Beyond third-quarter results

TransAtlantic Petroleum Ltd, (TAT) has reported Q313 net production of 4,076boe/d which comes in lower year-on-year and slightly below our expectations. We are lowering our Q4 production estimates to 4,720boe/d and revising our full year forecasts to 4,240boe/d, some 10% lower than previously. All said, the company continues to make good progress on its 38-well programme, which is on target for completion by year-end 2013, and with this, we are expecting stronger production volumes to follow in 2014 as new wells come online. Our revised core NAV is US$1.20/share, 5% lower than previously.

New wells to come online

TransAtlantic is currently operating three drilling rigs in south-eastern Turkey, one in the Thrace Basin in north-western Turkey, and one in Bulgaria. We are of the opinion that TransAtlantic’s 38-well drilling programme is on track, with the company announcing that it has drilled 31 wells and completed 20 of these wells year to date. We expect the next stages of completion and testing to have an impact on production, with management pointing to an expected year-end exit range above 5,000boe/d, realising a potential 300boe/d increase from current production levels of 4,700boe/d.

Selmo wells are seen as high potential

Currently drilling its third horizontal well on the Selmo field (TransAtlantic’s largest field oil producer), the company has reported multiple pay zones encounters in the lateral section, along with substantial oil shows reaching surface. After some instability issues, the third well has been re-drilled in the lower section and TransAtlantic plans to complete both wells 2 and 3 simultaneously. Further to these horizontals, TransAtlantic expects to spud five additional horizontal wells in the Selmo field in the fourth quarter of 2013. We are expecting progress on Selmo in the fourth quarter to be the main driver of oil production growth in the medium term.

Valuation: Potential of new technology not priced in

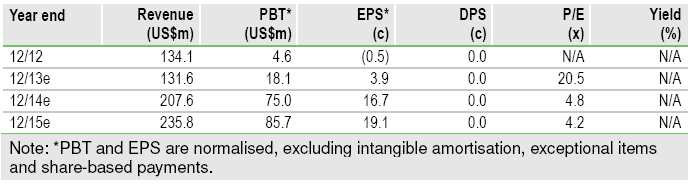

Our updated valuation models find a core NAV of US$1.20 per share, slightly lower than our previous US$1.26/share, on account of our downward revisions to 2013 and 2014 production levels. We remain bullish on the story and are of the opinion that markets have yet to fully price-in the potential production boost and upside from the successful application of North American horizontal drilling and fracking techniques to Turkey’s oil and gas basins.

To Read the Entire Report Please Click on the pdf File Below.