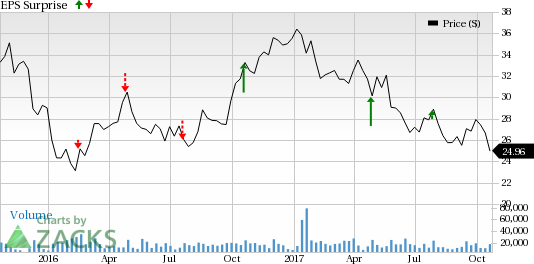

Oilfield services company TechnipFMC plc (NYSE:FTI) is set to release third-quarter 2017 results on Oct 25, after the closing bell.

A leading manufacturer and supplier of technology solutions for the energy industry, TechnipFMC offers subsea, surface, onshore and offshore solutions for oil and gas projects.

In the prior quarter, the London-based company reported better-than-expected earnings on the back of steady project executions, achievement of key milestones, efficiencies from its industry-leading solutions and cost-reduction efforts.

Let’s see how things are shaping up for this announcement.

Factors to Consider

Though oil prices have recovered from their historical lows, it still lingers around $50 per barrel, which is far below the breakeven price for many oil and gas firms. As a result, top energy companies continue to reduce spending and equipment suppliers like TechnipFMC struggle to protect its backlog amid the volatile price environment. For the third quarter, the Zacks Consensus Estimate for the total backlog order is pegged at $14,033 million as against $15,183 million reported in the prior quarter. The backlog for subsea technologies is anticipated at $1,080 million as against $1,773 million reported in second-quarter 2017.

The company’s subsea revenues and margins are also expected to decline. The Zacks Consensus Estimate for the revenues of the subsea segment is pegged at $1,612 million, lower than the $1,730 million recorded in the prior quarter. Operating profit for the energy infrastructure segment is expected to decline to $142 million compared with the preceding three-month period reported figure of $177 million.

The company has already cautioned that 2017 would be difficult year with order growth set to remain weak. All these factors account for our bleak earnings outlook for the company in third-quarter 2017.

Earnings Whispers

Our proven model does not conclusively show that TechnipFMC is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP for the company is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter

Zacks Rank: TechnipFMC presently carries a Zacks Rank #4(Sell). Please note that we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

Here are some companies you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat:

Unit Corporation (NYSE:UNT) has an Earnings ESP of +29.17% and a Zacks Rank #3. The company is likely to release third-quarter earnings on Nov 3.

RPC, Inc. (NYSE:RES) has an Earnings ESP of +4.89% and a Zacks Rank #2. The company is expected to release third-quarter earnings on Oct 25. You can see the complete list of today’s Zacks #1 Rank stocks here.

Newpark Resources, Inc. (NYSE:NR) has an Earnings ESP of +33.33% and a Zacks Rank #2. The company is slated to release third-quarter earnings on Oct 30.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

FMC Technologies, Inc. (FTI): Free Stock Analysis Report

Unit Corporation (UNT): Free Stock Analysis Report

RPC, Inc. (RES): Free Stock Analysis Report

Newpark Resources, Inc. (NR): Free Stock Analysis Report

Original post

Zacks Investment Research