Prothena Corporation plc (NASDAQ:PRTA) is expected to report first-quarter 2017 results early next month.

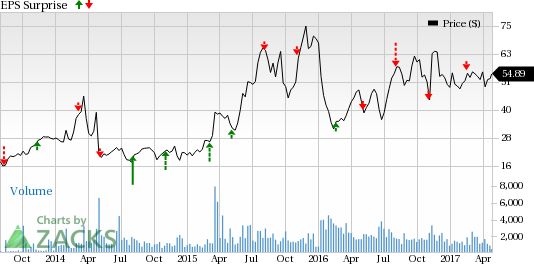

Last quarter, the company recorded a negative earnings surprise of 13.71%. In fact, Prothena’s track record has been dismal so far. The company reported a wider-than-expected loss in all the four trailing quarters, with an average negative surprise of 16.11%.

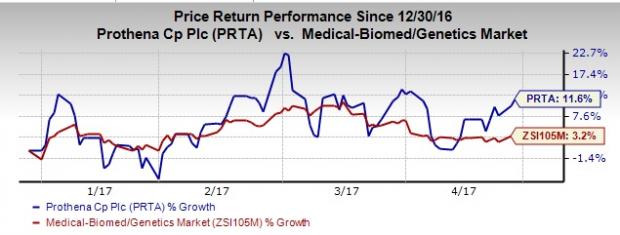

Prothena’s share price increased 11.6% in the past one year as against the Zacks classified Medical - Biomedical and Genetics industry’s gain of 3.2%.

Let's see how things are shaping up for this announcement.

Factors at Play

Prothena’s top line primarily comprises collaboration revenues earned through its license, development and commercialization agreements. In fact, the company earns collaboration revenues mainly under its license agreement with Roche Holding (SIX:ROG) AG (OTC:RHHBY) for PRX002.

We believe, investor focus should remain on pipeline updates by the company as it has no approved product in its portfolio.

PRX002 is currently in phase Ib study in patients with Parkinson's disease. The company expects to initiate a phase II study in patients with Parkinson`s disease in 2017.

Other key pipeline candidates include NEOD001 for the treatment of AL amyloidosis and PRX003 for the treatment of inflammatory diseases such as psoriasis and psoriatic arthritis,

PRX003 is being evaluated in a phase Ib multiple-ascending dose study. Interim and full results from the study are expected this year. Currently, the VITAL study on NEOD001 is on track. The company expects to complete enrollment by the second quarter of 2017. Additionally, the company expects top-line results from this study in early 2018.

Moving ahead, like any other development-stage biotechnology company, Prothena is likely to see an increase in research and development expenses due to higher spending on pipeline

What Does the Zacks Model Unveil?

Our proven model does not conclusively show an earnings beat for Prothena this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, that is not the case here, as you will see below.

Zacks ESP: Earnings ESP for Prothena is – 3.79%, because the Most Accurate estimate is $1.37, while the Zacks Consensus Estimate is pegged at a loss of 1.32. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Though Prothena’s Zacks Rank #3 (Sell) increases the predictive power of ESP, its negative ESP makes a surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some other health care stocks that you may want to consider, as our model shows that they too have the right combination of elements to post an earnings beat this quarter.

Fibrogen Inc. (NASDAQ:FGEN) has an Earnings ESP of +23.81% and a Zacks Rank #3. The company is expected to release results on May 8. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gilead Sciences, Inc. (NASDAQ:GILD) has an Earnings ESP of +2.13% and a Zacks Rank #3. The company is scheduled to release results on May 2.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Prothena Corporation PLC (PRTA): Free Stock Analysis Report

FibroGen, Inc (FGEN): Free Stock Analysis Report

Original post

Zacks Investment Research