Triumph Group Inc.’s (NYSE:TGI) adjusted earnings from continuing operations in third-quarter fiscal 2018 (ended Dec 31, 2017) came in at 76 cents per share, reflecting a decline of 24.8% from $1.01 a year ago. The bottom line surpassed the Zacks Consensus Estimate of 68 cents by 11.8%.

The company reported GAAP loss of $2.29 per share, against the prior-year quarter’s earnings of 59 cents. The reported loss included 45 cents of provisional tax-related benefit due to the enactment of the Tax Cuts and Jobs Act of 2017.

Total Revenues

In the reported quarter, net sales were $775.2 million, lagging the Zacks Consensus Estimate of $776 million by 0.1%. The top line also declined 8.2% year over year.

Organic sales in the quarter were down 3%, primarily due to the completion of previously disclosed programs and production rate reductions of the same along with the timing of deliveries on certain programs.

Operational Highlights

In the fiscal third quarter, the company’s operating loss was $119.7 million, against operating income of $55.2 million in the year-ago quarter.

Interest and other expenses during the quarter was $25.83 million, up from $19.70 million in the year-ago quarter.

Quarterly Segment Performance

Aerospace Structures: Segment sales were $282.5 million, down 7.1% from $304.2 million in the year-ago quarter. Operating income was $12 million, compared with $23.9 million in the year-ago quarter.

Integrated Systems: Segment sales dropped 6.6% year over year to $239.2 million. Operating income was $42.7 million, down from the year-ago level of $51.6 million.

Precision Components: Segment revenues declined 2.9% to $219.7 million in the reported quarter. However, the segment incurred an operating loss of $186.2 million against income of $2.9 million in the prior-

year quarter.

Product Support: Segment sales dropped 22.1% year over year to $68 million in the quarter. Operating income was $12.4 million in the third quarter compared with the year-ago quarter’s $14.7 million.

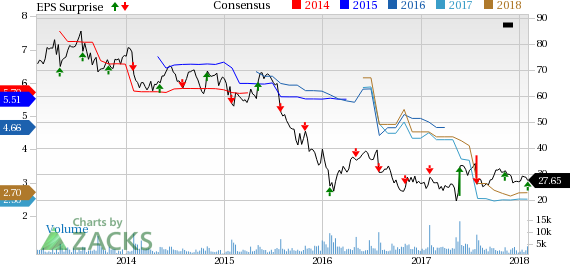

Triumph Group, Inc. Price, Consensus and EPS Surprise

Boeing Company (The) (BA): Free Stock Analysis Report

Triumph Group, Inc. (TGI): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research