Going into the ECB Press Conference, here are 4 potential setups that I am monitoring. The volatility from this event might push prices towards the key areas identified -

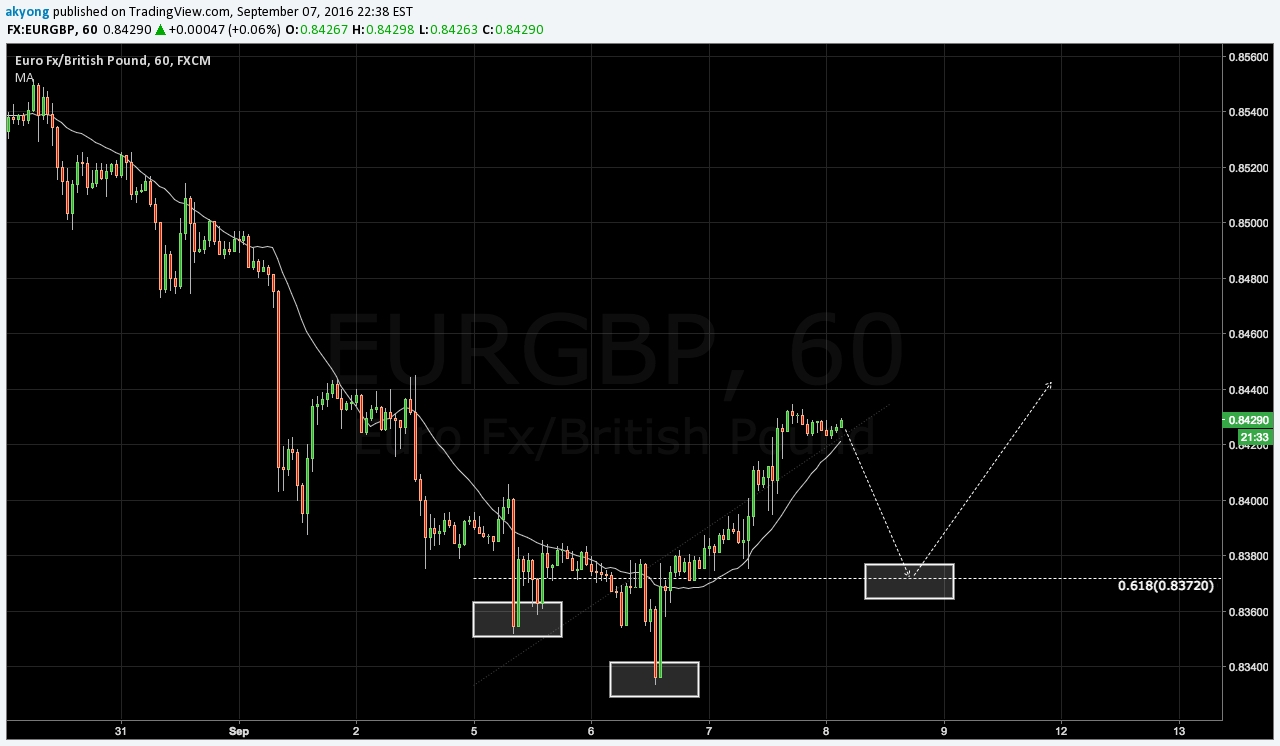

EUR/GBP

Price has broken the down trend line, and has since rallied higher. A retracement back to the 61.8 Fibonacci level might present a good opportunity to long the EUR/GBP. The 0.8372 level has a decent structure level as well; at the same time potentially forming the right shoulder of a head-and-shoulders pattern.

Price closed below the previous structure low; and formed a lower low. A retracement back to the 115.27 area, in confluence with the previous support, now turned resistance area, and a 78.6 Fibonacci level would present a good opportunity to short the EUR/JPY.

After forming a new low at 1.4582, price is currently consolidating in a range. A drop back towards the 1.4592 area, a confluence of the 127.2 Fibonacci extension level, and a completion of an advanced price pattern, would present a good opportunity to long the EUR/AUD, with stops just below the previous low.

EUR/CAD completed a double top divergence setup with the break of the previous structure low. A retracement back to the previous structure level, in conflence with a 61.8 Fibonacci level at 1.4567 would present a good opportunity to short the EUR/CAD.

SUMMARY

- Lookout for the overall tone and language used by Draghi during the ECB Press Conference.

- Look for buying opportunities on EUR/GBP and EUR/AUD if the overall sentiment is hawkish.

- Look for shorting opportunities on EUR/JPY and EUR/CAD if the overall sentiment is dovish.