The abrupt firing of Comey last week triggered political turmoil in Washington. What does it imply for the gold market?

On May 9, President Trump dismissed FBI Director James Comey. As he had been leading an investigation into the Trump 2016 presidential campaign’s possible collusion with Russia to influence the outcome of the election, Comey’s firing raises questions about Trump’s motivations. One week later, the media reports said that POTUS asked the FBI to back off from the investigation into former National Security Advisor Michael Flynn and his ties to the Russians. To add fuel to fire, it turned out that Trump disclosed classified and sensitive information to the Russians.

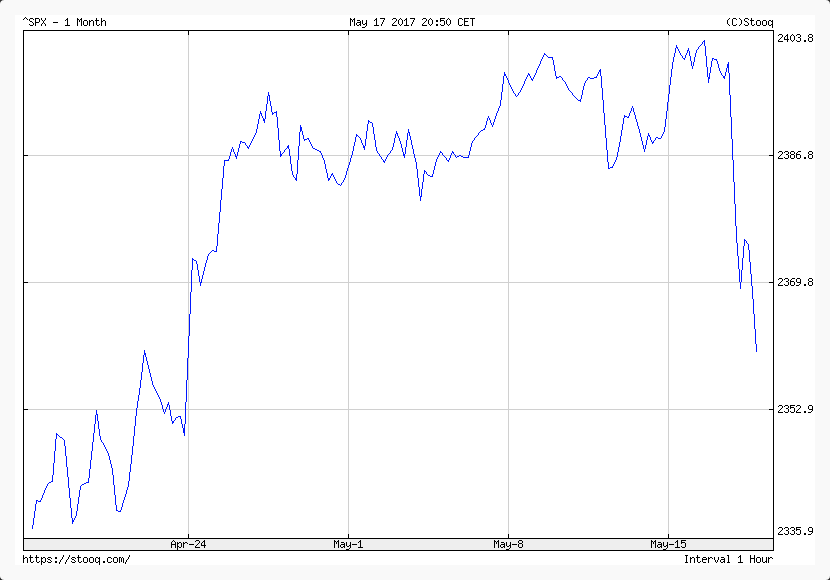

What does that all mean? We know that the price of gold surged Wednesday, as one can see in the chart below.

It shows that the current political turmoil triggered some safe-haven demand for gold. Moreover, tensions in Washington could delay tax cuts promised by the new administration. Such concerns decreased the market odds of a Fed hike in June from 87.7 % one week ago to the current 69.2 percent. In consequence, the U.S. dollar dropped, while the yellow metal caught the wind in its sails. However, the risk of Trump being impeached is relatively low. Hence, the recent decrease in risk appetite (the chart below shows the decline in the U.S. stock market) and gold’s rally may be only temporary.

So far, investors have been generally ignoring politics in Washington. But now markets worry that Trump could be in real trouble, which could slow down his reform agenda. There are fears of obstruction of justice, which spurred the safe-haven demand for gold. It may be the case that the stock market will run out of patience soon, which should be positive for the yellow metal. However, the risk of Trump’s impeachment remains low, so the current market turmoil may be only temporary. A lot depends on the upcoming information – stay tuned.