: I've updated the charts below through Friday's close. The S&P 500 is 2.39% off its all-time high set on April 11th. The yield on the 10-year note closed Friday at 1.73%, one basis point above the 2013 closing low on April 5th, 15th and 18th.

The latest Freddie Mac Weekly Primary Mortgage Market Survey puts the 30-year fixed at 3.41%, down from its interim high of 3.63% in mid-March and 10 basis points above its historic low of 3.31%, which dates from the third week in November of last year.

Here is a snapshot of selected yields and the 30-year fixed mortgage starting shortly before the Fed announced Operation Twist.

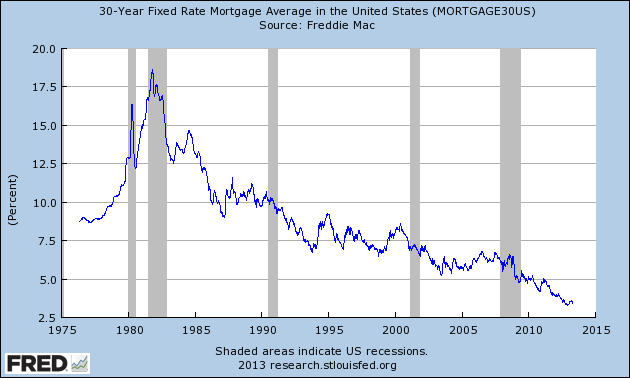

For a eye-opening context on the 30-year fixed, here is the complete Freddie Mac survey data from the Fed's repository. Many first-wave boomers (my household included) were buying homes in the early 1980s. At its peak in October 1981, the 30-year fixed was at 18.63 percent.

The 30-year fixed mortgage at the current level is a confirmation of a key aspect of the Fed's QE success, and the low yields have certainly reduced the pain of Uncle Sam's interest payments on Treasuries (although the yields are up from recent historic lows of last summer). But, as for loans to small businesses, the Fed strategy is a solution to a non-problem. Here's a snippet from the latest NFIB Small Business Economic Trends report:

Small business demand for credit remained weak in February, given the weak economy. Only 7% of owners surveyed reported that all their credit needs were not met, up 1 point but only 3 points above the record low. Twenty-nine percent reported all credit needs met, and 51% explicitly said they did not want a loan. Only 2% of owners reported that financing was their top business problem. Twenty-nine (29) percent of all owners reported borrowing on a regular basis, down 2 points and 1 point shy of the record low of 28 points set in November 2010.

A Perspective on Yields Since 2007

The first chart shows the daily performance of several Treasuries and the Fed Funds Rate (FFR) since 2007. The source for the yields is the Daily Treasury Yield Curve Rates from the US Department of the Treasury and the New York Fed's website for the FFR.

Now let's see the 10-year against the S&P 500 with some notes on Federal Reserve intervention. Fed policy has been a major influence on market behavior, and the S&P 500, our market exemplar below, is, as I pointed out above, just off its all-time high.

For a long-term view of weekly Treasury yields, also focusing on the 10-year, see my Treasury Yields in Perspective.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Treasury Yield Snapshot: 10-Year Yield Hovers Near 2013 Low

Published 04/22/2013, 01:27 AM

Updated 07/09/2023, 06:31 AM

Treasury Yield Snapshot: 10-Year Yield Hovers Near 2013 Low

What's New

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.