- This is the hedge-fund equivalent of Stalingrad. Someone is going to lose big. And the victor will be so bloodied that the word victory will sound hollow…

- For a short-seller who is as risk-averse as me watching this is pure hedge-fund porn.

From Bill Ackman enters the city of Stalingrad, John Hempton of Bronte Capital, January 2, 2012.

I think this quote sums up well the battle lines that have been drawn across the sands of Herbalife (HLF). It reminds us that what is unfolding has less to do with the fundamentals of HLF’s business and a lot more to do about which big boy can win and take the other big boy’s money. On the bearish side, Whitley Tilson is piggybacking Bill Ackman’s massive 20M shares short. The catalyst for the bears is government action, the FTC and/or the SEC, that severely constrains HLF’s business. On the bullish side, several hedge funds have piled on sniffing an opportunity to squeeze a vulnerable and over-exposed short position. These big boys include Robert Chapman, John Hempton, Dan Loeb, and perhaps even Carl Icahn (see my last piece Herbalife Gains A Big Friend In Robert Chapman As Bullish Momentum Rises and the N.Y. Post’s Hedgie’s Herbalife bet counters Ackman short). The catalysts for the bulls are the lack of government action and/or the inability of shorts and sellers to further pressure the stock.

Sometime This Week

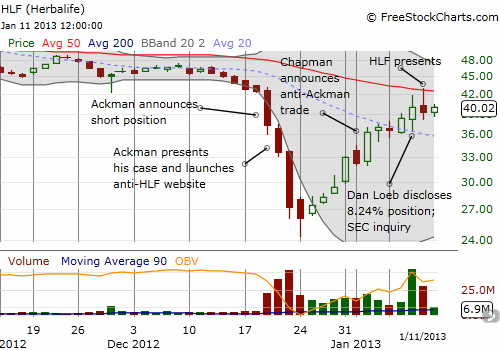

I described in my last posts why I thought a relief rally was very likely in the wake of the Ackman-inspired selling. I shorted puts on top of the small number of shares I own to play that bounce. The original plan was to cover the puts after HLF’s presentation under the assumption that I would receive an additional bonus in the form of a decline in implied volatility. However, I decided to cover a day early when HLF surged toward its 50-day moving average (DMA) on the heels of Dan Loeb’s disclosure of an 8.24% position in HLF stock. HLF has yet to break the resistance at the 50-DMA, and I strongly suspect the stock will pullback this week as battling participants relax a bit to recharge for the coming weeks. The chart below summarizes the recent action.

Source: FreeStockCharts.com

Back To Normal Trading Range

With the Ackman-inspired losses essentially reversed, I am now assuming that HLF will be back to “normal” trading, meaning that the range will not be nearly as wide as it has been since December. Between May’s massive post-earnings losses when famous short-seller David Einhorn asked questions on the conference call and Ackman’s announcement, HLF had settled into a wide trading range from about $44 to $55. A new trading range is likely for another substantial period until a definitive event occurs involving the FTC and/or the SEC. In the meantime, I fully expect rumors, leaks, and emphatic interviews to drive the stock sharply toward the boundaries of the trading range. Until HLF marches through the thickets of a resolution, I will be biased toward shorting puts in the wake of forced selling. The first opportunity might come as early as this week.

HLF is trading at resistance. With no fresh bullish catalyst, I am guessing that many traders who bought into Ackman’s selling will lock in profits. The options market seems to be pointing downward as well. I collected the options trading data across all strikes and expirations over the final three days of last week (using Etrade.com). I wanted to see whether the options market would reveal any clues about the bear/bull interpretation of HLF’s anti-Ackman presentation. The counter-acting news of Loeb’s position and then the SEC inquiry color these results. (As a side, the news of an SEC inquiry the day ahead of HLF’s presentation is the kind of drama you just cannot make up. It was another great example of the kind of temporary forced/trigger-happy selling that is perfect for selling puts).

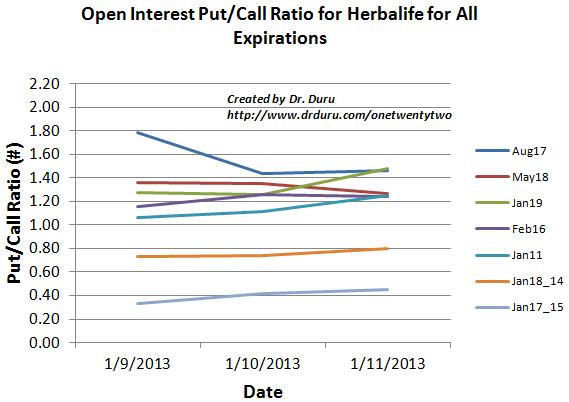

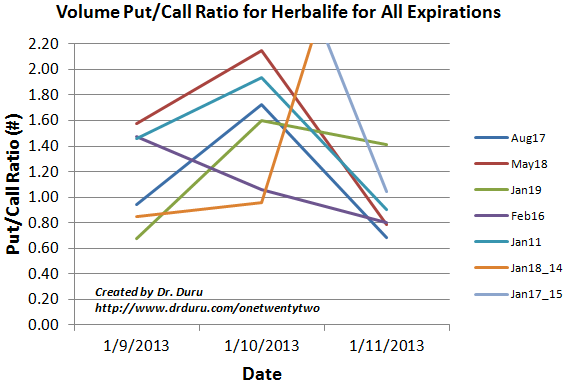

I present two charts. The first shows the open interest, and the second shows the volume. Options are identified by their expiration. For example, Aug. 17 represents the options expiring August 17, 2013. Jan18-14 represents the options expiring January 18, 2014. I sorted the first chart according to the put/call ratio on January 9th from highest to lowest. This configuration helps identify which strikes are represented by each line in the chart: the legend and the chart lines are aligned from top to bottom. I kept this same ordering for the second chart so that the color-coding is consistent between the two charts. I include all strikes for each expiration given the high volatility in HLF.

There are a few caveats for the volume put/call ratio chart. The Jan. 18-14 and the the Jan. 17-15 options are thinly traded with very small open interest. On January 9 and 10, the Jan. 17-15 options traded with a 43.50 and 3.50 ratio, off my chart. The Jan. 18-14 options traded with a 4.08 ratio on January 11th, also off my chart. I am not including these options in my immediate interpretation, but I do think it is noteworthy that, so far, there seems to be very little interest in the options pit for betting that HLF is going to zero “eventually.”

Note how trading in puts surged on the day of HLF’s presentation relative to calls as traders positioned for a “sell the news” reaction. They got their wish as HLF faded perfectly from the 50-DMA around $42. The open interest put/call ratio increased significantly for only two expirations: Jan. 11 (already past) and Jan. 19 (coming up this week). Notably, from January 9 to the 11, the open interest put/call ratio for May and August expirations dropped.

Bullish Bias

With options apparently biased bullishly -- interpretations are fraught with the hazards of figuring out who is buying and selling between traders and market makers -- I suspect that it will be much easier to detect a sudden interest in bearish bets than bullish bets. Regardless, it will be even more important to map options movements in advance of and in the wake of leaks, rumors, and disclosures. This trading should be even more revealing than the news itself. Given the big boys aligned for a big fight involving big money, we should expect several bursts of activity in the coming weeks and months.

Be careful out there!

Full disclosure: long HLF