Today's inventory data was anomalous with a 10.3 million barrel draw on headline Crude oil. In my experience, you only see massive draws like that in the last week of the year as producers try to get physical crude off their books for the end of tax year. Maybe this is related to last week's end of Quarter, but it's unusual. The draws in Gasoline and Distillates were also considerable, but not nearly as shocking.

In my opinion at some point very soon it would be advisable to: SELL DEC 2013 Crude v. BUYING DEC. 2014 Crude oil around $8.00 wide.

It traded up to $8 this morning and is softening as I type -- back to $7.55 Yesterday.

I recommended Long Brent v. Short WTI spreads and that looks to have reversed today as well.

Alternatively, I'm working orders with amenable clients to SELL THE DEC 13 Crude 115 call v. BUYING THE DEC 14 Crude 110 call. I believe this gives you considerable flexibility and also expresses the belief that the WTI term structure should flatten over time.

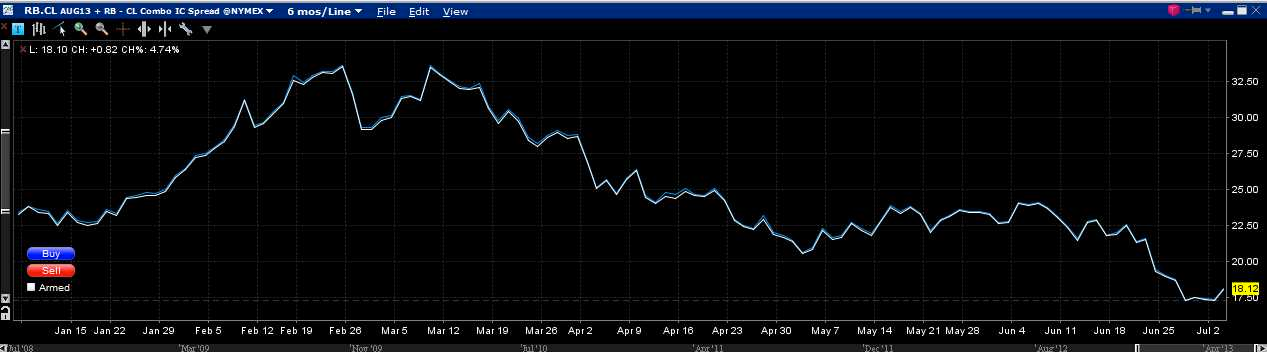

The Gasoline and Heating Oil crack spread may have bottomed as well. If you're unfamiliar with the Energy complex, these are all inter-related spreads as the products tend to track Brent prices more closely than WTI.

The August Gasoline crack traded as low as 16.10 this morning and it's back to 18.10. A $2.00 move in this spread = $2,000/spread. The near term Gas crack traded up to $38 (ish) in late February and early March (which, the record will show I advised being short).

These markets are dynamic and not for the faint of heart. The ongoing situation in Egypt will play a role and IF unrest spreads to the Energy producing neighbors then things escalate quickly (a la 2011). Feel free to email/call to discuss. I believe Brent/Gasoline has considerably more upside than WTI.

In less volatile news, Natural Gas traded back near interesting levels/recent lows. Watch 3.50 on front month NG. I would consider strategic long delta plays if/when that comes to pass.

Enjoy Independence Day.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trading The Holiday Energy Markets

Published 07/03/2013, 12:12 PM

Updated 07/09/2023, 06:31 AM

Trading The Holiday Energy Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.