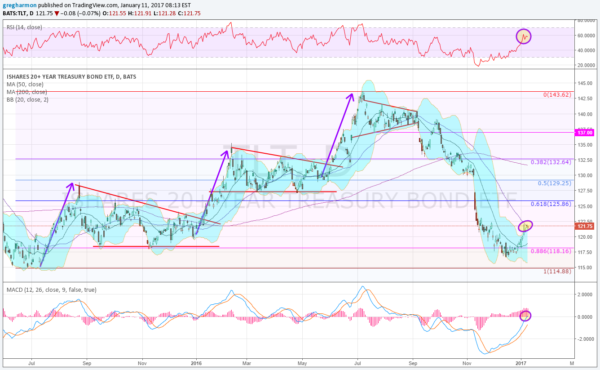

US Treasuries are facing a triple threat from market technicals. Rising off of the July 2015 low, TLT completed a 3-Drives pattern in July 2016. The following reversal retraced 88.6% of the pattern and stalled in December.

Since then, Treasuries have looked positive. A momentum divergence to the upside was followed by price as the year closed -- good movement to the upside. But this upside movement has hit a wall. The question is whether it is a paper wall or one made of bricks. And as Treasuries sit, the Triple Threat looms.

Three Threats

Starting at the top of the chart, the RSI has stalled just short of a move over 60. This would put momentum into the bullish zone. At the bottom, the MACD has also stalled at the zero line. Both are trending higher and support more price movement to the upside, but at critical junctures. Finally, price itself has a hurdle to cross. It sits at the 50-day SMA as it churns sideways on the chart and has yet to breach the November peaks. Until the Triple Threat has been removed, Treasuries are a wait-and-see asset. A dead-cat bounce that could gain strength.