TrueCar, Inc. (NASDAQ:TRUE) is slated to report second-quarter 2017 results on Aug 8 after the bell. Last quarter, the company delivered a positive earnings surprise of 20%.

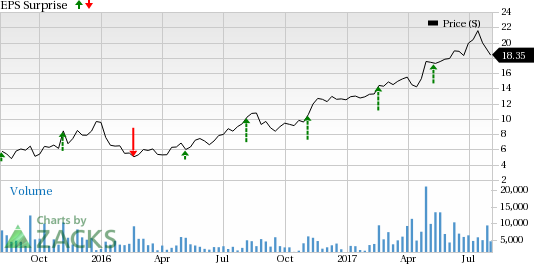

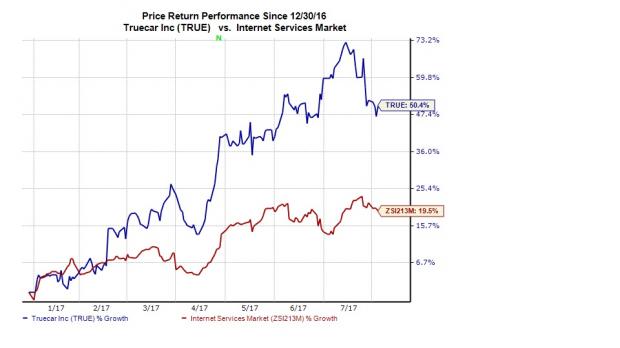

In fact, TrueCar’s surprise history has been quite impressive. It surpassed estimates in each of the last four quarters with an average positive surprise of 31.25%. Year to date, the stock has outperformed the industry it belongs to. It has gained 50.4% compared with the industry’s gain of 19.5%.

Let’s see how things are shaping up for this announcement.

Factors to Consider

TrueCar's revenues improved year over year in the last three quarters while its losses narrowed. The company’s first-quarter 2017 revenues increased 22% from the year-ago quarter. Moreover, non-GAAP net loss per share narrowed to 8 cents from 14 cents reported in the year-ago quarter.

TrueCar has been working on turning its business around. Consequently, its core businesses have been gaining strength. The company is currently working on a number of initiatives that are helping it grow traffic, raise conversion rates and improve close rates.

In addition to Inventory and Pricing Solution, the company is trying to steer upstream into the Research and Discovery phase of the car buying process, and downstream into the Transaction phase. It is designing OEM showcases that will allow automakers to present their products to a large number of shoppers in an ad-free experience. These initiatives are expected to help TrueCar build a more comprehensive marketplace, going forward.

It will also have a positive impact on the company’s revenues and margins.

For the second quarter, TrueCar expects revenues between $79 million and $81 million and adjusted EBITDA in the range of $6 million to $7 million. Additionally, it expects units to remain in a range of 235,000 to 240,000.

TrueCar, Inc. Price and EPS Surprise

Earnings Whispers

Our proven model does not conclusively show that TrueCar is likely to beat estimates this quarter as it does not have the right combination of two key ingredients. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of 8 cents per share. Hence, the difference is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: TrueCar currently has a Zacks Rank #3 which when combined with a 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some stocks, which you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

CACI International (NYSE:CACI) with an Earnings ESP of +1.83% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Broadcom Limited (NASDAQ:AVGO) with an Earnings ESP of +2.57% and a Zacks Rank #2.

Luxoft Holding (NYSE:LXFT) with an Earnings ESP of +5.17% and a Zacks Rank #1.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

TrueCar, Inc. (TRUE): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

CACI International, Inc. (CACI): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Original post