The transportation sector of the stock market is one with a rich and impactful history. Technicians, economists, and forecasters often lean on this industry to predict major changes in global growth trends. When transport companies are thriving, it is commonly viewed as a positive sign of worldwide trade and business activity. Conversely, when they are contracting, it can be deemed as a negative omen of shrinking commerce.

The idea originated all the way back in 1884 when Charles Dow first created the Dow Jones Transportation Average. In its inception, this index was composed of 11 companies, including nine railroads and two non-rail companies. It also plays a major component in the investment strategy known as “Dow Theory”, which is a historical method of using technical indicators to map out buy and sell signals.

Today, that same index, often called the “Dow Transports”, is comprised of 20 large-cap stocks and has widened its scope significantly with advancements in technology. The Dow Transports now include airlines, railroads, trucking, marine transportation, delivery services, and even car rental stocks.

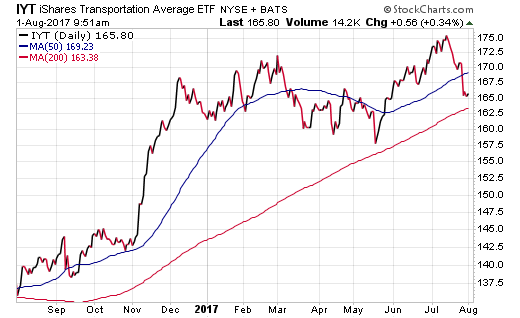

The largest exchange-traded fund to track this index is the iShares Transportation Average ETF (NYSE:IYT), with $866 million under management. IYT debuted in 2003 and is an easy way for investors to access this historic index in a transparent and low-cost vehicle.

Top holdings in IYT include: FedEx Corp (NYSE:FDX), Norfolk Southern (NYSE:NSC), and United Parcel Service (NYSE:UPS). It’s market-cap weighted structure means that the largest three companies account for over 28% of the total portfolio makeup. Remember that IYT has just 20 holdings, albeit major corporations with a truly global footprint.

More recently the price action of IYT has begun to diverge from the broader market. IYT peaked in July and has dropped approximately 6% in a matter of weeks as many of its top components grapple with earnings season woes.

This ETF has gained just +2.55% year-to-date through July 30 compared to +11.48% for the SPDR S&P 500 ETF (NYSE:SPY). One potential headwind for this fund is the short-term strength of crude oil prices, which tend to negatively impact logistics, airline, and shipping companies. Higher input costs lead to compressed margins and thinner earnings growth.

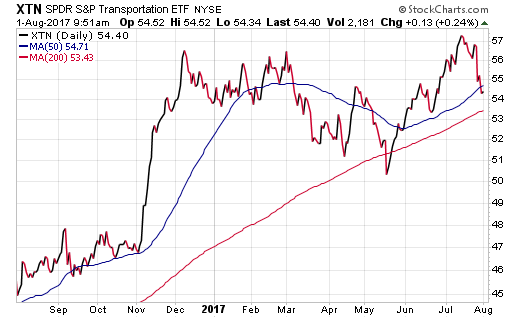

It’s also worth noting that this same pattern has been extending towards smaller stocks in this category as well. The SPDR S&P Transportation ETF (NYSE:XTN) is a modified equal weighted index with a wider selection of 45 companies within its portfolio. XTN gives each of its holdings a similar distribution of capital to allow smaller stocks an equal opportunity to contribute towards performance.

This ETF has also begun what could be the early stages of a correction with a 4% drop from its July highs. That price move has erased much of its gains for the year and may lead to flared concerns about the health of the global economy if further declines unfold.

Investors who want to explore this category further can also reference the US Global Jets ETF(NYSE:JETS). This exchange-traded fund focuses on a narrower subset of airline stocks within the transport industry and includes some defense companies in its portfolio as well. It offers a unique way to invest in the transportation theme for those who want specific exposure to this segment of the economy.

The Bottom Line

The recent drop in transportation stocks may simply be the result of earnings hiccups combined with a surging cost environment. However, it’s worth noting that many investors closely follow these indicators due to their longevity in the global marketplace as well as their fundamental impact on the economy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.