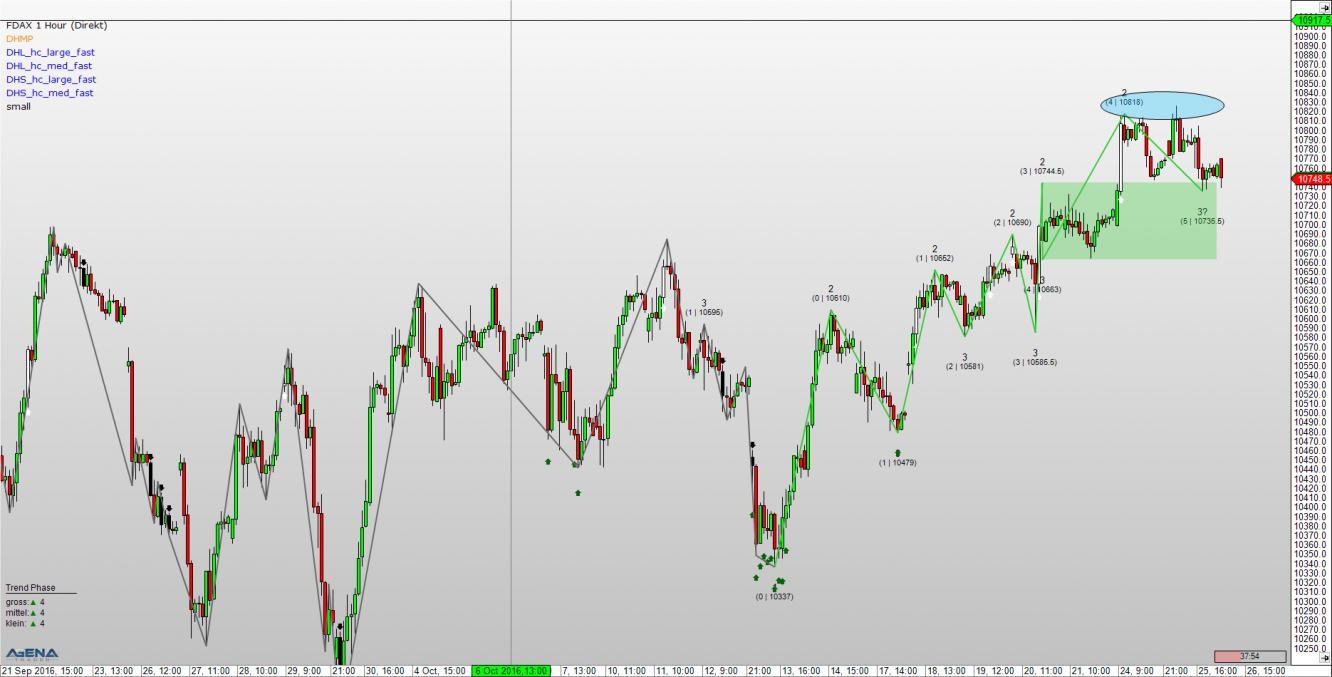

FDAX:

The strong weekly opening led the small trend further upwards and thereby into a trend continuation with a daily high at 10818 points. With his, we now have a new correction zone between 10744 and 10663 points. If it looked like there would be a trend continuation yesterday morning, here you can clearly see the failure at the high, which led to a significant sell-off directly thereafter and led the price to the upper edge of the green box. The small trend is slowly reaching a certain maturity, which one should keep in mind. Nevertheless – consider the Dow approach – the trend will remain intact as long as the green zone is not undercut.

Dow Jones 30:

The US markets remain unanimously inconsistent, which can be seen in an exemplary manner in the Dow Jones. Here we see two different trends, whereby the small trend is facing upwards and the larger trend is pointing downwards. From the perspective of the small trend, there is still sufficient potential upwards, which is supported by the more distantly located correction zone of the red downward trend. With this, the short-term probabilities are more on the upper side.

Hugo Boss (DE:BOSSn):

From the perspective of the hourly chart and the big trend here, the price of this stock has been fighting its downward trend for quite some time. After the last low at €46, the value ran a considerable distance back into the red box and has been unable to continue the trend since then. For approx. 2 days now, our Dow How signals have been appearing once more and are indicating a trend continuation. This should begin soon, as long as the red box is not exited upwards.

IMPORTANT NOTE:

Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk.