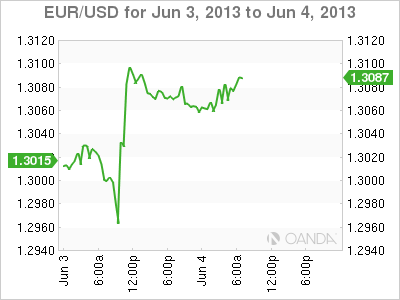

Wow! Pricing in the “tapering trade” can unwind just as quickly. Yesterday provided another fine example of how swiftly a fickle market can change sentiment. A disappointing US ISM headline print took investors by surprise and provided the market the ammo to sell the dollar with a ‘rabid viciousness.’ For most of last month the talk centered on the Fed reducing its bond purchases as early as late summer. Investors were quick to price that in, lifting US 10-year yields +50bp on the month. But, how strong really are current investor’s convictions?

After just one US economic release in June the market seemed to have overshot expectations and were an aggressive off-loader of dollars yesterday. Proven time and time again one economic release does not make a “market conviction” – the dollar has rebounded smartly in the overnight session, especially against the Yen and AUD$, mostly on the back of the Nikkei grinding +2.1% higher.

Despite the Euro region remaining in a recession, Monday’s manufacturing activity data was surprisingly strong for the bloc’s more troubled economies – Spain, Italy and Greece. This may suggest that the zone’s downturn could possibly be waning and also stabilizing. The big four headline print’s (Germany, France, Spain and Italy) all rose, and even Germany, the economic backbone of Europe, is threatening to enter expansion territory again. However, even with a strong link there is a weaker link and France remains the ‘big four’ economic outlier. It continues to still lag with a PMI print just above that of Greece (46.4). The PMI’s also happened to highlight Europe’s core weakness – it’s reliance on sustained “global demand.”

With ongoing efforts marked to reduce budget deficits, analysts note that much of the Euro fiscal heavy lifting was predominately carried out last year and that no countries are currently undertaking extra austerity measures that could lead to a gradual economic uptick in H2. Under these constraints, Draghi and his fellow policy cohorts are expected to hold rates steady later this week, coupled with a dovish tone. That also means that there will probably be little respite in the form of a weaker 17-member currency for the struggling south, unless of course the US growth recovery starts to gather some serious ‘steam.’

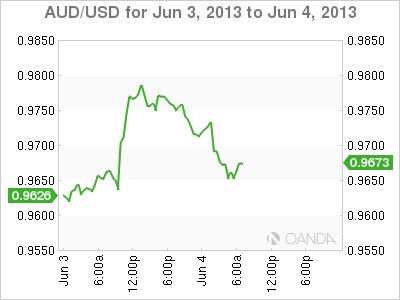

The dollar has recovered some of its overnight losses against the majors and the AUD$ is one of them (0.9660). Aiding the “mighty buck” was the Reserve Bank of Australia keeping their overnight benchmark rates unchanged. The statement was little changed from last month and retained a bias to ease if necessary. The communiqué suggests that the RBA’s Governor Stevens thinks that the AUD$ is still too strong for the country’s fundamentals – don’t most central banks think that way? In other data news, the country also posted a current account deficit of -A$8.5-billion in Q1 compared to the market expectations of a -A$9.0-billions deficit. The Q4 deficit was revised slightly lower to -A$14.8-billion from -A$14.7-billion.

Also aiding a weaker AUD$ outright was the data for foreign holdings of government debt. It fell to +68.9% in Q1 from +70% in Q4. Analysts note that the “fall in foreign holdings came despite large FX reserves accumulation by EM central banks. ” This would suggest that reserve managers believe that with Euro area sentiment improving somewhat there is less of a need to hold AUD$ products, and certainly a bearish AUD$ viewpoint – sometimes it pays to follow the money!

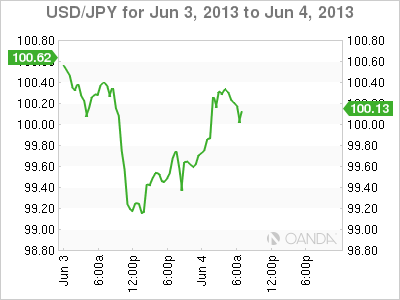

It seems that the current markets two most crowded trades caught a break in the overnight session. The Nikkei managed to find some positive traction after the Yen weakened – certainly a sigh of relief for Abenomics. Trading in Tokyo has been somewhat volatile over the past fortnight as the Nikkei strong rally was interrupted by some steep one-day declines. Already this week the equity bourse has managed to fall -3.7% on Monday (as noted by analysts: the fourth largest fall in eight-sessions). The index is currently -14% lower from last months yearly peak.

The positive dollar correlation with the Nikkei continues. The greenback has managed to gain ground against the Yen, climbing back above the psychological ¥100 level with domestic Japan amongst the buyers. The market seemed to have caught some investor’s dollar short. Everyone will now be looking towards Friday’s non-farm payroll release for dollar “conviction and direction.” In the short term the market expects the dollar to run into some natural resistance ahead of ¥100.35-50.

Already this morning Cable (1.5300) has produced a quarter-cent boost from above forecast UK construction PMI (50.8 vs. 49.6) and follows yesterday’s above forecast 51.3 UK manufacturing PMI (services PMI will be revealed tomorrow). Construction spending is now expected to make a positive contribution to Q2GDP. BRC also reported that May retail sales rose by a healthy +3.4%, y/y, after a -0.6% fall in April. At the moment it’s more about watching the dollar than the currency for direction.

Investors are expected to remain focused on US data and on how this affects expectations of a shift in US monetary policy – yesterday’s weaker-than-expected ISM reading triggered a wave of USD selling. Will this morning’s US trade balance do the same? The market anticipates a -$41-billion print, this after printing -$39-billion in March. Obviously Friday’s NFP print remains the dollar’s direction key. For the Fed’s Bernanke and his cohorts, it’s all about jobs!

It’s not caught in the “headlights’ just yet and this despite dealers talking the EUR down while it goes higher. Supposedly, the market has layered offers above the psychological 1.3100 levels with some light stop-losses below. To many, the recent rally feels more forced than fundamental. Perhaps this is the by-product of existing positions. At the moment it’s about following the dollar and focusing on US data can do this.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

True Conviction: The Majors To Follow US Data

Published 06/04/2013, 08:21 AM

Updated 07/09/2023, 06:31 AM

True Conviction: The Majors To Follow US Data

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.