The transportation sector had a great 2014 -- at least until last month. With crude oil's fall, the railroad stocks (a big part of the sector) took a hard right to the face. The ironic part is that many in the sector transport crude oil, but that's a story for another day.

Trucking stocks have had mixed results. Some are falling while others have spent the time consolidating. But doesn’t cheap crude oil lead to cheap gas and diesel? What's important is not how they should react but how they're starting to react.

Here are two companies, JB Hunt Transport Services (NASDAQ:JBHT) and Knight Transportation (NYSE:KNX), which look poised for a drive higher into year's end.

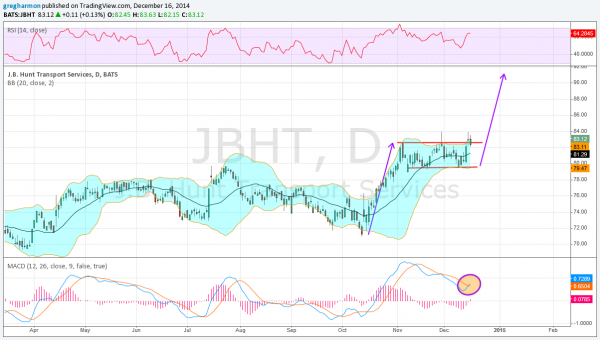

J.B. Hunt has been consolidating between 79.60 and 82.60. At least until Tuesday when it broke the range higher with a Measured Move to 91. And momentum indicators support it. The RSI held at the mid line and is rising again. And the MACD is crossing up, also a buy signal.

Knight Transportation went through a bit of a pullback, which reset the RSI lower, while it held over the mid line. The MACD is now leveling as the RSI is rising. The price also bounced and is now crossing the 20-day SMA as it moves higher.

Keep an eye on Heartland Express (NASDAQ:HTLD), Swift Transportation (NYSE:SWFT) and Werner Enterprises (NASDAQ:WERN) as well. All of their charts are looking similar.