Very quiet conditions currently, with the US earnings season starting in earnest tomorrow morning. All central banks (except the Fed) have met and passed on changing their respective status quos, while China has remained very quiet on monetary policy, but expectations are building.

The lull is certainly giving markets time to reposition after the June to September sell off.

Last week saw a very solid snap-back, creating the current lull. Investors and traders are clearly assessing if the move was cyclical or will create another leg higher in the coming week.

Three assets catching my attention

AUD/USD logged its third longest consecutive gain since floating in 1983. It has added a full four cents since 29 September, making it the biggest gain of the year.

Shorts have clearly been shaken out

The commodities complex snap back is also driving the upside as oil and copper price spike

RBA is signalling it’s unlikely to shift rates lower in 2015 – positive for the pair

The Fed backing out of moving rates higher in 2015 – also positive for the pair

China trade balance today will impact the pair – the composition of exports which is a major key to the data could break the upside trend

Mainland Chinese indices

These are finally seeing a base forming

China A50 futures were traded for the first time on the CME last night further signs of liberalisation. The cash market has added 7.5% in October

CSI 300 has added 10% in October

Several major Chinese officials have spoken over the past week, all suggesting this year’s rout has had limited impact on the Chinese economy

The PBoC deputy governor was quoted in the paper yesterday stating that the market correction is ‘almost over’

Thursday’s CPI data should be watched. If it continues to stagnate, the growing expectations of a PBoC move will only accelerate. We would expect benchmark interest rate cuts and/or further cuts to the reverse requirement ratio as the likely place to see tweaks (rather than physical stimulus)

This would suggest further upside to China exposed stocks and indices is a likely outcome

Copper on the LME) has added US$385/tonne since 29 September (+7.9%)

The metal is being positively impacted by cuts to supply side and speculation Glencore (L:GLEN) and other such mining companies (BHP or RIO) will be forced to cut production in the coming year

China is driving speculation that its demand will be positively impacted due to the sliding construction sector, and therefore possible PBoC stimulus

Technically, however, copper is trading well inside its Bollinger bands® suggesting the upside may be capped US$5433/tonne which is the top of the range

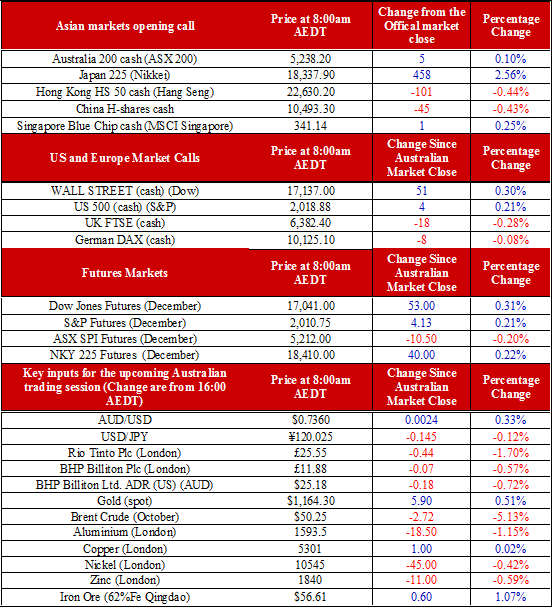

Ahead of the open, we are calling the ASX up five points to 5238.