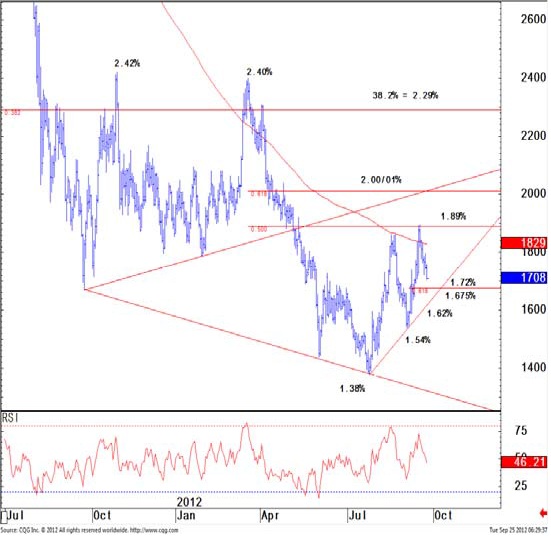

After fears across the pond resurfaced the 10-Year U.S. Treasury rallied as the yield fell 5 basis points to 1.71%. With yesterday’s move, the 10-Year U.S. Treasury is kissing against key resistance.

Credit Suisse technical analysts David Sneddon, Christopher Hine, Pamela McCloskey, and Cilline Bain set their focus on resistance at 1.70%. If the yield trades below, the 10-Year would see a more extended recovery to 1.65/635%. In Credit Suisse’s latest U.S. Fixed Income Daily, they provided the following color on the 10-Year:

10yr US yields have held support at 1.80% and are again testing chart resistance at 1.70. Extension through here would confirm a small top and see strength extend to 1.67% then the 61.8% retracement level at 1.635%. Removal of the latter is needed to target trend resistance from the July chart low at 1.62%.

Above 1.80% would look to 1.83%. A break here is needed to trigger a test of the 1.89/90% level. Extension through it would confirm a better base and target 2.00/01% – triangle and 61.8% retracement support – next.

Until the 10-Year falls below the aforementioned resistance level, the strategy for the research team is still short at 1.75% with a Stop-Loss below 1.70%. Their target continues to be 2.00%.

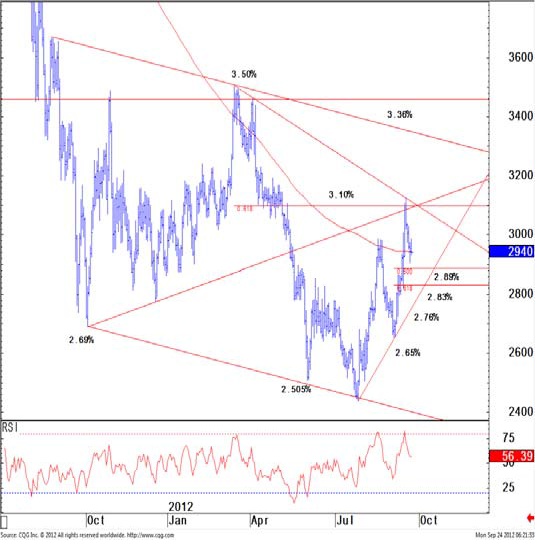

As for the Long Bond which has recovered by closing at 2.90%, resistance for the 30-Year U.S. Treasury lies at 2.89% and a trade below would lead to a push lower according to Credit Suisse.

The recovery has extended and through 2.89% would look to 2.83/795%. 30yr US has held support at 2.99/3.00% and rallied to test retracement resistance (50%) at 2.89%. We again look for selling here, but through it would allow a test of tougher resistance at chart and 61.8% retracement barriers at 2.83/795%. A break here is needed to ease ongoing bearish risk and see a test of 2.75%.

Above 2.99/3.00% looks to 3.03/3.035%. Through here is needed retest of 3.095/125% – trend and retracement support.

As with the 10-Year, the strategy is to look to short the 30-Year at 2.93% with a Stop-Loss below 2.89%. The bearish bias remains as their target for the benchmark bond is at 3.20%.

Disclaimer: The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Treasury Yields May Bounce Higher After Touching Resistance

Published 09/25/2012, 12:46 AM

Updated 07/09/2023, 06:31 AM

Treasury Yields May Bounce Higher After Touching Resistance

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.