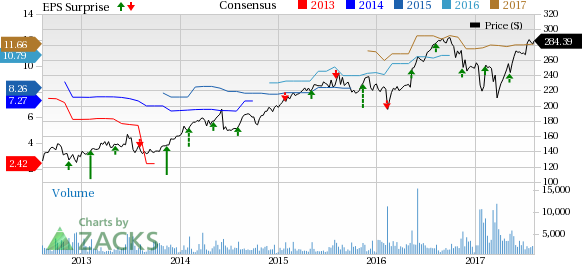

TransDigm Group Incorporated (NYSE:TDG) reported its fifth successive earnings beat, as third-quarter fiscal 2017 adjusted earnings came in at $3.20 per share (including stock-based compensation adjustments), comfortably beating the Zacks Consensus Estimate of $2.98.

On a reported basis, the company’s earnings per share rose 6.9% to $3.08.

The bottom-line growth came on the back of robust top-line performance and improvements in operating margin. Also, consistent efforts to boost productivity and lower refinancing expenses costs fuelled the earnings growth.

Inside the Headlines

Net sales for the quarter amounted $907.7 million, representing an impressive year-over-year growth of 13.8%. Also, the top line surpassed the Zacks Consensus Estimate of $902 million.

Decent growth in Defense (up 8% year over year) and Commercial Aftermarket (up 5%) revenues supplemented the top-line performance. Furthermore, contributions from the previously completed acquisitions boosted the overall sales performance during the quarter. TransDigm’s commercial aftermarket transport business witnessed solid year-over-year revenue growth.

TransDigm’s EBITDA (earnings before interest, taxes, depreciation and amortization) grew 23.1% year over year to $344.6 million.

Acquisitions

During the reported quarter, TransDigm announced the acquisition of three add-on aerospace product lines, for a total consideration of roughly $100 million. These product lines mainly comprise proprietary, sole-source products with significant aftermarket content. The product lines are in sync with the company’s long-term plan and reflect its strategy to acquire proprietary aerospace businesses with significant aftermarket content, in a bid to fortify its core business.

The acquired business lines have combined revenues of about $32 million and will be consolidated into TransDigm’s existing businesses. The company financed the acquisitions through existing cash on hand.

These acquisitions will add to TransDigm’s product range with their proprietary products that enjoy strong positions on high use of platforms, robust aftermarket content and an excellent reputation. Products offered by them include highly engineered aerospace controls, quick disconnect couplings, as well as communication electronics.

Liquidity

TransDigm ended the quarter with cash and cash equivalents of $970.5 million, down from $1587.0 million as of Sep 30, 2016. At the end of the reported quarter, the company’s long-term debt was $10.8 billion compared with $9.9 billion at the end of Sep 2016.

During the quarter, TransDigm repurchased 205,800 shares of its common stock at an aggregate cost of approximately $50 million.

Fiscal 2017 Guidance

Concurrent with the fiscal third-quarter 2017 results, TransDigm reiterated its fiscal 2017 outlook. The company continues to expect net sales to be in the range of $3,530–$3,570 million. This guidance takes into account the contribution from the Schroth buyout. Also, TransDigm affirmed adjusted earnings to be in the range of $12.09–$12.33 per share.

Additionally, as guided earlier, projected net income is expected to lie in the band of $605–$619 million and EBITDA is likely to be in the range of $1,693–$1,713 million.

Our Take

TransDigm’s thriving commercial aftermarket and defense business proved to be staple growth drivers for its third-quarter fiscal results, which surpassed expectations. The aftermarket business comprises 55% of sales, but makes up over 75% of EBITDA. This translates into consistent revenue generation capacity through all phases of the aerospace cycle. The aftermarket business is expanding as majority of aircraft bought during the financial crisis is beginning to age and requires more frequent and comprehensive servicing.

Also, this Zacks Rank #2 (Buy) company’s defense business, which had suffered some slowdown in the past, has been performing better-than-expected in recent times. This will likely stoke overall top-line growth. In addition, strategic acquisitions made over the past few years has significantly expanded the company’s market share. This is likely to supplement TransDigm’s core revenue growth.

Other Stocks to Consider

Other top-ranked stocks in the industry include CAE Inc (TO:CAE) , Huntington Ingalls Industries, Inc. (NYSE:HII) and Teledyne Technologies Incorporated (NYSE:TDY) . While Teledyne Technologies sports a Zacks Rank #1 (Strong Buy), CAE Inc and Huntington carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Teledyne Technologies has an average positive surprise of 36.1%, beating estimates all through.

Huntington Ingalls has an average positive surprise of 8.6% over the trailing four quarters, beating estimates twice for as many misses.

CAE Inc managed to beat estimates thrice in the trailing four quarters, for a positive earnings surprise of 11.8%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Transdigm Group Incorporated (TDG): Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY): Free Stock Analysis Report

CAE Inc (CAE): Free Stock Analysis Report

Original post

Zacks Investment Research