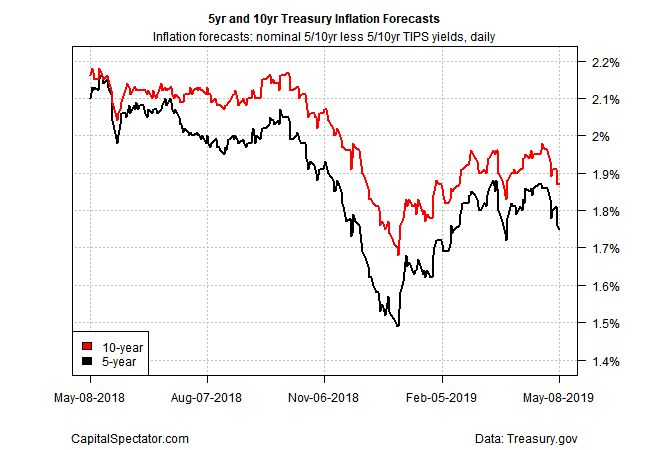

The widely followed 5-year Treasury market’s implied inflation forecast fell to a six-week low ahead of tomorrow’s April update on the Consumer Price Index (CPI). The softer outlook for pricing pressure could be noise that’s linked to the US-China spat over trade. Alternatively, the market is pricing in higher odds that the already subdued inflation trend is set to ease further in the months ahead.

The yield spread on the nominal 5-year Treasury less its inflation-indexed counterpart ticked down to 1.75% on Wednesday, May 8 – the lowest since March 28, based on daily data published by Treasury.gov. That’s still a middling rate relative to spreads in recent months. Nonetheless, the sudden downside bias in the market’s implied inflation outlook this month raises questions about expectations following recent comments by Federal Reserve officials that softer inflation data of late is “transitory.”

The Fed still expects inflation to perk up and so the market continues to price in low odds that the central bank will cut interest rates anytime soon, based on Fed funds futures via CME data.

Philadelphia Fed President Patrick Harker on Monday said he expects that inflation will be a temporary phenomenon, but also noted:

If any component of the outlook were to affect my view on the appropriate path of monetary policy, it would be inflation. However, we’re not there yet, and it would take more data to convince me. I therefore continue to see one increase at most this year; possibly one, at most, next.

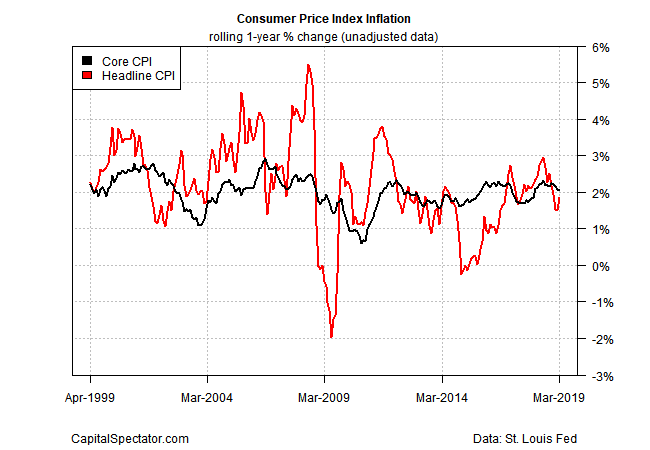

Tomorrow’s April data on consumer prices is on track to show that headline and core (excluding food and energy prices) readings of CPI will tick up for the one-year changes, based on Econoday.com’s consensus forecasts. If correct, headline CPI will strengthen to a 2.1% year-over-year change (a five-month high) and core CPI will rise to 2.1%, up from 2.0% in March. Based on this outlook, CPI data is set to show that inflation is basically in line with the Fed’s 2.0% target. In that case, worries about a softer pricing trend will ease.

The Treasury market, however, appears to be pricing in somewhat higher odds that inflation will be weaker than expected in the months ahead. If so, that could be interpreted as a sign that economic growth will be slower than current expected. Note that the Atlanta Fed’s GDPNow model is currently projecting a hefty slowdown in second-quarter GDP growth to a sluggish 1.7% vs. 3.2% in Q1.

For the moment, however, the dip in Treasury market inflation expectations is probably tied the risk-off environment triggered by fresh uncertainty related to US-China trade negotiations. In particular, President Trump has threatened to raise tariffs again on China’s imports on Friday and China vows to retaliate in kind.

How this plays out for the economy, Fed policy, inflation and interest rates is highly speculative at this point. As a hedge, the crowd is loading up on Treasuries, which in turn is pushing implied inflation expectations lower. Deciding if this leads to softer inflation in the hard data is debatable. Meantime, until a clearer picture emerges on the trade front the Treasury market is inclined to price in slightly higher odds that inflation will edge down.