There you go. The Reserve Bank of Australia has cut interest rates to a record low level of 1.5%.

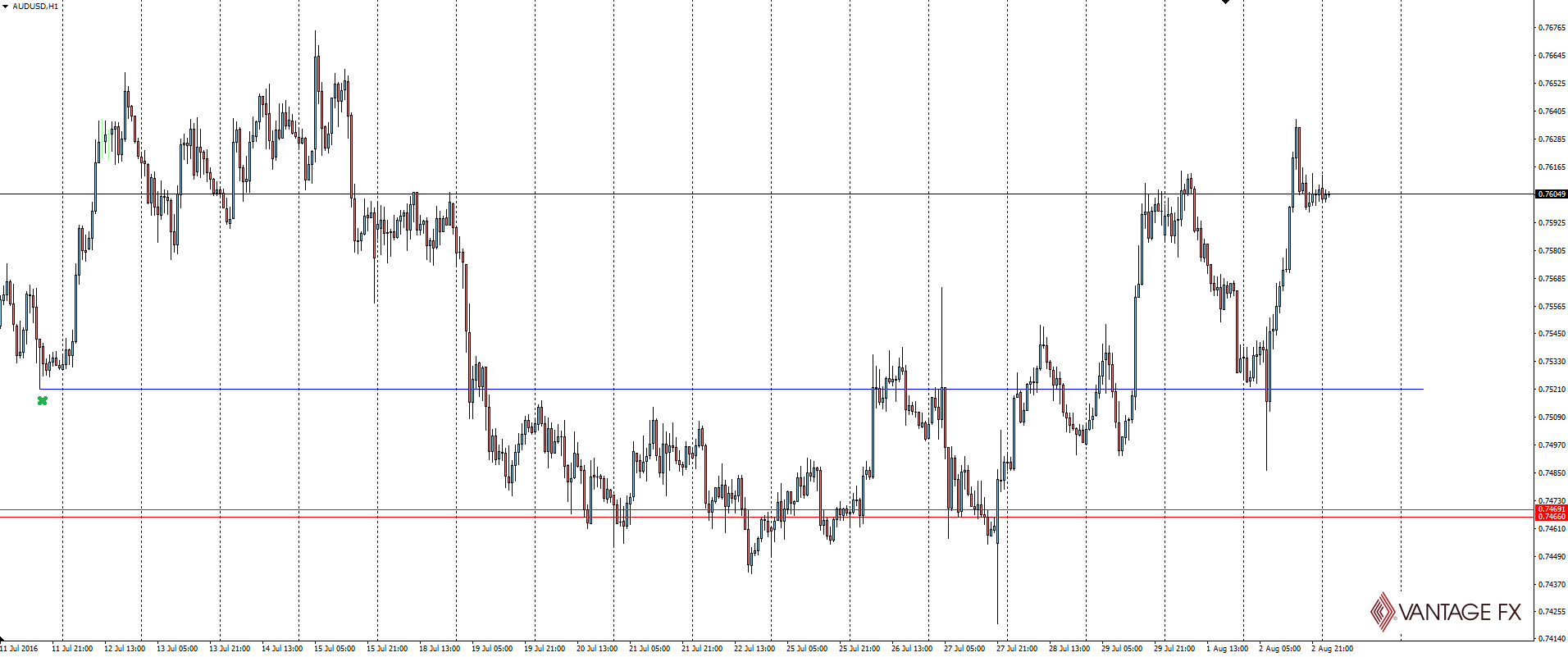

With the Aussie well off its highs heading into the release in a weak USD environment, the surveyed economists and the pre-release market ‘got it right’.

But other than an immediate post decision headline spike down, the Aussie rallied basically vertical for the day’s three trading sessions. Yes, the currency RALLIED on a rate cut.

Why you ask? That’s not what the textbooks say is meant to happen? When you cut interest rates, investors are meant to be discouraged from holding the currency in question, therefore selling and making price go down.

But the realities of market dynamics for fundamental Forex traders aren’t as simple as following a macroeconomic textbook of when to buy and when to sell. Exactly the same that being a successful Forex trader isn’t about being right or wrong on whether they think a central bank will press the red or green button when it comes to interest rate decisions.

Successful Fundamental Forex trading, especially in the retail trading environment that we find ourselves in, is about identifying where the market expectations lie and then trying to take advantage of the subsequent re-pricing if the realities do not actually align.

“There are no prizes for being right or wrong on a central bank call and just because you side with consensus and get it right, doesn’t mean the market will give your trade the strong directional move you’re looking for.”

This is why yesterday’s RBA Preview blog wasn’t just about about whether we thought the RBA would cut interest rates or not. It was actually about finding trading opportunities from misplaced market expectations.

Our thinking heading into the RBA decision was as follows:

So putting this all together, we have an expectantly bearish market going into a live RBA meeting where the ‘shock’ will be a no change to interest rates. That says to me that the greatest risk of disappointment lies with AUD/USD shorts. No matter what the RBA does, the sensible trade from a risk:reward point of view is more likely long AUD/USD.

Yes, playing from the long side on an interest rate cut may seem crazy on the surface, but when interest rate futures markets are pricing in a 2 in 3 chance that the RBA cuts and the Aussie Dollar has been hammered off its highs in expectation of a cut, expectations were extremely stretched to the one side.

You haven’t been building your yearly Aussie Dollar position for months. Your trading algo hasn’t been taking ticks on price mismatches. You’re a retail trader who in the grand scheme of things has come late to the party and just wants to get paid!

Expectations have been getting priced in for weeks so it’s not about taking a news punt. An ECN Forex broker like Vantage FX can’t guarantee you a price and blindly hitting buy/sell as news is released isn’t like hitting the bid/offer on a futures ladder. You are going to get slipped and if a broker tells you that you aren’t, then it is so often too good to be true. So identify your levels, and play the fallout.

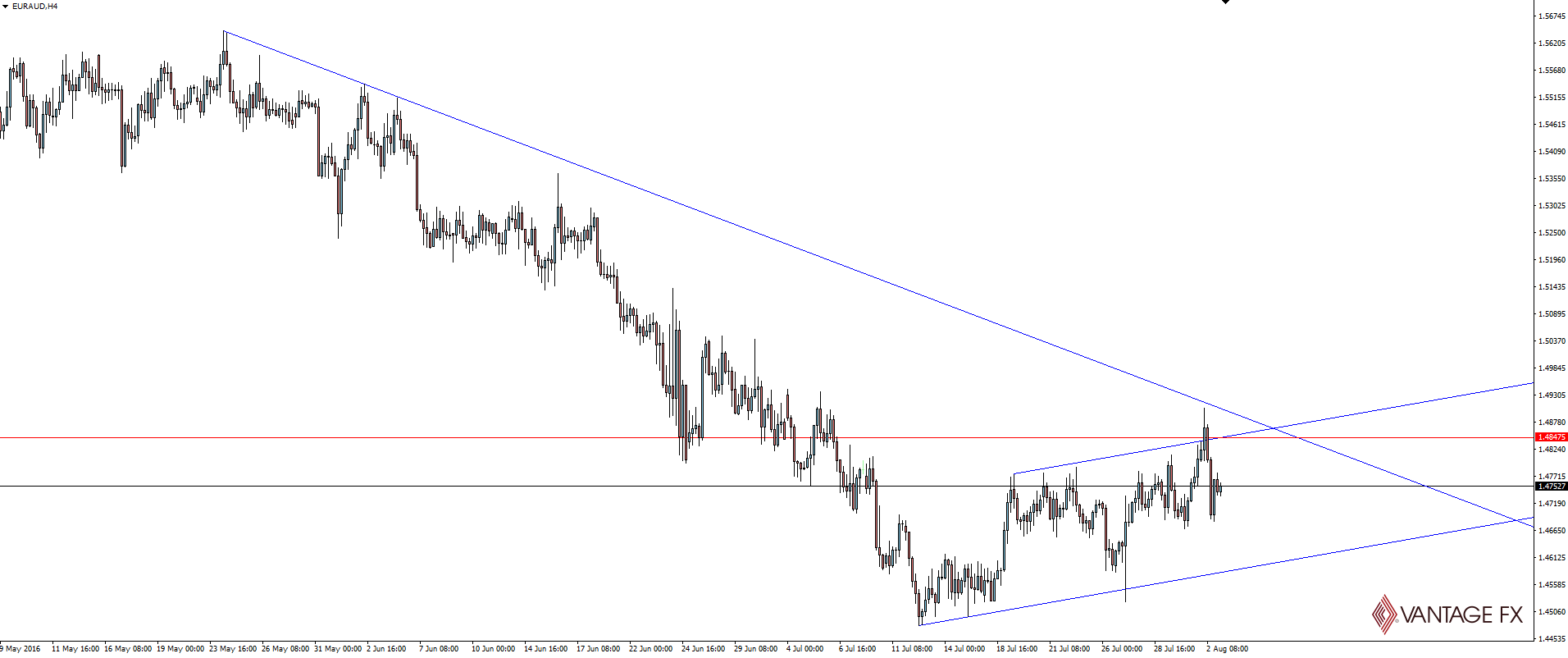

Take a look at some of the following charts we’ve been sharing on the @VantageFX Twitter account, taking note of how long after the initial news move that it takes to fully re-price the misplaced expectations:

EUR/AUD 4 Hourly:

USD/JPY Daily:

We hope this slightly out of the box way of thinking about fundamental trading is a help.

Safe trading!

On the Calendar Wednesday:

CNY Caixin Services PMI

GBP Services PMI

USD ADP Non-Farm Employment Change

USD ISM Non-Manufacturing PMI

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.