Trading successfully in low volatility markets

The state of the markets

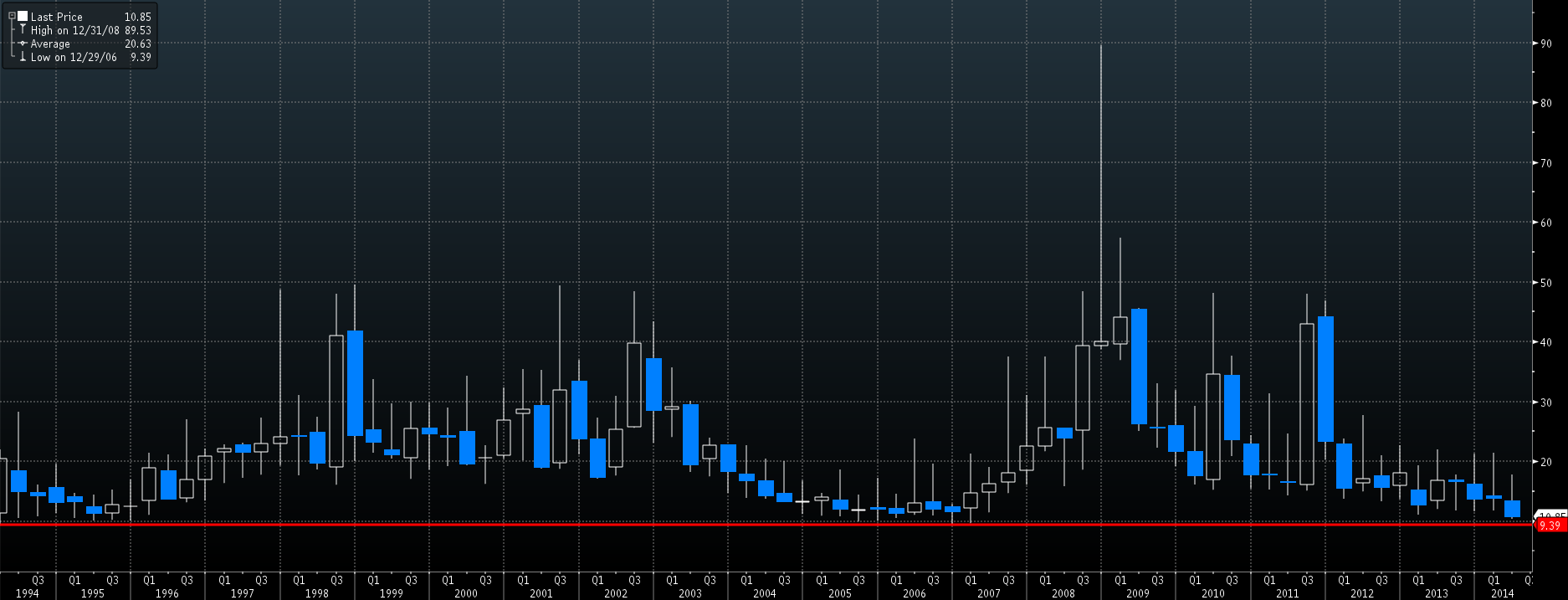

Many traders may have noticed of late, the markets experiencing a period of low volatility. Indeed, the VIX index which shows U.S. Stocks suggests that volatility is at a historical low. As shown in the Bloomberg charts below, the VIX index has fallen to 10.86, not far away from the seven year low of 9.4. For a comparison point on how low these levels are, during the Global Financial Crisis the average level was moving around the 30 mark.

This scenario has also been matched in the Forex markets. The volatility of major currency pairs has declined to lows not seen for many years. An obvious case is Dollar/Yen, which has been sitting in the current sideway for almost five months now. Its recent movement range has been narrowed into a channel between 101.50 and 102.50.How do I trade when there is so low volatility?

Here are some of my tips on how to capture profits during these times of low volatility.

Option 1. Narrow your take profit/stop loss distance

If you had set up take profits/stop losses for any of your trades, this may be the ideal time to narrow your take profit/stop loss distances.

During times that are lacking volatility, there is a very high chance that prices will reverse before hitting any previously set targets – rendering them useless. In this case scenario, traders may lose most of their profits or even experience loss. Correspondingly, if the profit taking distance is narrowed, whilst maintaining the return rate, the contract size also needs to be upwardly adjusted.

Option 2. Use the breakout strategy

Although the market volatility is relatively low at the moment, it doesn’t mean there aren’t any trading opportunities out there. The breakout strategy captures these opportune moments. When the price is moving within a parallel channel, traders can set a buy stop order beyond the channel and/or a sell stop order below the channel. By using this strategy, when the price ‘breaks’ out of its original consolidation model, possibly due to surprising data announcements or changing market sentiment, the trend outside of the model may continue for quite some time, which will provide traders a great chance to capture profits.

Option 3. Carry trade

The non-existent volatility can mainly be attributed to the easing policies implemented by the major Western Central Banks. Traders now tend to borrow from currencies with cheap borrowing costs and use the funds to pursue high-return currencies banking on the interest rate difference. Considering the leverage, the profits of this carry trade strategy could be very substantial. Taking note though, the disadvantage of the carry trade is that investors are open to the risk exposure of FX exchange rates for a long period.

More now than ever though, a carry trade strategy would be suitable for this current period of low volatility. Earlier in June 2014, the European Central Bank decided to introduce a negative-interest-rate policy and made the Euro available as a funding currency for carry trades. More traders are delving into trades shorting the Euro and going long for high-return currencies such as the AUD and NZD.

According to Bloomberg, in the recent six months, the return of shorting EURNZD and EURAUD were the best investing options. The historical return does not necessarily represent future performance but considering that the ECB will be keeping its easing policy for the mid-term, traders could still probably find chances to trade those two pairs.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trading In A Low Volatility Market

Published 08/21/2014, 08:45 PM

Updated 07/09/2023, 06:31 AM

Trading In A Low Volatility Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.