Strategy continues to deliver

A strong set of interim figures, following another potentially rewarding acquisition (announced last month), points positively to the future, despite the more challenging trading climate. Trifast (L:TRFT) has a clear strategy, which continues to deliver. The prospective rating is not demanding.

Ahead of estimates

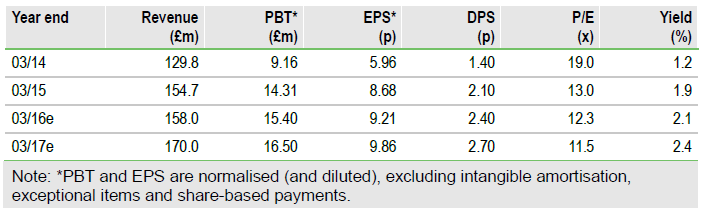

Trifast’s interim figures show another strong performance, with underlying pre-tax profits up by 25% from £6.6m to £8.3m, comfortably above our minimum target of £7.6m. The main impetus was in Asia, where operating profits (before central costs) rose by 42% to £3.8m, while efficiency improvements in the UK delivered an 11% profit increase to £3.2m on unchanged turnover. Progress in continental Europe was held back by a weak euro. The group has not been “unduly affected” by the slowdown in global trade, with management indicating that full-year results should be in line with expectations. We are leaving our estimates unchanged.

To Read the Entire Report Please Click on the pdf File Below