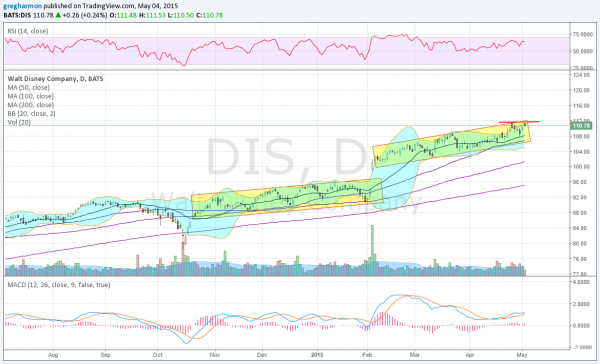

Walt Disney Company (NYSE:DIS) has had a solid run higher for over 5 years. The company shows us their latest results Tuesday morning before the market opens. The Estimize consensus is for $1.17 per share in earnings off of $12.474 billion in revenues. Higher than Wall Street by 6 cents on earnings and $235 million in revenue. Recently it has built 2 rising channels since the October market low.

Heading into earnings the price is at the top of the current channel and threatening a break out higher. The RSI is strong in the bullish range, while the MACD is moving back up after a pullback. There is support lower at 108.35 and 104.20 followed by 102.60 and 101.60 before 99.10. There is no resistance above 111.70 but there is a Measured Move to 115.20. The reaction to the last 6 earnings reports has been a move of about 2.98% on average or $3.35 making for an expected range of 107.35 to 115.20.

The at-the money weekly May 8 Expiry Straddles suggest a larger $4.45 move by Expiry with Implied Volatility at 46% above the June at 23%. Short interest is low at 2.6%. Open interest favors the 107 and 110 Call Strikes, but is also large open interest at the 105 Put. Activity has been bullish in the weeklies selling Puts and buying calls. I would love to get some clients into this lower.

Walt Disney

Trade Idea 1: Buy the May 8 Expiry 109/107 1×2 Put Spread for a $0.20 credit.

Trade Idea 2: Buy the May 8 Expiry 111/114 1×2 Call Spread for 5 cents.

Trade Idea 3: Buy the May 110/115 Call Spread Risk Reversal selling the 108 Put for 69 cents.

Trade Idea 4: Buy the June 12 Expiry 111/115 Call Spread ($1.65) and sell the June 12 Expiry 107 Put for free.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.