Based on the market activity last week, it is time to look at a pairs trade. The components, US Treasuries, as measured by the iShares Barclays 20+ Year Treasury ETF (ARCA:TLT), and Crude Oil, using the United States Oil Fund (NYSE:USO) ETF as a proxy, are both at critical levels. The TLT is on support after a fall from resistance. Will it hold and reverse or fall further?

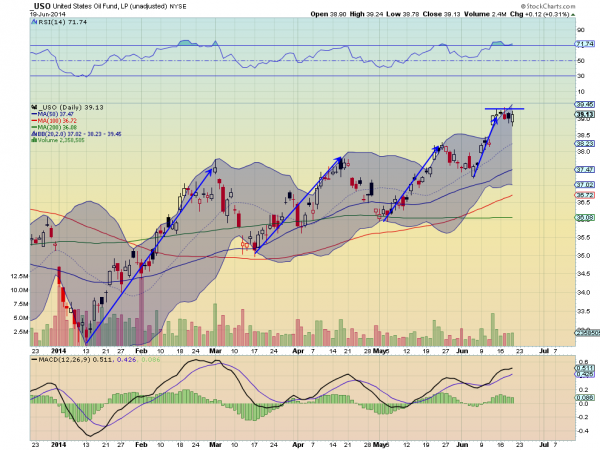

The USO ETF has had a series of runs higher followed by consolidating pullbacks. It is consolidating again but by moving sideways. Will it roll over or change its character and continue higher?

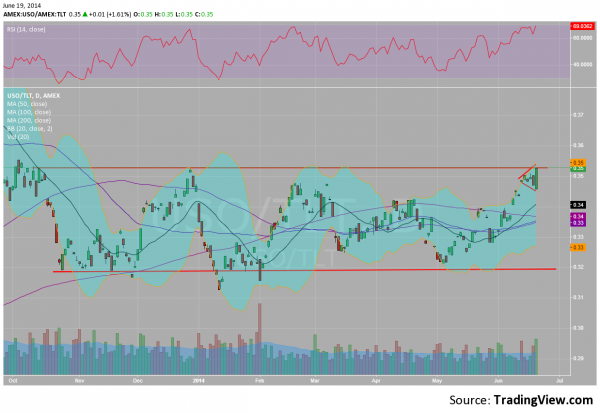

When you look at the pair trade between them there is no need to know which is moving which way. The final chart below shows that the ratio of the USO to the TLT has been in a range between about 0.32 and 0.35 for nearly a year. It moves from the top to the bottom and back again but that is a really tight range. The technicians have probably already noticed that it is at resistance again, but this time with some conflicting technical information. The long candle we saw Thursday, with no shadows on either end—a Marubozu, is very bullish and it is a bullish engulfing candle to boot. This calls for more upside if confirmed, but the last 6 days have also formed an expanding wedge, which can be a reversal after a big run up.

Neither pattern is a given, meaning it's not clear that either will play out, but the one that does can be played as a trade in the ratio. To do this, on a move higher over 0.35 go long 3 units of USO and short 1 of TLT. If it breaks lower under 0.345 go short 3 units of USO against 1 unit long of TLT.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.