- Bitcoin’s price approached the $70,000 psychological mark but faced rejection.

- Open interest in Bitcoin futures’ has reached a new all-time high, suggesting that investor demand for the world’s largest cryptocurrency is increasing.

- Factors influencing Bitcoin’s price include Donald Trump’s pro-crypto stance, rising geopolitical risks, and potential Federal Reserve interest rate cuts.

Bitcoin prices have rallied into the key psychological $70000 handle following a courting session by Donald Trump.

Former President Trump addressed Crypto enthusiasts at the Bitcoin convention in Nashville over the weekend, where he vowed to end the “persecution” of the industry if elected President.

Bitcoin had already been enjoying a positive week but the comments were the shot in the arm needed to propel BTC/USD toward the psychological $70000 barrier. This was coupled with rising Geopolitical risk, something which has been benefitting Bitcoin more and more in 2024.

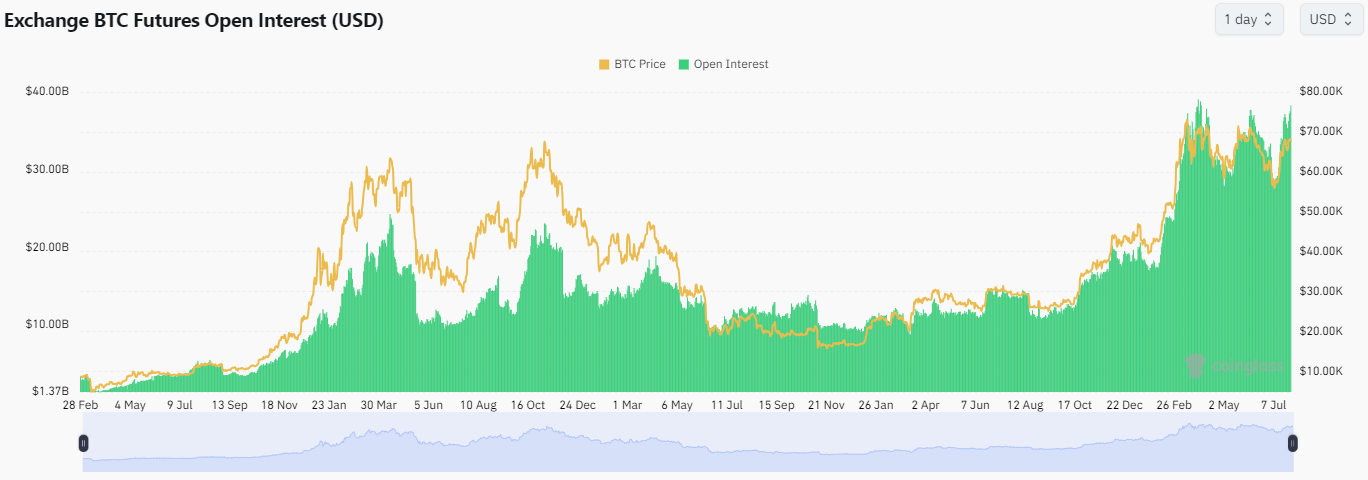

Bulls have been growing more vocal that a breakout in Bitcoin is imminent and there are a host of factors that have been cited to back this up. Open interest in Bitcoin futures’ has reached a new all-time high, suggesting that investor demand for the world’s largest cryptocurrency is increasing.

(Open interest is frequently used to measure the level of interest and liquidity surrounding an asset).

Bitcoin open interest can offer valuable insights into market participants’ sentiment towards the cryptocurrency. For instance, increasing open interest might suggest a growing bullish sentiment among traders, whereas decreasing open interest could indicate a rising bearish sentiment.

Source: Glassnode

Incorporate this with the recent Glassnode and Coinbase (NASDAQ:COIN) institutional report that tracks Bitcoin cycles, and you have another compelling data point.

According to the research, the current bull market cycle, which started in November 2022, has seen prices increase by 4x from the lows. The two previous bull markets (2015-2017 and 2018-2021) saw prices surge by 100x and 20x, respectively.

Source: Glassnode/Coinbase Institutional Crypto Market Guide

Moving forward and this week is fraught with risk events both from an economic data perspective and external factors. The US Federal Reserve meeting could provide further insight on the rate cut path by the Federal Reserve. A dovish tone by Fed Chair Jerome Powell could help propel Bitcoin to fresh highs above the $74000 handle.

External factors may come in the form of the geopolitical risk in the Middle East which has increased since the backend of last week. A wider war which draws in Lebanon, Syria, Yemen and quite possibly even Iran and Russia continues to concern market participants and should be monitored in the coming days.

Technical Analysis BTC/USD

From a technical perspective, Bitcoin encountered significant rejection and a selloff after approaching the $70,000 mark. This rejection now sets BTC/USD on a path to retest the ascending trendline originating from the July 8 lows.

A candle close below the trendline on the H4 or Daily chart could lead to a retest of a crucial support area where the 50 and 100-day moving averages (MAs) are located. This is also the region where the previous swing low found support, between $63,362 and $64,580.

If the price holds at this level, bulls might gain confidence, indicating that a breakout could be imminent. This could push Bitcoin towards its all-time high once again.

On the other hand, breaking below the trendline and the support provided by the MAs would shift the focus to the support level at $61,751, and below that, $58,862.

Support

- 64580

- 61751

- 58862

Resistance

- 70000 (psychological level)

- 71935

- 73800

Bitcoin (BTC/USD) Daily Chart, July 29, 2024

Source: TradingView.com