GBP crosses have lined up in such way that they can use some retraces to let go of over-bought conditions before surging for newer highs. With this view, I will be looking to track some optimum spots on it’s crosses to go short. Later on if we do see the drop coming in, I intend to try longs for newer highs.

There is an important UK GDP news release tomorrow, and a better than expected numbers can boost the GBP and vice versa on poor readings. Hence some caution is required, especially if the entry comes close to the news. It is also advisable to try 1 or 2 of its crosses and preferably with lower lot sizes than the regular.

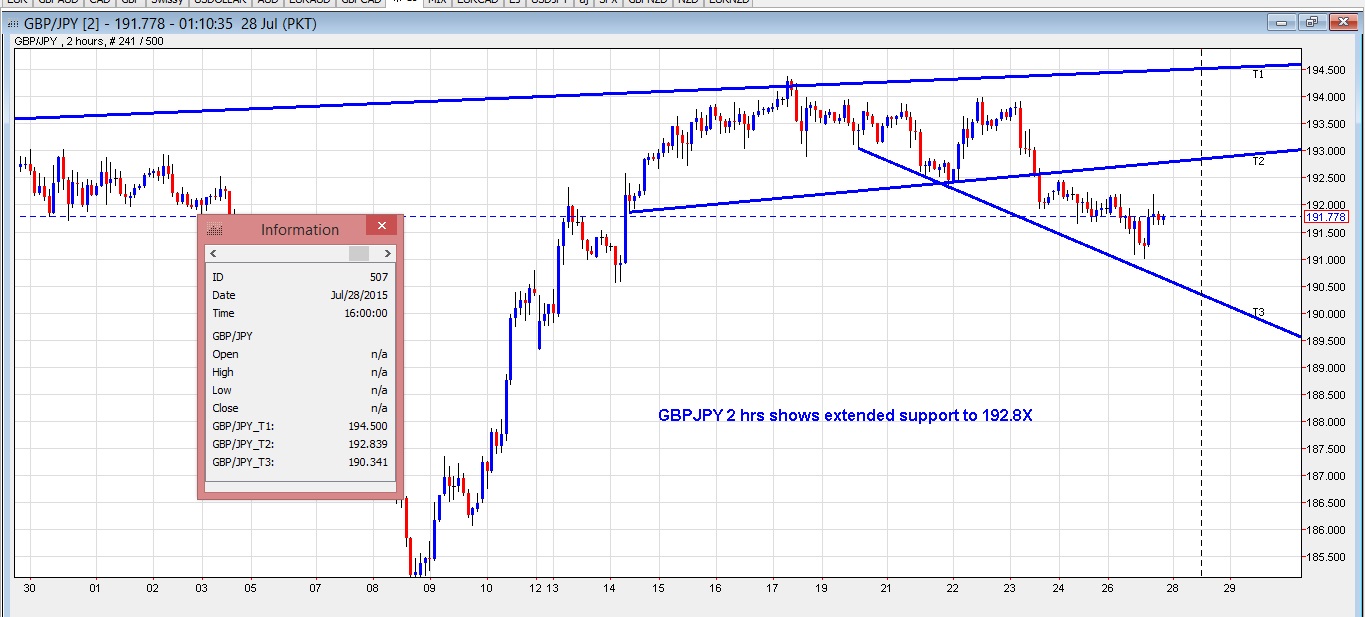

We are looking to set shorts ideally into 192.8X for a possible move lower to 190.2X and subsequently to long off the target zone for a possible meatier target into 196 handle.

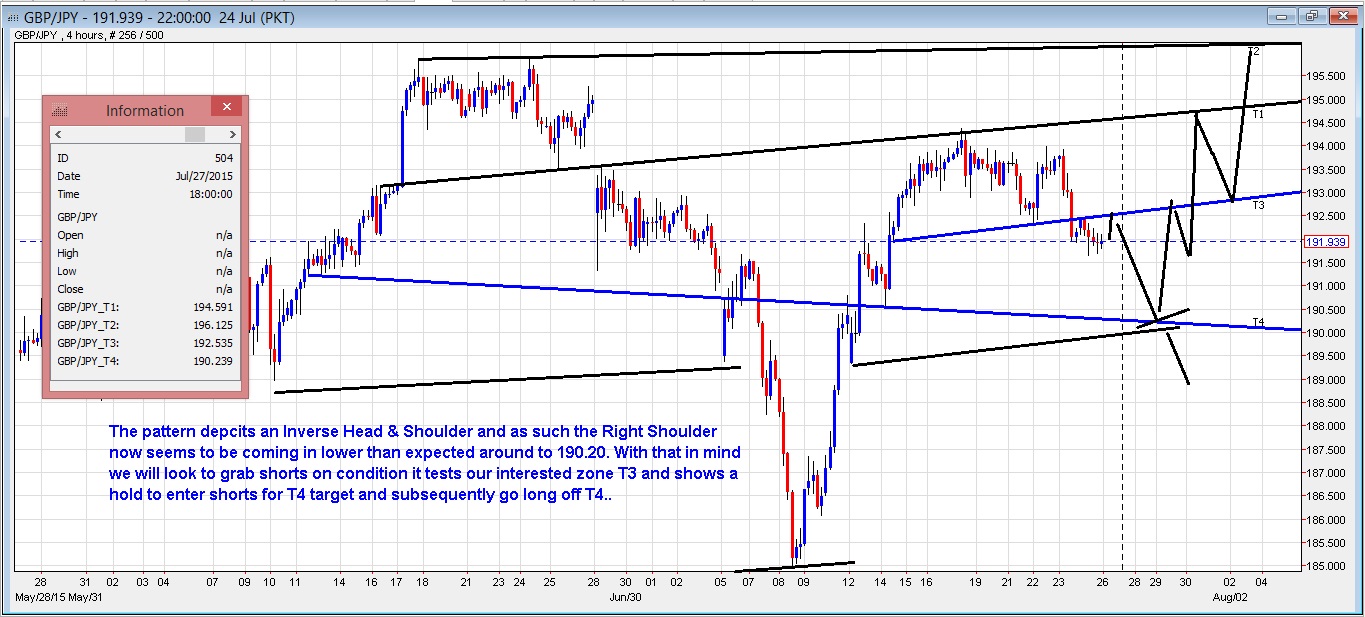

We are looking at what looks to be a possible inverse head & shoulder and originally were expecting right shoulder to end to 192.2X. We had an earlier decent bounce, but than later it fell under and this is hinting that right shoulder can come in lower as shown in the 4-hour chart layout. The overall scenario on the pair is bullish, but an initial dip lower seems to be on the card.

The 4-hour chart layout shows resistance to 192.60 and the 2-hour chart shows extended to 192.8X. Naturally getting shorts off 192.8X would be better and as such we keep options open to see if price once tested 192.60 shows any holding pattern to go short or else try off 192.8X.

The ideal target comes to 190.2X and can look to long from there for the bigger moves likely to try a 196 handle out.

I’m interested in trying to short off newer highs possibly around the 2.042X zone for an initial run to 2.0355-60 with a potential run lower to 2.0080-2.0010. The prime target on the intended shorts also comes in as decent looking retrace to long the pair for newer highs.

Just like GBP/JPY, which I believe will end up been higher, the overall picture on GBP/CAD is also bullish. Try to get on the possible drop that may be coming to swing shorts and then the longs.

While the above GBP crosses are mainly a sell if desired levels come into play, we are using GBP/AUD to enter retrace buys from the T4 trend line or 2.115X. T4 comes in as a decent looking zone to enter longs for a possible retrace back to 2.123X or even fuller back to testing T3 breakout. Alternatively, we can look to sell the break of T3 or 2.1260 as we have upcoming GBP data.

Please check this link as the setup was done last week and it is still valid.