Bond buyers again have the last word, forcing yields down towards that 1.27% trendline support. Comments from Powell, Macklem and other central bankers on Wednesday largely stuck to the script on transitory inflation but caveats are creeping into their language. US weekly jobless fell by more than expected, triggering only a temporary rally in yields and selloff in gold. NZD lost more than half of Wednesday's 100-pip rally.

Wednesday was busy on the news front. The Bank of Canada tapered by $1bn, which was the consensus and bumped up growth forecasts but didn't pull forward rate hike expectations and the result was a drop in the loonie.

In the US, Powell helped out risk assets by repeating that inflation will ease. He also said that reaching the standard of 'substantial further progress' is still a ways off and that there will be plenty of notice before policy changes.

On the fiscal front, Democrats began to roll out a $3.5 trillion infrastructure program and that should eventually breathe new life into the reflation trade.

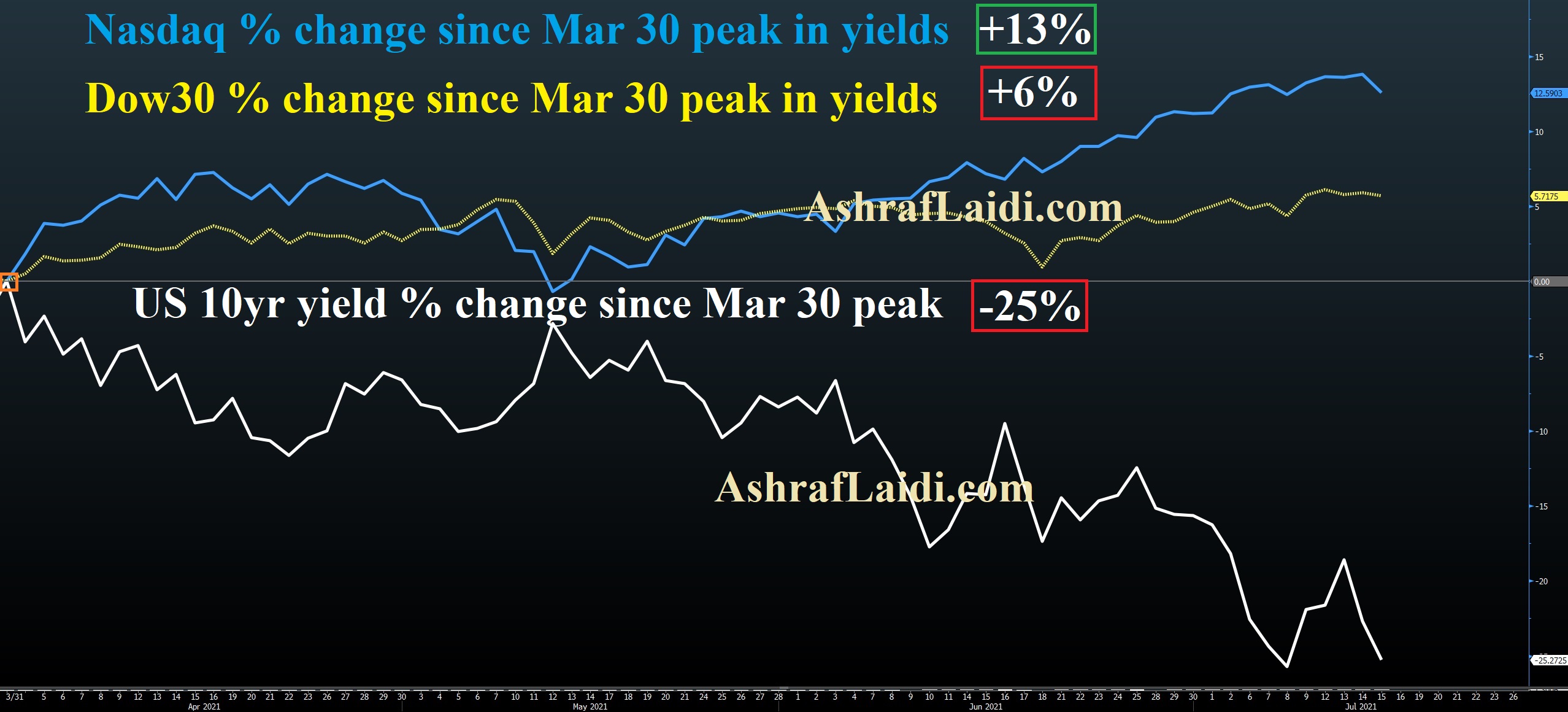

For now through, pricing was choppy with the dollar giving back much of Tuesday's gains as Treasury yields backpedaled.

All sides of the market continue to struggle with the inflation question and that was evident in central banker comments. The bravado about transitory inflation forecasts has been replaced by an increasing number of caveats. Macklem said supply chain bottlenecks will prolong temporary inflation, prompting tighter vigilance. Powell said recent prints on inflation were unexpectedly high but that the baseline remains the same. The Fed's Beige Book said that while some contacts felt that pricing pressures were transitory, “the majority expected further increases in input costs and selling prices in the coming months.”

In the UK, Ramsden took a harder line. The BOE hawk said he envisions tightening sooner than before.

One market signal that's worth keeping a close eye on is gold. It rose $20 Wednesday after a week of unchanged prices and is now flirting with the 200-day moving average.

US retail sales data will be a key input on the strength and willingness to spend of the consumer.