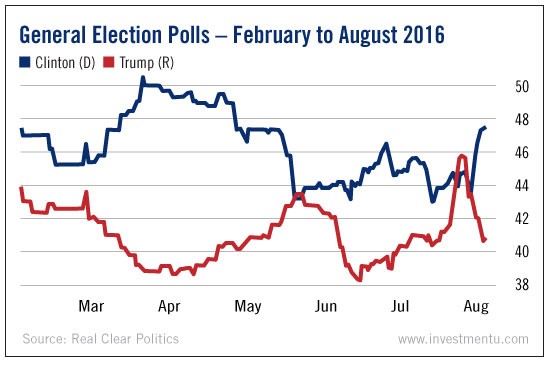

Over the last year, Donald Trump has gone from protest candidate to Republican nominee. At a couple of points, he’s even been ahead of Hillary Clinton in national polls.

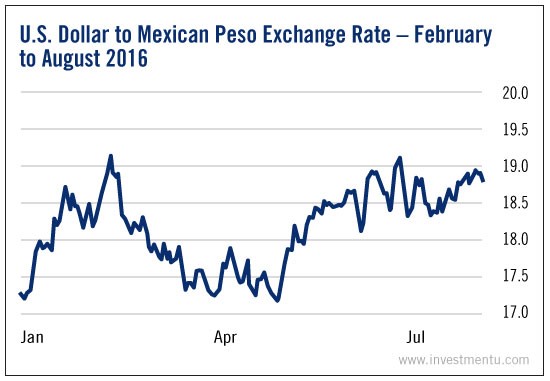

During the same period, the price of the Mexican peso has seen a whopping 15% difference between its annual low and its annual high.

Ordinarily, we’d say that the price of one country’s currency is totally unrelated to the election forecasts of a different country. But 2016 has been far from ordinary.

Trump’s flagship issues include locking down our border with Mexico and renegotiating U.S.-Mexican trade deals like NAFTA and the TPP. Whether or not you support his protectionist agenda, there’s no debate that it could deal a serious blow to the Mexican economy. So it’s no wonder its currency price has been tracking the inverse of Trump support in polls.

The “Mexican-peso-Trump-support" indicator is a fascinating phenomenon. It teaches us about the complex forces that drive currency markets. And it gives us a legal way to bet on the results of our election. Here, we’re looking at why it’s so accurate and how you can profit from it.

Why Does The Peso Reflect Trump Support?

Let’s start with some numbers.

Exports account for more than 17% of Mexico’s GDP. That’s considerably more than the share of U.S. exports in our GDP. And an incredible 80.3% of Mexican exports end up here. Almost 85% go to NAFTA countries.

So if Trump manages to pass his policies, about 14% of Mexico’s economy could go up in smoke.

To be fair, Trump’s big idea is to bring all of that outsourced production back to the States. You could argue that it could help American exports, though that’s far from certain.

But with Mexico facing this kind of systemic risk, it’s easy to see why investors pull their money out of the Mexican peso when Trump is doing well. Look at this graph of aggregated polls in recent months...

Now look at the dollar-peso exchange rate over the same time period...

And you’ll notice, many of the biggest peso crashes line up with Trump’s best weeks.

How To Profit From The Peso's Trump-Support Indicator

This phenomenon gives politically conscious investors a valuable opportunity. It is very illegal for U.S. citizens to bet on elections -- and for good reason. Whenever people bet on something, there’s a decent chance someone will try to rig the outcome. And that’s no good for anybody.

But the Mexican peso provides a legal and more ethical workaround. Its price doesn’t directly track the polls, but it’s hard to miss the correlation between the two.

In general, those who think Clinton will win should long the peso. But if you think Trump could pull off a Brexit-style surprise victory, now might be the time to short it.

The indicator is responsive enough that short-term election betting might also be feasible. Every day, more hacked emails from within the Clinton campaign are being released to the public. And more and more women are coming forward to accuse Donald Trump of sexual assault.

Both of these revelations are potentially damaging to their respective candidates. And a skilled trader could monitor the balance of Wikileaks releases and groping allegations to make some quick profits from the peso.

This historic election has been among the most scandalous in our history. If you feel anything like this writer, you’re ready for it to be over.

But in this last week, investors would do well to keep an eye on the Mexican peso. It gives us an outside perspective of what’s happening in our political process. And it could give you some hefty returns as well.