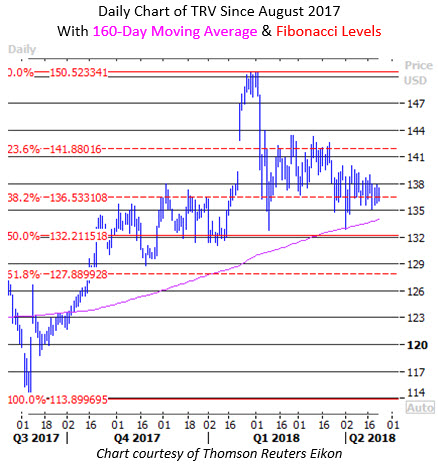

The Travelers Companies Inc (NYSE:TRV) is scheduled to report earnings before the open tomorrow, April 24, and the stock has been testing a key level on the charts ahead of the event. Specifically, TRV shares have pulled back to the $135-$137 area. The $135 price point equals a roughly 10% decline from the equity's Feb. 2 record high of $150.55, and is around the year-to-date breakeven point. Just above here, located near the $136.50 level, is a 38.2% Fibonacci retracement of the rally from the September low to February peak.

As you can also see on the chart above, a sharp intraday drop back on April 6 was neatly contained by the 160-day moving average. Travelers stock was last seen trading up 0.5% at $137.55, giving it a year-over-year lead of 15.6%. Recent post-earnings performances suggest more upside could be coming, too.

For example, TRV shares gained 5% after earnings last quarter, and added 2.4% the day following earnings the quarter before that. Implied volatility data shows the options market is pricing in a swing of 3.3% for tomorrow's session, regardless of direction.

Speaking of options, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows 783 TRV calls were bought to open over the past 10 days, compared to just 26 puts. However, the largest increase in open interest during this time occurred at the May 140 call, and most of the positions were sold to open -- suggesting traders foresee the security holding below $140 over the next month or so.