Today I will be quickly going through few pairs. Most were expecting another volatile session as we saw on Monday; but found the markets to be quite smooth comparatively. Still caution advise as if the stocks end up getting sold again; we can see some wild swings again and especially on the JPY.

Going forward 137.4X is resistance and if gets a test and a hold comes in as a decent zone to try shorts for a possible move down to 135.7X; alternatively this T2 zone looks decent to try longs.

EUR/JPY 2 hr – T2 comes in as a decent support to consider going long. 137.4X expected resistance

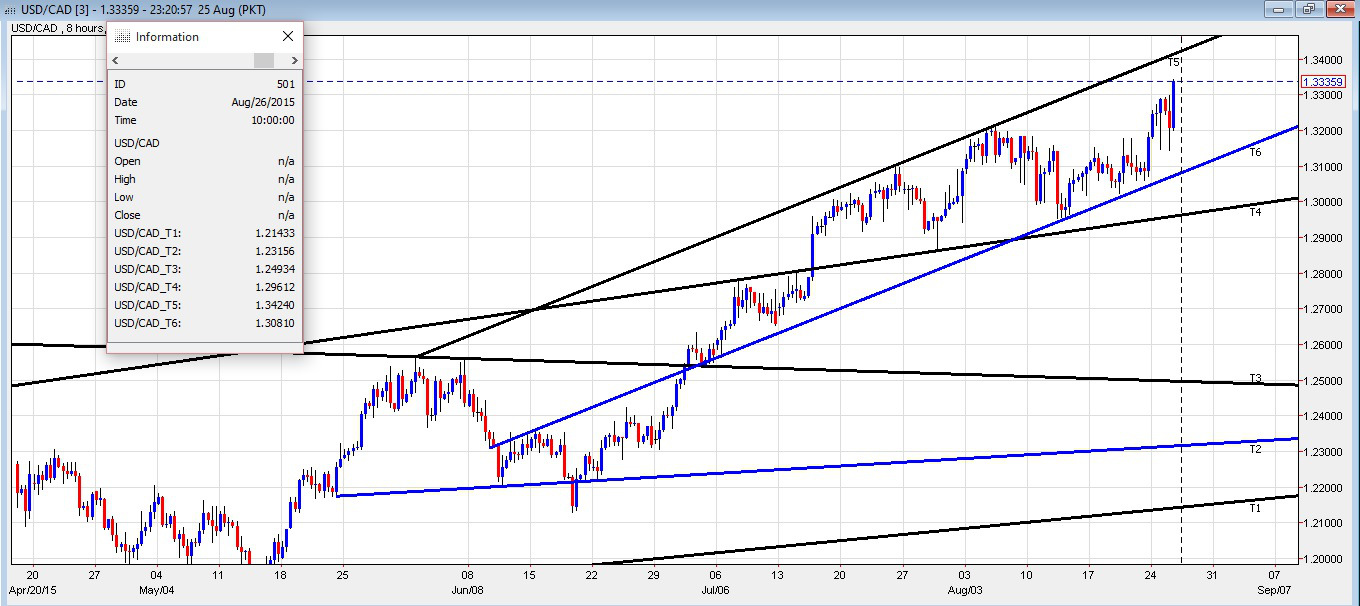

The pair is ever looking bullish and with falling oil prices; we just may get to see a print of 1.342X and like to try shorts off there. The pair can use a little correction and if so T4 comes in as an ideal spot.

USD/CAD 8 hrs – 1.342X expected resistance and looks good to try shorts

The pair can use some decent retrace / correction. With that in mind; like to try set shorts off from T2 in anticipation of a decent corrective drop.

GBP/AUD 4 hrs – Looking at T2 & T3 channel and like to see T2 test for going shorts

The pair is stuck within a channel after that big plunge lower to the base of the channel which was quickly recovered.

Can opt to buy off the base of the channel or T2 else prefer to try shorts off T3 test.

NZD 8 hrs – Like to try shorts off the breakout Trend Line T3