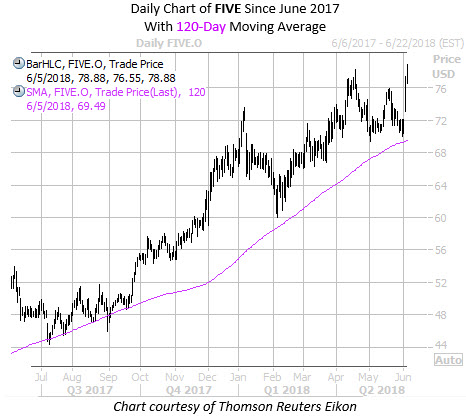

Discount retailer Five Below Inc (NASDAQ:FIVE) is slated to report first-quarter earnings after the close tomorrow, June 6. Five Below stock is up 2.1% at $78.88, at last check, and fresh off a record high of $79.23. The retail name has been on a tear on the charts since its July lows, up 78% with help from its rising 120-day moving average. After popping higher yesterday, FIVE stock is pacing for its best week since November 2016, up 10.8% so far.

Digging into the stock's earnings history, FIVE has closed higher in the session following five of the company's last eight reports, including a 4.2% jump in March. Looking at reactions over the past eight quarters, the stock has averaged a one-day post-earnings swing of 4.1%, regardless of direction. This time around, the options market is pricing in a 12.8% move -- more than triple the norm -- for Thursday's trading, per data from Trade-Alert.

Despite the security's positive price action, options traders have been scooping up FIVE puts. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity's 10-day put/call volume ratio comes in at 1.62, and ranks in the 78th annual percentile. This lofty ratio suggests that puts have been purchased over calls at a faster-than-usual clip during the past two weeks.

Echoing this skepticism, FIVE's Schaeffer's put/call open interest ratio (SOIR) of 1.82 ranks higher than 97% of all comparable readings taken in the past year. In other words, options traders are more put-heavy than usual among contracts set to expire in three months or less.

Outside of the options pits, though, traders have been reducing their bearish exposure to the stock. Short interest on FIVE fell 18% during the past two reporting periods to 5.91 million shares. Nevertheless, this still represents a healthy 11% of the stock's total available float, or 6.3 times the equity's average daily pace of trading -- plenty of fuel for a continued short squeeze in the wake of a celebrated earnings report