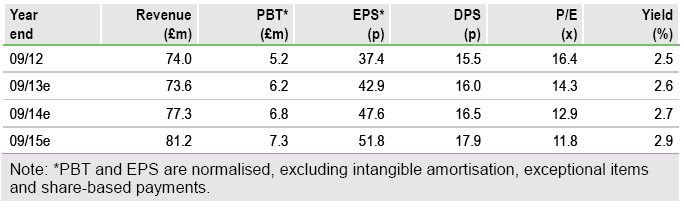

In July 2012, Daemmon Reeve, then CEO of Treatt USA, was appointed group CEO. In May 2013, he presented his new strategy to shareholders, focused on value-added revenue growth and strict cost control. Both the acceleration in group performance in 2013 and his track record in turning around Treatt USA point to a positive future. In July 2013, the Bovill family sold their remaining stake to institutional investors, removing a c 30% overhang. We see upside to our double-digit earnings forecasts.

A credible medium-to-long-term strategy

Management’s new strategy is aimed at accelerating revenue growth by focusing on sales of its value-added products to larger multinational customers in key growth markets, such as beverages. In addition to the associated gross margin uplift this will generate, management is keen to instil a culture of keen cost control, which should further benefit the operating line. With an EBITA margin of 7.8% reported in the year to September 2012 versus peer group operating margins ranging from low double-digits to mid-teens, if executed well, there could be a significant opportunity for medium- to long-term value creation.

Early signs bode well

Although early days, a strong H1 performance (PBT +29%, EPS +40%) and early reassurances around 2014 and 2015 forecasts, in combination with Daemmon Reeve’s track record at Treatt USA, where profitability improved by 250% over his three-year tenure, all bode well. With c 20% of group sales exposed to orange oil, Treatt will inevitably suffer year-on-year fluctuations in revenue and cash flow despite management’s best efforts to hedge its position. However, in spite of the risk of short-term revenue volatility, we think that the medium- to long-term outlook for profitability has materially improved.

Valuation: Significant discount

Treatt trades at 13.1x FY14e and 12.0x FY15e calendarised P/E, a discount of over 20% to its listed peer group in the ingredients flavours and fragrance sector, and a 30% discount to its end-customers in the beverage industry. Given its global reach and strategy for growth in fast-growing areas of the beverage market, and with its renewed focus on strict cost control, we not only believe that its current discount is unwarranted, but also see potential for upside to our forecasts over the medium to long term. A key catalyst would be an upgrade announcement precipitated by major new contract wins with multinational customers.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Treatt Initiation Of Coverage

Published 10/01/2013, 09:08 AM

Updated 07/09/2023, 06:31 AM

Treatt Initiation Of Coverage

A sweetening outlook

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.