Offshore drilling powerhouse Transocean Ltd. (NYSE:RIG) is set to release its second-quarter 2017 results after the closing bell on Wednesday, Aug 2.

In the preceding three-month period, the Vernier, Switzerland-based rig supplier reported stronger-than-expected earnings on the back of the company’s outstanding revenue efficiency (at 97.8%) and lower operating and maintenance expenses.

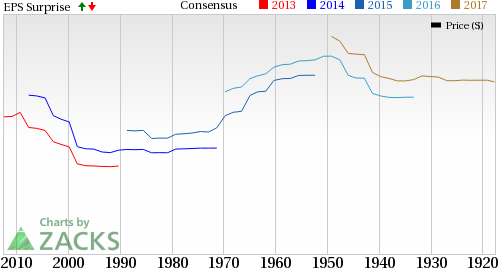

Coming to earnings surprise history, Transocean has an excellent record: its beaten estimates in each of the last four quarters.

Let’s see how things are shaping up for this announcement.

Factors to Consider This Quarter

As is the case with other offshore drillers, Transocean’s revenues/earnings have borne the brunt of the freefall in realized commodity prices over the past 3 years. As oil remains in a bearish territory, the top energy companies have cut spending (particularly on the costly drilling projects) on the back of lower profit margins. This, in turn, has meant less work for the beleaguered drillers as offshore exploration for new oil and gas projects has almost come to a standstill.

While we continue to believe that demand for deepwater drilling services will eventually improve, we have no reason to believe that a recovery will take place anytime soon. Moreover, deepwater/ultra-deepwater drilling – with its associated risks and steep costs – require a far higher oil price than what is prevailing currently.

However, Transocean has come up with certain strategy initiatives to overcome the industry-wide slump and outperform earnings estimates yet again in the second quarter.

Firstly, with an aggressive cost reduction program, Transocean is looking to shore up its operational performance even in this weak oil and gas pricing environment. As part of this strategy, the company has embarked on a policy to optimize overhead and maintenance expenses.

Secondly, Transocean has zeroed its focus on reducing out-of-service times by carefully planning the frequency of its in-service maintenance and shipyard repairs.

Finally, Transocean has set itself an ambitious target to achieve a very impressive 95% revenue efficiency for 2017. As it is, the company has delivered revenue efficiency at or above 95% over the last several quarters. The continuation of this trend will aid operating margin in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively show that Transocean will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat consensus estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is 0.00%. This is because the Most Accurate estimate and the Zacks Consensus Estimate both stand at a loss of 11 cents.

Zacks Rank: Transocean has a Zacks Rank #3. Though a Zacks Rank #3 increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Share Performance

Transocean has lost 33.9% of its value during the second quarter versus the 28.7% decline of its industry.

Stocks to Consider

While earnings beat looks uncertain for Transocean, here are some firms from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this quarter:

Summit Midstream Partners L.P. (NYSE:SMLP) has an Earnings ESP of +208.33% and a Zacks Rank #2. The company is expected to release earnings results on Aug 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

WPX Energy Inc. (NYSE:WPX) has an Earnings ESP of +6.25% and a Zacks Rank #3. The partnership is anticipated to release earnings on Aug 2.

Diamondback Energy Inc. (NASDAQ:FANG) has an Earnings ESP of +1.06% and a Zacks Rank #3. The company is likely to release earnings on Aug 1.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Summit Midstream Partners, LP (SMLP): Free Stock Analysis Report

Transocean Ltd. (RIG): Free Stock Analysis Report

WPX Energy, Inc. (WPX): Free Stock Analysis Report

Diamondback Energy, Inc. (FANG): Free Stock Analysis Report

Original post

Zacks Investment Research