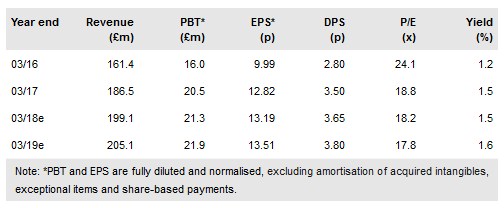

A strong set of interim results has led us to upgrade our EPS forecasts for FY18 by 5.0% and FY19 by 2.5%. Other than a weather-related hiccup in the smaller US activity, there was good like-for-like progress in Europe, Asia and the UK. Input cost pressures at the gross profit level were mitigated by strong overhead control. Investment for growth continues across all regions and the strong balance sheet should facilitate M&A as appropriate opportunities arise with management taking a more proactive approach in target identification. Trifast's (LON:TRFT) shares have been very strong in the run-up to the results and are rated more appropriately, in our view, with the P/E discount to peers substantially diminished.

Good progress in the first half

H118 sales up 9% at £97.8m and a near 10% advance in underlying profit before tax represent very good progress as the company invests in future growth opportunities as well as operational performance. The growth was boosted by positive FX effects, with some of the anticipated input cost headwinds mitigated in the UK by improved export profitability. Nevertheless, the 4.8% growth in the top line at constant exchange rates (CER) and 4.5% CER growth at the underlying pre-tax level both reflect a sound trading environment as we enter the second half. As a result, while we still err on the side of caution with respect to both market growth and likely FX headwinds, we have increased our FY18 EPS forecast by 5%.

To read the entire report Please click on the pdf File Below: