Chicago, IL-based TransUnion (NYSE:TRU) is a consumer information services company that offers data and analytics solutions, particularly in credit risk management. The company is one of the three largest credit reporting agencies in the U.S.

However, TRU caters to a highly competitive market. Its competitors widely vary according to its business segment, geographical market and industry vertical that its solutions address. The high degree of competition restricts its pricing power to some degree.

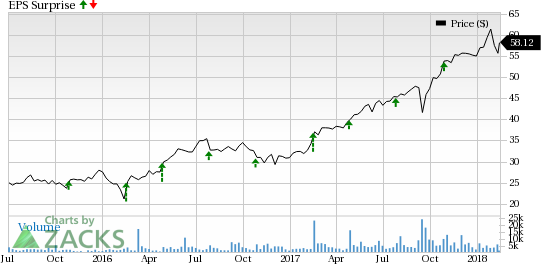

In the last four trailing quarters, TRU has managed to beat estimates in each, registering a positive average earnings surprise of 10.3%.

Currently, TRU has a Zacks Rank #3 (Hold), but that could definitely change following the latest fourth-quarter 2017 earnings report, which was just released. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: TRU reported adjusted EPS of 50 cents, which comfortably beat the Zacks Consensus Estimate of 49 cents.

TransUnion Price and EPS Surprise

Revenue: TRU beats on revenues. The company reported revenues of $506.1 million, compared to Zacks Consensus Estimate of $488 million.

Key Stats to Note: Concurrent with earnings release, TRU provided bullish 2018 outlook. For full year 2018, revenues are likely to be between $2.12 billion and $2.14 billion, up 9-11% year over year. Adjusted earnings per share is expected to be between $2.26 and $2.31, an increase of 20-23% year over year.

Stock Price: Shares were flat in the pre-market trading following the earnings release. It would be interesting to see how the market reacts to the results during the trading session today.

Check back our full write up on this TRU earnings report later!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

TransUnion (TRU): Free Stock Analysis Report

Original post