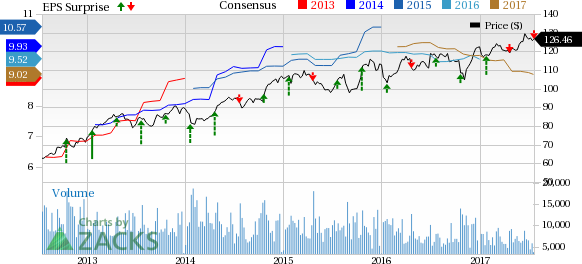

The Travelers Companies, Inc.’s (NYSE:TRV) second-quarter 2017 core income of $1.92 per share missed the Zacks Consensus Estimate of $2.07 by 7.2%. Also, the bottom line deteriorated 12.7% year over year.

This year-over-year decline in earnings can be attributed to high levels of catastrophe and non-catastrophe weather-related losses caused by the significant U.S. tornado and hail activity. The storm activity had a significant impact on Personal Insurance, affecting results in both home and auto. However, the increased net investment income partially offset the downside. Also, the bottom line was boosted by share buybacks.

Behind the Q2 Headlines

Total revenue of Travelers improved nearly 5.9% from the year-ago quarter to $7.2 billion. Revenues surpassed the Zacks Consensus Estimate of $6.9 billion.

Net written premiums displayed a record 4.6% year-over-year increase to $6.6 billion due to growth in each of the business segments – Business and International Insurance, Bond & Specialty Insurance and Personal Insurance.

Net investment income grew approximately 8.9% year over year to $598 million owing to higher private equity returns. This improvement however, was partially offset by a decrease in fixed income returns due to lower reinvestment rates available in the market.

Travelers’ underwriting gains plummeted 55.4% to $173 million. Combined ratio deteriorated 360 basis points (bps) year over year to 96.7% due to higher underlying combined ratio, wider catastrophe losses and lower net favorable prior-year reserve development.

At the end of the second quarter, statutory capital and surplus was $20.61 billion and the debt-to-capital ratio (excluding after-tax net unrealized investment gains) was 23.3%. This was within the company’s target range of 15–25%.

Adjusted book value per share was $82.71, up 6.6% year over year.

Segment Update

Travelers’ Business and International Insurance unit reported net written premiums of $3.5 billion, up 2.1% year over year. A continued strong retention and an improved renewal premium change led to the upside.

Combined ratio came in at 96.5%, remaining unchanged year over year.

Segment income of $429 million rose 7% owing to higher net investment income and a slightly higher underlying underwriting gain. However, the upside was partially offset by higher catastrophe losses.

Bond & Specialty Insurance: Net written premiums increased 4.9% year over year to $598 million, primarily driven by strong retentions and higher renewal premium change in the Domestic business, as well as a rise in management liability in the United Kingdom and contract surety in Canada.

Combined ratio deteriorated 1420 bps year over year to 68.7% due to lower net favorable prior-year reserve development, partially offset by a lower underlying combined ratio and lower catastrophe losses.

Segment income plunged 24.2% year over year to $163 million due to lower net favorable prior-year reserve development.

Personal Insurance: Net written premiums increased 8.5% year over year to about $2.5 billion.

Combined ratio deteriorated 630 bps year over year to 104.1% due to a higher underlying combined ratio, no net unfavorable prior-year reserve development when compared with net favorable prior-year reserve development in the year-ago quarter as well as higher catastrophe losses.

Segment income of $12 million plummeted 87.4% due to lower underlying underwriting gain and wider catastrophe losses. However, this downside was partially offset by higher net investment income.

Dividend and Share Repurchase Update

The property & casualty (P&C) insurer returned a total capital of $676 million to shareholders in the reported quarter. This included a buyback of 3.8 million shares worth $475 million in the reported quarter. The company is now left with shares worth $5.2 billion for repurchase under its existing authorization at the end of the second quarter.

The company’s board declared a quarterly dividend of 72 cents per share in the reported quarter, payable on Sep 29, 2017 to shareholders of record at the close of business as of Sep 8, 2017.

Zacks Rank

Currently, Travelers has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings so far, the bottom line at Brown & Brown, Inc. (NYSE:BRO) and RLI Corp. (NYSE:RLI) beat their respective Zacks Consensus Estimate, while The Progressive Corporation (NYSE:PGR) lagged expectations.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research