President Trump announced his decision to withdraw from the Paris climate agreement last Thursday, compounding the woes of the clean energy industry. It’s ironic, given the announcement was made just a few days prior to today, ‘World Environment Day.’

Trump’s walkout decision in his controversial speech clearly reflected his long-proclaimed belief that climate change is a ‘Chinese hoax.’

The startling announcement came as a major blow to not only the environment advocates across the other 195 nations of the Paris settlement, but also heads of states of his own nation, along with members of the President’s own staff.

Many fear that whatever progress the U.S. made last year toward pollution mitigation and renewable assets expansion, in accord with the Paris agreement, will now go in vain. Under the accord, the U.S. had pledged to cut its greenhouse gas emissions 26– 28% below 2005 levels by 2025. In fact, the agreement was signed largely on account of a preliminary understanding between the U.S. and China — the two largest carbon-emitting nations.

With the U.S. pulling out at present, China and other countries like India will get increased opportunities in leading the clean energy space, which means that their companies will get a boost in the growing and competitive green economy.

Coming back to the announcement, Trump’s claim that the contract would be a job killer for Americans, holds no valid authentication. The statistics he cited in favor of his decision, related to job recession as a result of this agreement, has been opposed by the majority. On the contrary, with green economy on the rise, jobs of the future are in renewables. Had the U.S. stayed in the Paris accord, it would have undoubtedly gained from these developments.

It is clear that employees in renewable energy space like solar, wind and natural gas would be adversely affected by the decision. According to the U.S. Department of Energy, 3 million Americans work in clean energy at present, a number that would be threatened by the Paris pullout.

In January, the Energy Department released a report on energy and employment that showed that over 370,000 people were employed in the solar industry compared with 86,000 workers in the coal industry. It is conclusive that despite Trump’s enthusiastic efforts to push and revive the coal industry, the future of the nation lies is in the hands of the renewable industry.

Nevertheless, for the time being, renewable companies — in particular solar stocks — will be the ones affected by the decision. Meanwhile, coal stocks are expected to gain the most.

Stocks Likely to Gain

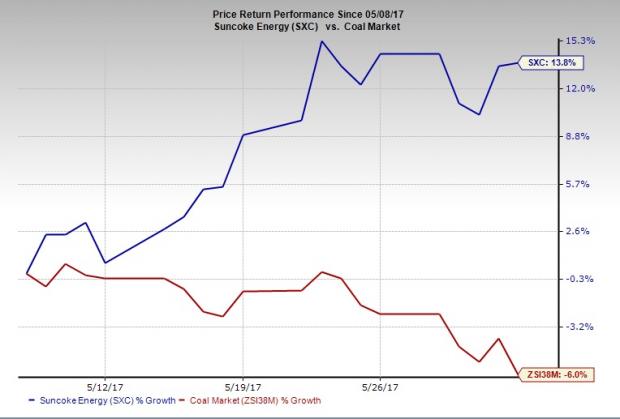

SunCoke Energy, Inc. (NYSE:SXC) : Shares of this metallurgical coke producer improved 0.2% following the U.S.’ confirmation of withdrawing from the Paris accord. In fact, the company has been outperforming its broader industry in recent times. SunCoke’s share price improved 13.8% in the last month against the Zacks categorized Coal market's loss of 6%.

Last quarter, the company had a positive earnings surprise of 120.00%. It currently sports a Zacks Rank #1 (Strong Buy).

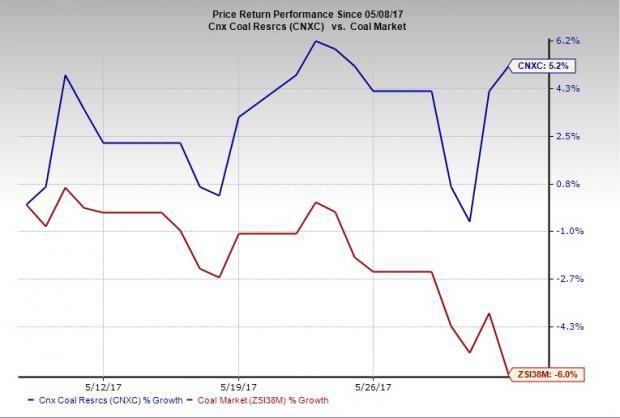

CNX Coal Resources LP (NYSE:CNXC) : Shares of this thermal coal producer improved 1.9% following the news. This company has also been outperforming its broader industry in recent times. CNX Coal Resources’ share price improved 5.2% in the last one month against the Zacks categorized Coal market's loss of 6%.

The Zacks Consensus Estimate for the current quarter stands at 51 cents, reflecting 359.1% year-over-year growth. The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Likely Losers

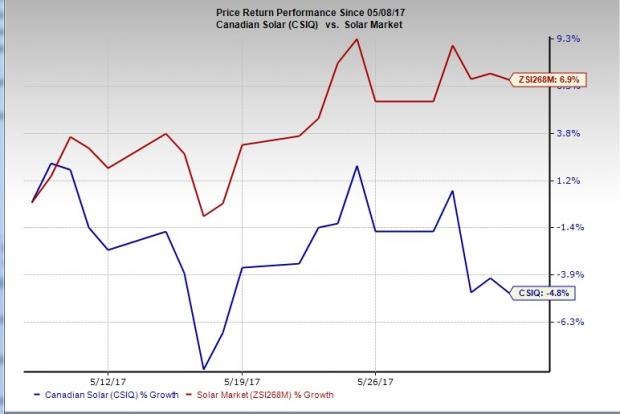

Canadian Solar, Inc. (NASDAQ:CSIQ) : Shares of this solar panels and custom-designed solar-power-applications manufacturer dropped almost 1% following the U.S.’ confirmation of pulling out of the Paris accord. The company has been particularly underperforming its broader industry in recent times. Canadian Solar’s share price declined 4.8% in the last month against the Zacks categorized Solar market's gain of 6.9%.

Last quarter, the company had a negative earnings surprise of 17.24%. In the last 60 days, the company has witnessed loss per share of a penny. Canadian Solar currently carries a Zacks Rank #5 (Strong Sell).

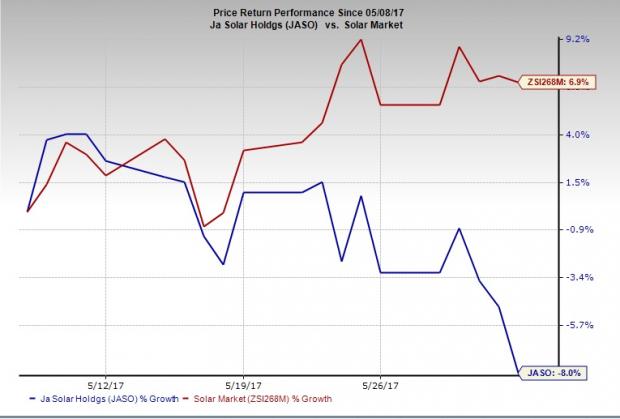

JA Solar Holdings Co., Ltd. (NASDAQ:JASO) : Shares of this high-performance solar cells manufacturer dropped 3.4% following the news. The company has also been underperforming its broader industry in recent times. JA Solar’s share price declined 8% in the last month as opposed to the Zacks categorized Solar market's gain of 6.9%.

The company has a negative long-term earnings growth rate of 15%. In the last 60 days, the company’s earnings per share came down to break even. The company currently carries a Zacks Rank #4 (Sell).

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

SunCoke Energy, Inc. (SXC): Free Stock Analysis Report

CNX Coal Resources LP (CNXC): Free Stock Analysis Report

JA Solar Holdings, Co., Ltd. (JASO): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

Original post

Zacks Investment Research