Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

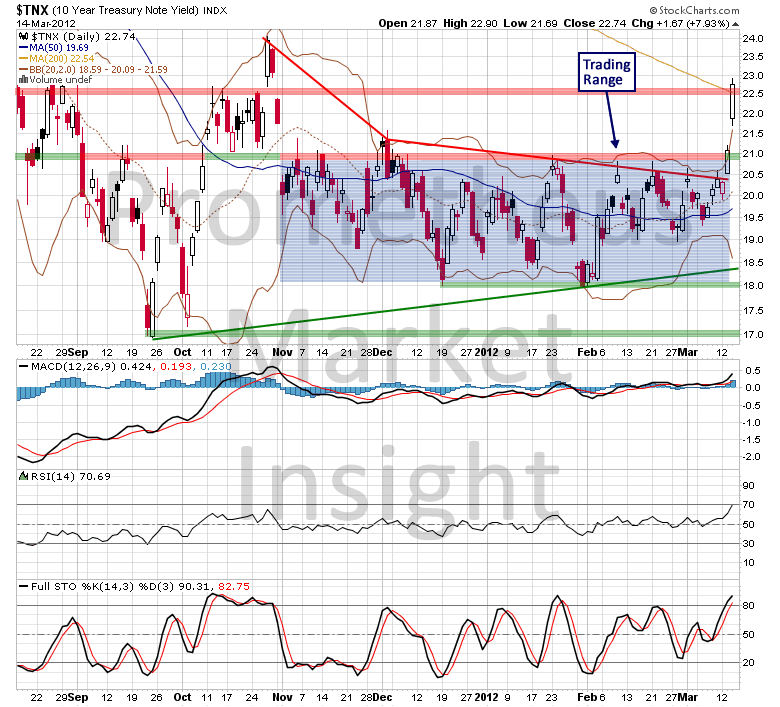

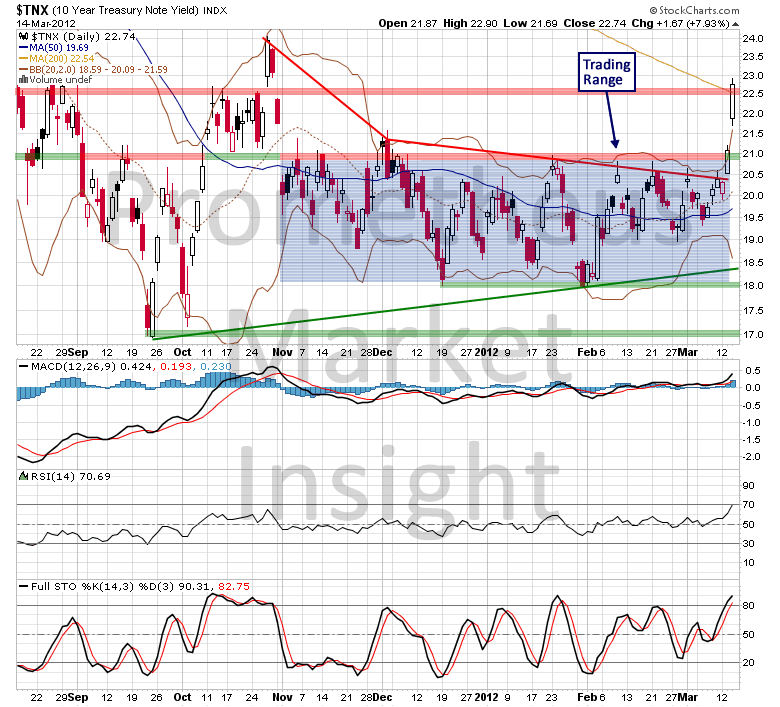

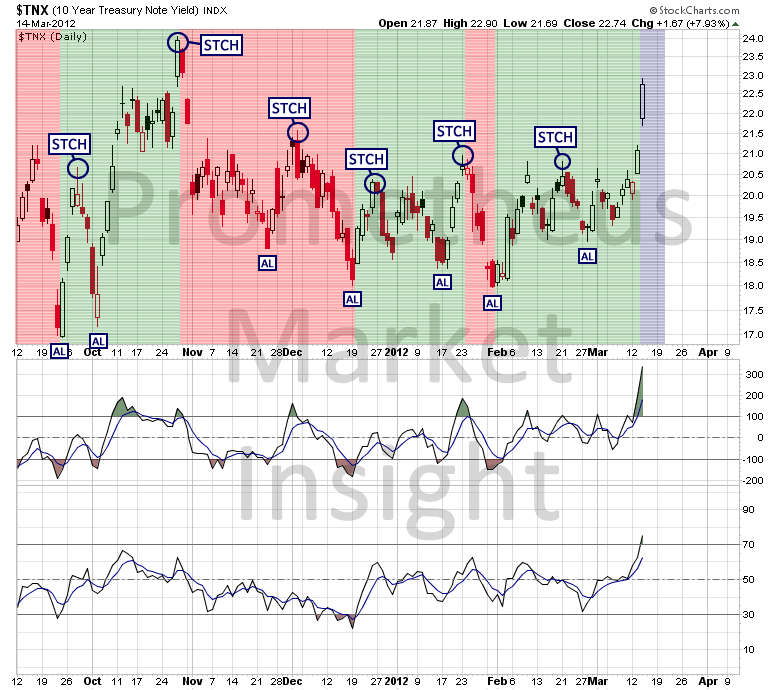

The 10-year Treasury note yield surged nearly 8% higher yesterday, breaking well above the upper boundary of the recent trading range between 1.80% and 2.10%. As expected, the breakout resulted in a very strong move higher.

A subsequent close well above current levels would confirm a break above congestion resistance in the 2.25% area and forecast additional gains.

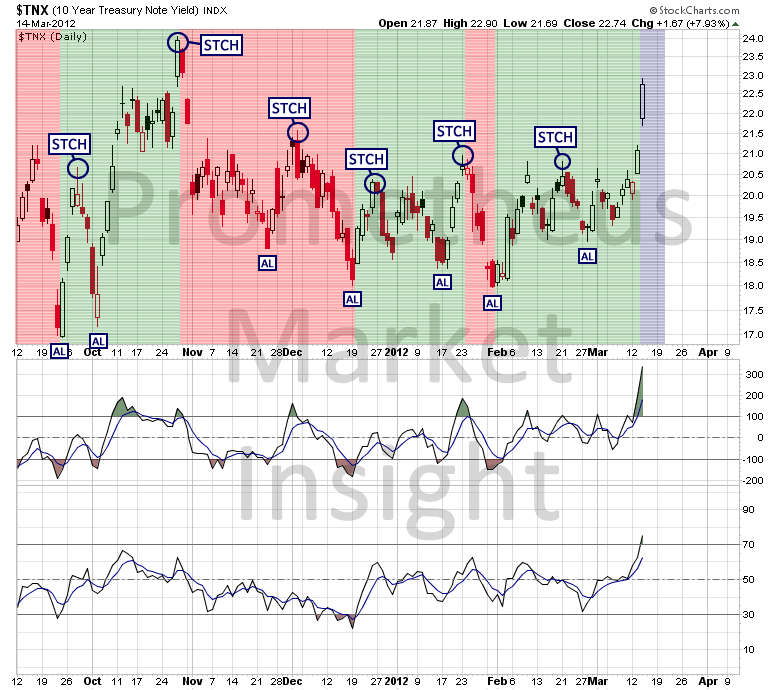

With respect to cycle analysis, the strong move higher reconfirms the bullish translation of the current cycle and favors additional short-term strength. However, we have entered the window during which the latest Short-Term Cycle High (STCH) is likely to form, so an overbought retracement could occur at any time during the next several sessions.

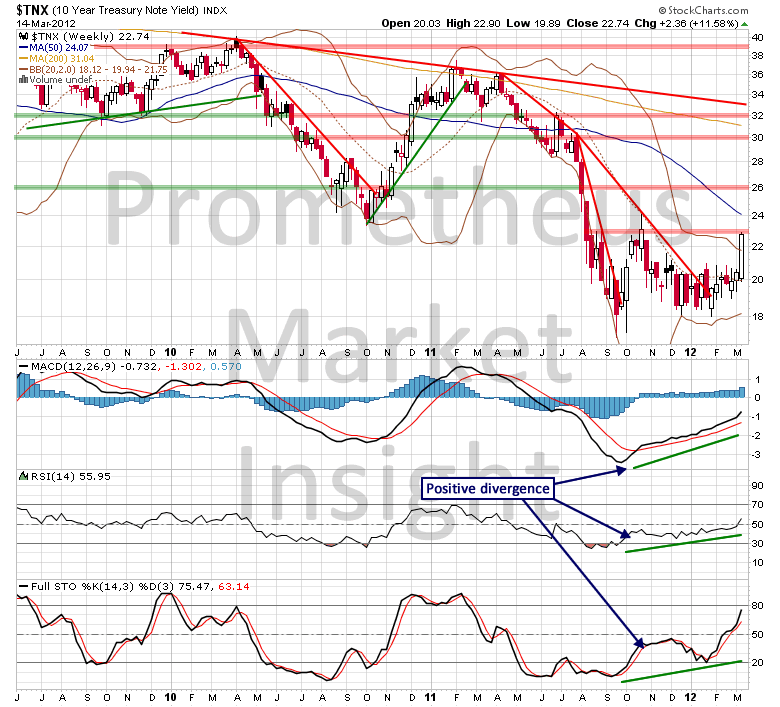

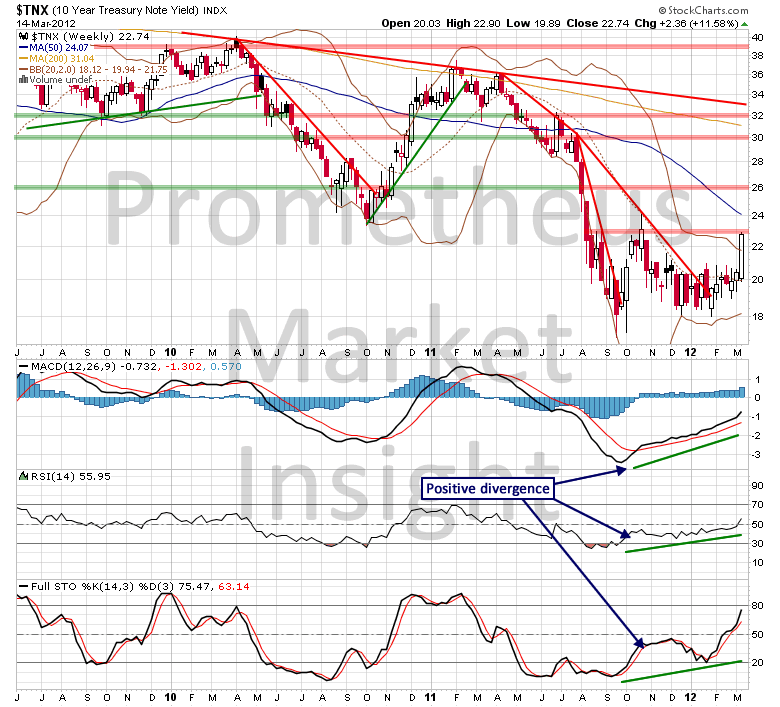

The positive divergence between technical indicators and yield behavior that we have been monitoring on the weekly chart favored the development of an oversold reaction and the rebound has already returned to relatively strong congestion resistance in the 2.30% area.

Now that the oversold condition created by the decline in 2011 has been cleared, yield behavior during the next several weeks will provide the next signal with respect to long-term direction.

A subsequent close well above current levels would confirm a break above congestion resistance in the 2.25% area and forecast additional gains.

With respect to cycle analysis, the strong move higher reconfirms the bullish translation of the current cycle and favors additional short-term strength. However, we have entered the window during which the latest Short-Term Cycle High (STCH) is likely to form, so an overbought retracement could occur at any time during the next several sessions.

The positive divergence between technical indicators and yield behavior that we have been monitoring on the weekly chart favored the development of an oversold reaction and the rebound has already returned to relatively strong congestion resistance in the 2.30% area.

Now that the oversold condition created by the decline in 2011 has been cleared, yield behavior during the next several weeks will provide the next signal with respect to long-term direction.