Trimble Navigation Ltd. (NASDAQ:TRMB) recently acquired technology company 10-4 Systems. The deal for sure will expand the transportation-related technology services portfolio of the original equipment manufacturer of positioning, surveying and machine control products.

The financial details of the deal have been kept under wraps.

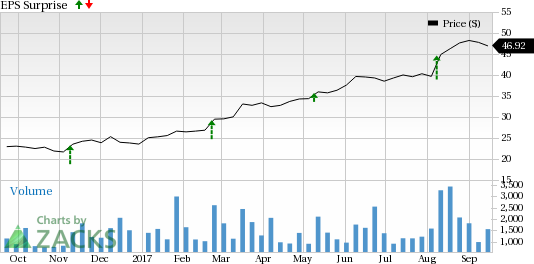

On a year-to-date basis, shares of Trimble have been steadily treading higher. The stock has returned 31.5% compared with the industry’s gain of 24.5%. This has been largely backed by the company’s aggressive merger and acquisition strategy.

10-4 Systems Deal Complements Trimble's Portfolio

Acquisitions have helped Trimble in building a comprehensive portfolio, entering new markets and generating additional revenues.

Headquartered in Boulder, CO, 10-4 Systems offers transportation-related applications and technologies. These solutions help shippers and carriers to electronically monitor the movement of goods and process freight transactions in a more transparent and an effective way.

The acquisition, effective immediately, will enhance Trimble’s capabilities in serving its customers in the transportation business. The deal will allow Trimble to add 10-4 Systems’ cloud-based solution for its small carriers, thereby providing increased visibility to shipments. It will focus on advanced technologies and implementation solutions for better freight management. The acquisition will enable Trimble to provide its customers with robust and effective transportation enterprise solutions.

Post acquisition, 10-4 Systems’ businesses will become part of Trimble's Transportation Segment (TMS). Also,Travis Rhyan, president and CEO of 10-4 Systems, will continue to lead the business as the executive vice president and general manager.

Bottom Line

The acquisitions are part of Trimble’s bid to expand its international business, while sustaining focus on commercial applications. These being more macro-sensitive, allow a stable revenue stream and better profits.

Trimble has added a large number of companies to its portfolio in the last few years. In June, Trimble acquired privately held company, Innovative Software Engineering (ISE),which offers telematics systems to track driver hours of service and vehicle maintenance. In April, it acquired Muller-Elektronik, a German-based company which specializes in implement control and precision-farming solutions. In 2014, 2015 and 2016, it acquired 10, five and three companies, respectively, as well as important assets of several others to complement its current business and capabilities.

These acquisitions are small in comparison to Trimble, so there have been no integration issues. Instead, the acquisitions facilitated market expansion and revenue buildup. The company also forms joint ventures to build positions in strategic areas. We expect acquisitions to remain an important growth driver going ahead.

Other Stocks to Consider

Currently, Trimble Navigation has a Zacks Rank #3 (Hold). A few better-ranked stocks in the same space are Lam Research Corporation (NASDAQ:LRCX) , Applied Materials (NASDAQ:AMAT) and Stamps.com Inc. (NASDAQ:STMP) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Applied Materials delivered a positive earnings surprise of 2.66%, on average, in the trailing four quarters.

Stamps.com Inc. delivered a positive earnings surprise of 30.64%, on average, in the last four quarters.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Stamps.com Inc. (STMP): Free Stock Analysis Report

Trimble Navigation Ltd. (TRMB): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post