Treatt PLC (LON:TET) has posted yet another year of excellent growth, with revenues up 25% and adjusted PBT up c 45%. The company has reached its FY20 financial objectives three years early, and the management has therefore updated its strategy to take the company through to the next phase. A new facility is being built in the UK, and the US site is being expanded. Both projects are on track and Treatt has now announced a share placing to fund these projects. This was always flagged as a possibility. We update our forecasts to reflect the FY17 results and the share placement. Our fair value is 515p (from 522p previously).

FY17 was a record year

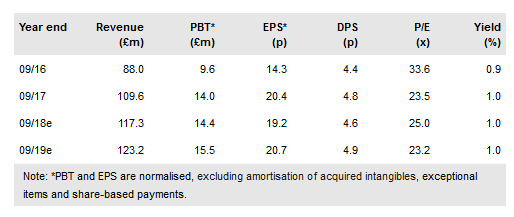

FY17 was a record year for the company, with revenues topping £100m for the first time (£109.6m), adjusted PBT of £12.9m and EPS of 18.3p on a company adjusted basis. The growth rate achieved in FY17 will be hard to replicate and should not be considered the new norm, but it does demonstrate the company is successfully embracing the sweet spot in flavour ingredients. We note management’s comments that FY18 has started well, and the growth in FY17 was broad-based – both in terms of geography and product mix – which sets a good base for the future.

To read the entire report Please click on the pdf File Below: