Strategy One: "Consistent Losses, with Occasional Big Gains when the Market is Stressed."

Strategy Two: “Consistent Gains, with Total Wipe-out Risk When Market is Highly Stressed”

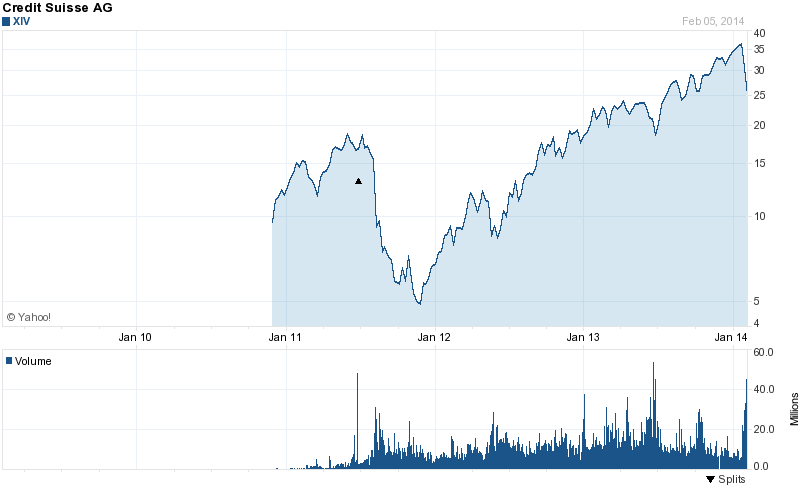

How do these two strategies sound to you? Not too appealing? I would agree with that. The second of those strategies was featured in an article at Bloomberg.com recently — Inverse VIX Fund Gets Record Cash on Calm Market Bet. And though the initial graph confused me, because it was the graph for the exchange traded note VXX, which benefits when the VIX spikes, the article was mostly about the inverse VIX exchange traded note XIV.

Why would someone pursue the second strategy? Most of the time, it makes money, and since January 2011 we haven’t a horrendous market event like the one from August 2008 through February 2009, it makes money.

I would encourage you to look at the decline in the second half of 2011, where it fell 75% when the VIX briefly burped up to around 50. But given the amazing comeback as volatility abated, the lesson that some investors drew was this: “Volatility Spike? Time to buy XIV!” And that explains the article linked above.

You might remember a recent book review of mine — Rule Based Investing. In that review, I made the point that those that sell insurance on financial contracts tend to win, but it is a volatile game with the possibility of total loss. To give another example from the recent financial crisis: most of the financial and mortgage insurers in existence prior to 2007 are gone. Let me put it simply: though financial risks can be insured, the risks are so volatile that they should not be insured. You are just one colossal failure away from death, and that colossal failure will tend to come when everyone is certain that it can’t come.

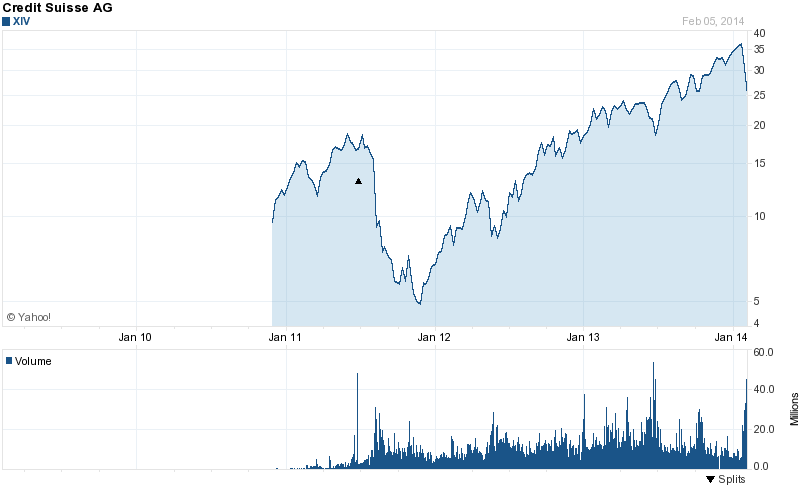

But what of the first strategy? How has it done?

Wow! Look at the returns over the last few weeks! Rather, look at a strategy that consistently loses money because it rolls futures contracts for the VIX where the futures curve is upward-sloping almost all the time, leading to buy high, sell low.

Does it pay off in a crisis? Yes. Can you use it tactically? Yes. Can you hold it and make money? No.

Back to the second strategy. People are putting money into XIV because they “know” that implied volatility always mean-reverts, and so they will make easy money after a volatility spike. But what if they arrive too early, and volatility spikes far higher than expected? Worse yet, what if Credit Suisse goes belly-up in the volatility? After all, it is an exchange-traded note where owners of XIV are lending money to Credit Suisse.

Back to Basics

Do I play in these markets? No.

Do I understand them? Mostly, but I can’t claim to be the best at this.

What if I try both strategies at the same time? You will lose. You are short fees and trading frictions.

What if I short both strategies at the same time? Uncertain. It comes down to whether you can hold the shorts over the long term without getting “bought in” or panic when one side of the trade runs the wrong way.

Recently, someone pinged me to speak to CFA Institute, Baltimore, where he wanted to talk about “not all correlations of risky assets go to one in a crisis” and pointed to volatility investing as the way to improve asset allocation. Sigh. I’m inclined to say that “you can’t teach a Sneech.”

I favor simplicity in investing, and think that many exchange traded products will harm investors on average because the investors do not understand the underlying economics of what they own, while Wall Street uses them as a cheap way to hedge their risk exposures.

There may be some value to speculators in using “investments” like strategy one for a few days at a time. But holding for any long time is poison. Worse, if you are accidentally right, and the world comes to an end — this is an exchange-traded note, and the bank you lent to will be broke. That will also kill strategy two.

So, my advice to you is this: avoid either side of this trade. Stick with simple investments that do not invest in futures or options. Complexity is the enemy of the average investor. I can understand these investments and they don’t work for me. You should avoid them too.

PS — before I close, let me mention:

- A Google search that I did: “Why does vxx always go down“

- And the article: VXX: Where Wealth Goes to Die