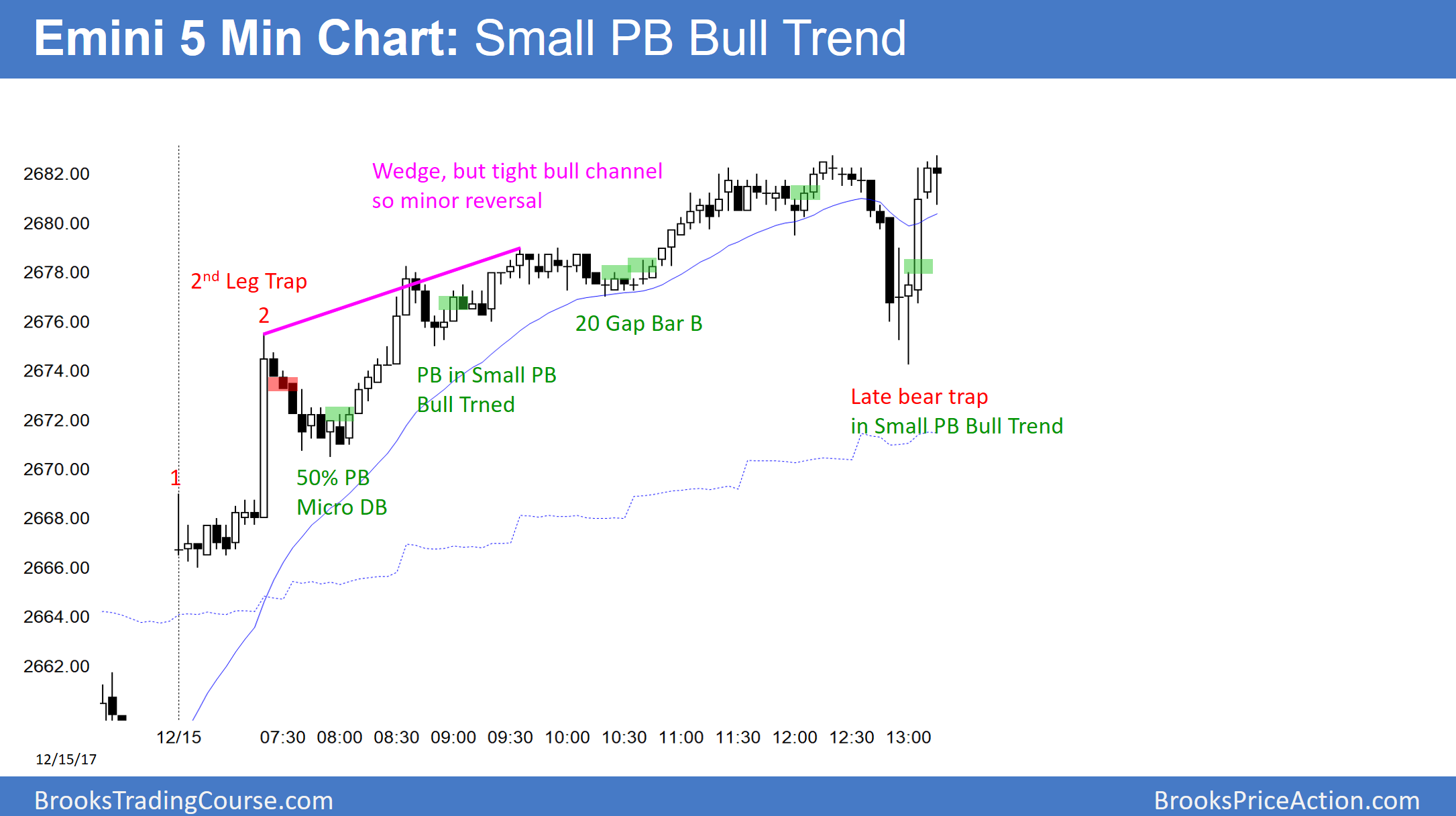

The Emini rallied strongly to a new high on Friday. The bears want a small wedge top today, but the overnight rally makes that unlikely. Friday’s breakout was strong enough so that there will probably be some follow-through buying this week.

Congress will probably vote on the tax bill. The strong rally over the past couple of months is in part due to the belief that the bill will pass. If it fails, the Emini will probably sell off. Even if it passes, the market still might sell off. This is because trade might have wanted a more bullish bill. Also, some traders will want to take some profits before year end.

There is no sign of a top. The odds continue to favor higher prices, despite the buy climaxes on the daily, weekly, and monthly charts.

Overnight Emini Globex

The Emini is up 10 points in the Globex session. It will therefore likely gap up. It is now close enough to the 2700 Big Round Number to likely get there this week.

When there is a big gap up, the 5-minute chart is far above its 20 bar exponential moving average. Many traders do not like to buy too far above the average price. Therefore, the Emini usually cannot rally more than an hour or so without stalling. To get closer to the average price, it then usually either enters a tight trading range for several hours, or it reverses down to get near the average. Once near the average, the odds favor another leg up.

The first several bars are important. If there are several big bull bars, the odds are against a bear trend day. However, traders always have to watch for a parabolic wedge top, which can lead to a trend reversal.

If there are several big bear bars on the open, the odds will be against a bull trend day. The bears would then have a 40% chance of a bear trend day. If they get 4 or 5 unusually big bear bars, the odds would favor a reversal down into a bear trend day.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.