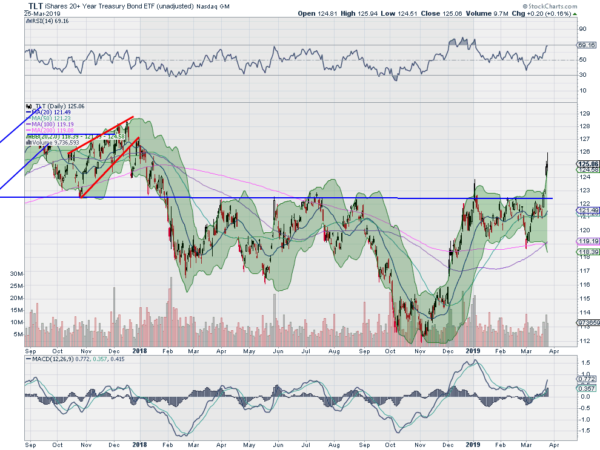

US Treasuries have been a head scratcher for the past 15 months. Ever since dropping below support in January 2018 they have both show signs of life and death. They have bounced against that support as resistance several times without breaking higher. And they took a new leg lower to new lows from August into November. Since that last drop, they have moved right back to resistance.

In late December the Treasury ETF, $TLT, cracked resistance and made a new 11 month high. But just for 1 day, and then fell back. Then at the end of last week, it broke through again. It ended Friday with a big gap up to a new 15 month high. Is this another false move or has there been a tremor in the Treasury market that has released a new bull run?

The evidence is mixed. First, the RSI is already overbought. The ETF can certainly consolidate for a while and this will reset. Or it can get more overbought. So not a concern for the short term at least. The MACD is positive and rising. This is positive and it is far below previous peaks which means it has room to run. The Bollinger Bands® have also opened higher allowing for a further move up. The next important level seems to be the December 2017 high. A move over that would be a strong signal for a new bull market in Treasuries.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.