When one analyzes the economy, there are always some sections which do better than others. When the economic growth is weak (like currently), several segments can be in contraction while others are expanding.

Follow up:

There is a general softness and contraction of the transport sector which historically is a forward looking bellwether for the economy. There should be a general correlation between:

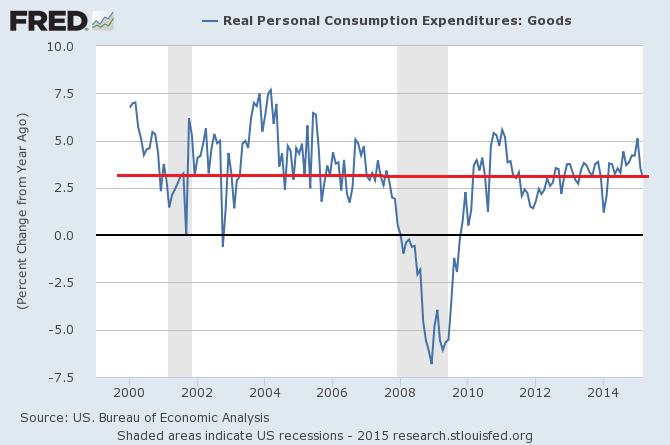

- consumer consumption of goods vs.

- transport.

Even with the poor GDP performance in 1Q2015, the consumer goods segment of the economy was expanding near its average rate for the 21st century.

In analyzing the economy - I give higher weight to non-monetary measures - the main reason is the inaccuracy of inflation adjustments. It is far better to rely on counting non-monetary things - like trucks, ships, and trains which are not affected by inflation.

Rail traffic has been slowing for almost one year (barring a little noise). It is currently flat-lining near no growth.

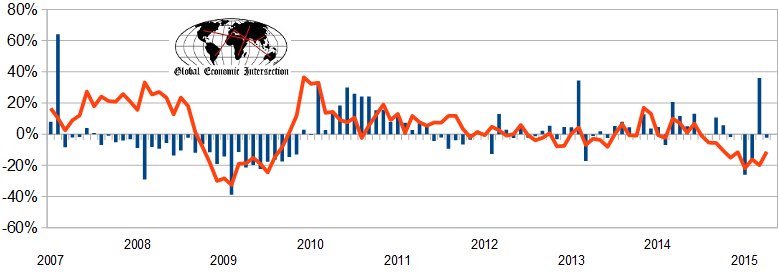

Container through-put through the ports (even when filtering out the West Coast Labor issues) is in contraction. The data for this series continues to be weak. Not only is year-to-date volumes contracting for both imports and exports - but both April exports and imports are contracting month-over-month and year-over-year. This continues to indicate weak economic conditions domestically and globally.

Unadjusted Year-over-Year Change in Container Counts - Ports of Los Angeles and Long Beach Combined - Imports (red line) and Exports (blue bars)

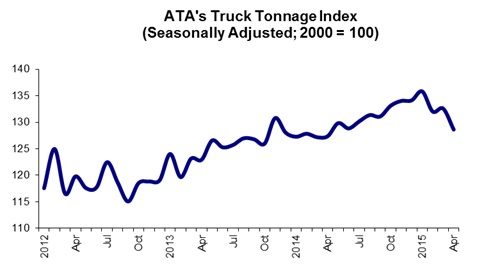

Also this past week, the American Trucking Associations' (ATA) trucking index declined 3% following an downwardly revised improvement of 0.4% in March. From ATA Chief Economist Bob Costello:

Like most economic indicators, truck tonnage was soft in April. Unless tonnage snaps back in May and June, GDP growth will likely be suppressed in the second quarter. Truck tonnage is off 5.3% from the high in January. The next couple of months will be telling for both truck freight and the broader economy. Any significant jump from the first quarter is looking more doubtful.

Goods transported are generally included in GDP (GDP recognizes goods at point of final sale or when warehoused) between one month and three months after movement. Transport is indicating the economy likely will be as least as bad in 2Q2015 as it was in 1Q2015.

Other Economic News this Week:

The Econintersect Economic Index for May 2015 is indicating growth will continue to be soft. The tracked sectors of the economy are relatively soft with most expanding but some contracting. The effects of the recently solved West Coast Port slowdown (a labor dispute which had been going on for months) and weather related issues are no longer evident in the raw data. Therefore, the economic slowdown forecast last month is cyclic and not resulting from transient causes.

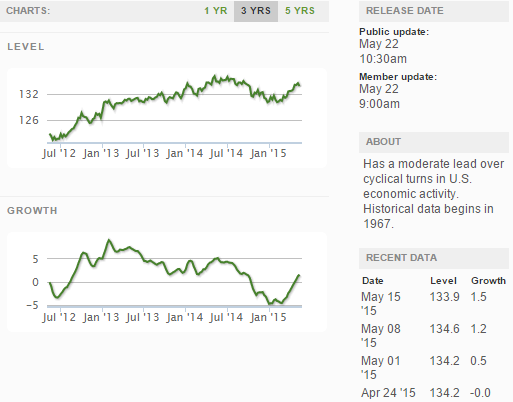

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

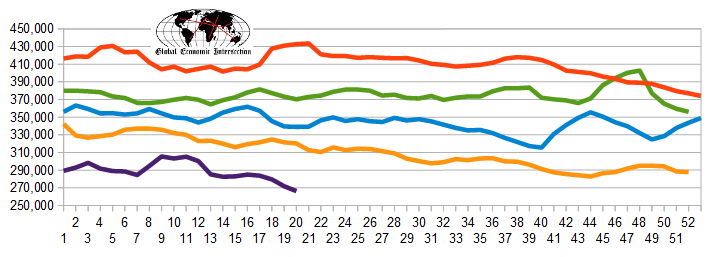

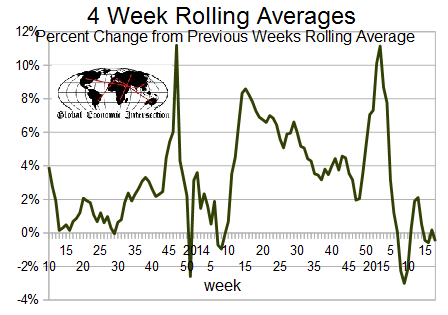

The market was expecting the weekly initial unemployment claims at 265,000 to 280,000 (consensus 270,000) vs the 274,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 271,750 (reported last week as 271,750) to 266,250. The rolling averages have been equal to or under 300,000 for most of the last 7 months.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Tortola, British Virgin Islands-based OAS Finance Limited,

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: