The Trump administration unveiled their tax plan yesterday, with details to follow. It will take a while to work the plan through Congress but this is our quick take on how the plan affects municipal bonds and municipal finance.

The plan calls for three tax rates – 35%, 25%, and 10%. These are whittled down from the existing seven levels of marginal rates. It eliminates the ObamaCare tax on investment income for families making over $200,000 and also eliminates the Alternative Minimum Tax (AMT). The result of that is that the MARGINAL federal tax rate will decline for the wealthiest individuals from 43.4% (39.6% +3.8%) to 35%. To put this in yield terms, a 3% tax-free municipal yield currently has a taxable equivalent yield of 5.30% (3.0/1-.434), which will fall to 4.61% at a 35% tax rate. While that is a pretty good change at the margin, it is important to realize that the AVERAGE federal tax rate paid by municipal bond holders is 25%. In addition, the elimination of a number of loopholes and deductions will keep municipal bonds in demand. For example, the AAA muni-yield-to-US-Treasury-yield ratios are 92% for 10-year levels and 101% for 30-year levels, which means that, for anything less than the most stellar of credits, the yield ratios are significantly higher currently. (Cumberland is still able to purchase some 4% AA-type yields in the long end, which means a 130% yield ratio). Tax cuts have been baked into the muni market, thus the current yield levels – particularly in the long-maturity end – should stay around current levels, and yield ratios will most likely DRIFT DOWN over time. There is no current mention of capping municipal interest in this plan.

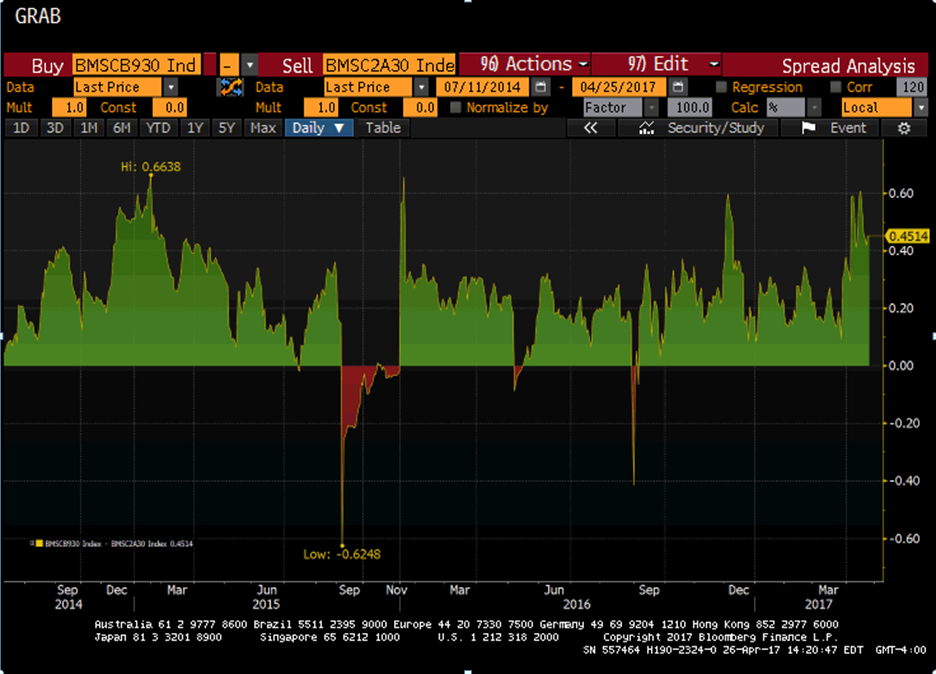

The plan also calls for the elimination of the Alternative Minimum Tax. The AMT was enacted in 1982 to ensure that individuals paid a certain minimum income tax. The tax limited tax benefits from a variety of deductions (think state and local taxes among other things). One aspect of the bill mandated that income from certain private-activity municipal bonds (municipal bonds issued by corporations, housing bonds over certain cap limits, and other municipal issues that have a private end user) be included in the calculation of the AMT. This provision was one of the most poorly designed parts of the AMT, as individuals who would be subject to the AMT would not buy bonds subject to the AMT. The cumulative amount of tax raised from this aspect of the AMT has been negligible. But the provision has come at a cost to these private issuers. Attached is a Bloomberg graph showing the difference between AA Bonds subject to the AMT and AA bonds NOT Subject to the AMT over the past two-plus years. This difference should DISAPPEAR over time if the proposed tax plan is passed.

Yield spread between 30-year AA bond subject to AMT and 30-year AA bond not subject to AMT.

Source: Bloomberg

The last important part is the fact that under the proposed plan, state and local income taxes will no longer be deductible on one’s federal tax return. Thus, in California the top state tax rate is currently 13.3% on income over $1 million. When the top current federal tax rate of 39.6% is added to the current ObamaCare tax of 3.8%, the EFFECTIVE rate of the California tax is roughly 7.5% (13.3 (1-(.396 +.038) ). Eliminating both the federal deduction for state income taxes and the Obamacare tax means that a current California taxpayer in the top bracket will face the FULL 13.3% tax rate. This result will have two effects:

- The demand for in-state tax-exempt bonds in high-tax states will climb, pushing yields down relative to yields for other munis.

- There will be a decided pushback on state and local governments to forgo any tax increases and roll back tax rates if possible, since state taxes effectively increase suddenly and significantly from their current levels (which are partly subsidized by the federal deduction).

We will follow developments closely; but from today’s vantage point, we feel that muni bonds, particularly in the intermediate and longer maturities, should face little adjustment under the proposed plan and that the demand for municipal bonds in high-tax states should advance smartly.