During this whole run up in the stock market off of the February low, one thing has been a quandary. That is that there is supposed to be a trade off between stocks and bonds. So if stocks have risen over 16% since the February low why is it that treasury bonds have not fallen at all? Hmmm, maybe that traditional wisdom is not really true?

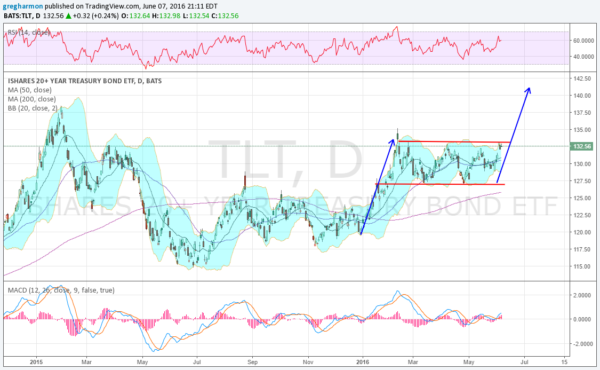

The chart above clearly shows that treasuries have held in a range as stocks (via SPDR S&P 500 (NYSE:SPY)) have risen. The consolidation between 127 and 133 has gone on for most of the year. But as stocks are preparing for a test of the all-time high bonds are also. They are not fading to the bottom of the range even. They are pressing against the top with the Bollinger Bands® opening and momentum indicators supporting more upside.

A break higher in the Treasury ETF, iShares 20+ Year Treasury Bond (NYSE:TLT) would target a move to 141. That would be an all-time high. Certainly that must spell the end of the stock market rise. Well, maybe that is not the case. The chart below can explain why.

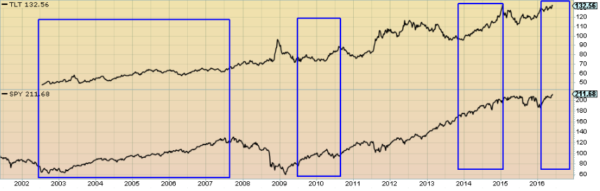

Going back to the start of the bond ETF in 2002, there have been periods of time where bonds and stocks have moved in the opposite direction. But the blue boxes indicate where they have moved in the same direction. Over this 14 year period they have moved in the same direction about half of the time.

Stocks may break out to new all-time highs soon. But this does not mean the demise of the US treasury bond. Or if bonds move first it does not mean that stocks must fall. With a loose enough range, both have actually trended higher over the entire 14 year period. So don’t be so fast to sell your bonds if stocks make all -time highs. Or to sell your stocks if bonds get there first. Like the picture above, girls may push boys aside but there is a long history of both living together in harmony.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.