Street Calls of the Week

On The Radar

Now that the shorts have been squeezed out of the 10-year note, it might top out.

Treasury futures bearish specs have finally been squeezed out.

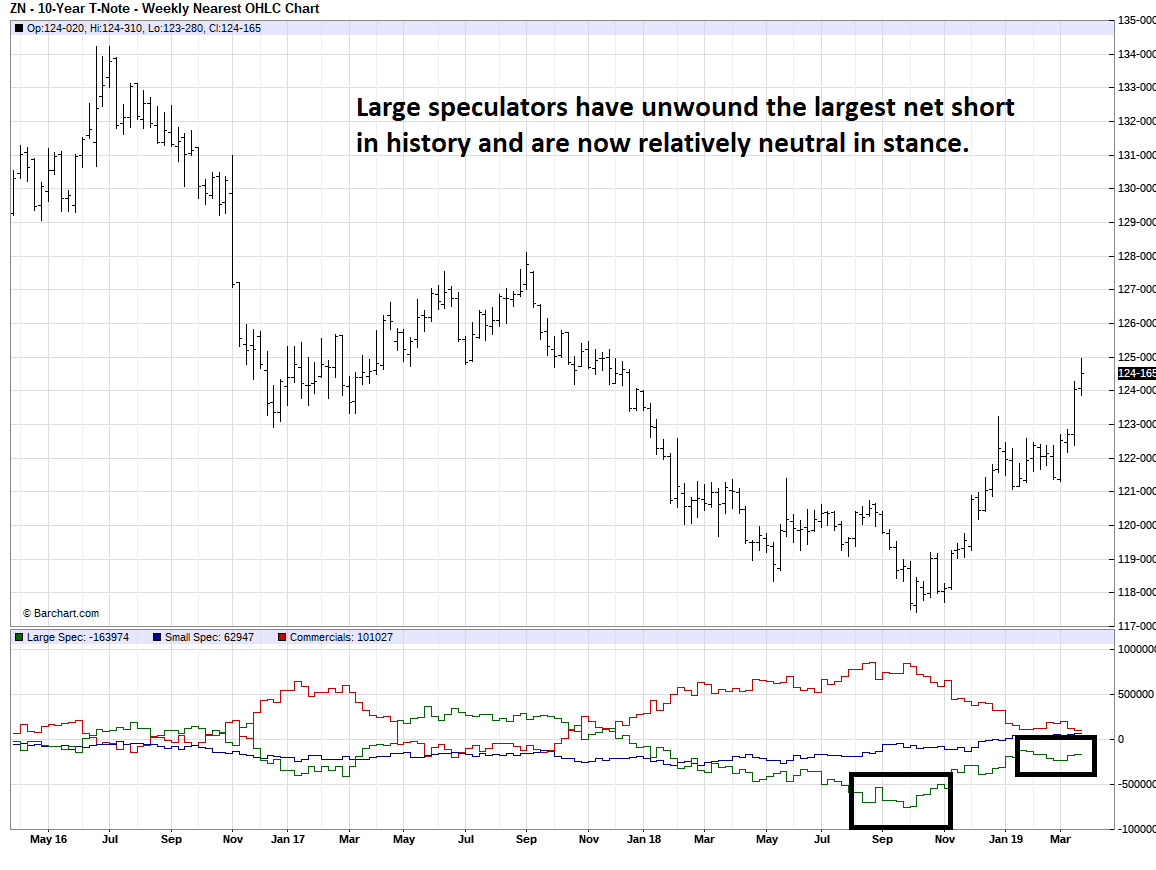

Throughout much of 2018, we made an effort to remind our followers that speculators in the 10-year note futures market were holding record net shorts. We also pointed out that when “everyone” is short, they will eventually have to exit, which puts buying pressure on a market. That is exactly what has ensued in the Treasury market in recent months. Although the short squeeze wasn’t as quick and swift as we thought it might be, it didn’t disappoint in the end.

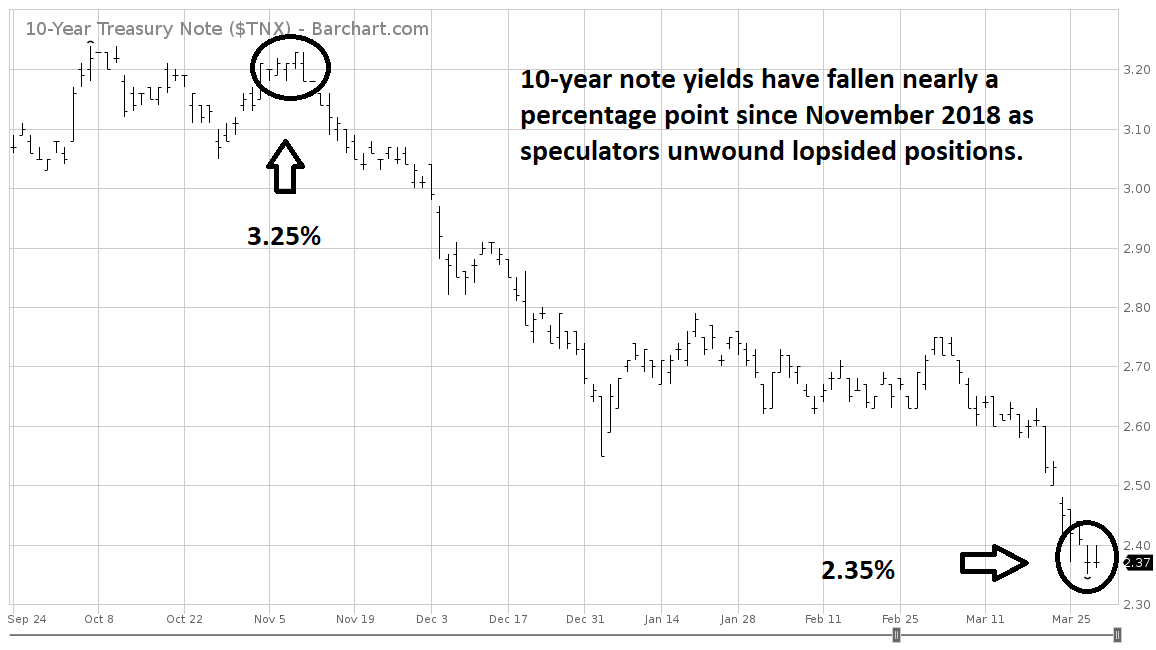

As Treasuries have rallied, the 10-year note yield has fallen from roughly 3.25% in November to nearly a handle lower at 2.35%. On its own, this is a stunning move but considering the sentiment dominating trade in late 2018, it is even more impressive. For instance, during this time we’ve gone from a Federal Reserve locked into a rate hike campaign in which 2019 was supposed to see two to four notches higher, to a complete standstill in tightening monetary policy and even some whispers of rate cuts to loosen the economy’s shoe strings. We’ve seen monetary policy officials turn on a dime and market sentiment turned with it.

Not surprisingly, with this change in environment traders have also shifted their stance. As mentioned, speculators held large and complacently bearish positions most of last year. In October of 2018, just prior to the Treasury market bottoming and yields peaking, large speculators who are assumed to be the smart money due to their large trading size, were holding a record net short 740,192 contracts. Since then, we’ve seen this group of traders methodically unwind their bearish positions and are positioned relatively neutral at this stage. From here, buying and selling will be dominated by speculative opinion, not a need to offset existing trades as it has been.

In late 2018, investors became queasy at the pace yields were rising (and Treasuries were falling). Eventually, concerns over higher interest rates took their toll on the equity markets. Ironically, at precisely the time interest rates seemed like a deal breaker for the stock rally, they reversed. Similarly, in today’s environment, the yield curve inversion (T-Bill paying higher interest than the 10-year note) is attracting attention and being blamed for recent weakness in equities, but we feel like the attention is coming at the latter stage in the game as it did in late 2018. In fact, the 10-year note is probably putting in some sort of intermediate-term high (and low yield).

A weekly chart of the 10-year note futures suggests there is significant resistance overhead as marked by simple trend lines. Also, oscillators such as the RSI (Relative Strength Index) and Williams WMB %R suggest the rally is overheated. That said, tops in Treasuries are typically messy; so, any speculative plays should leave room for the potential of a temporary spike to run any remaining buy stops. If this occurs, 126’0 would be a likely target for the June 10-year note futures contract but 128’0 could be seen if there is a fundamental shock to the market (such as no deal in China or Brexit complications). However, we believe the market is due for a corrective break, at minimum, and if fundamentals turn bearish we would expect to see the 10 – year note make its way back toward 118’0 to 116’0, this would mean yields back in the 2% handle.

In summary, we believe the best trades will be reserved for the Treasury bears in the coming weeks and months, but the environment calls for a conservative and well-hedged approach to the market.

*There is substantial risk of loss in trading futures and options.

DeCarley Trading (a division of Zaner)

Twitter:@carleygarner

info@decarleytrading.com

1-866-790-TRADE(8723)

DeCarleyTrading.com

HigherProbabilityCommodityTradingBook.com

Seasonality is already factored into current prices, any references to such does not indicate future market action.

There is substantial risk of loss in trading futures and options.

** These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.